-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

What is Employee Mileage Reimbursement? Eligibility & Calculations

- Author:Nandita Gupta

- Read Time:10 min

- Published:

- Last Update: May 28, 2025

Table of Contents

Toggle

Field employee mileage reimbursement is offered to field staff who spend their money on operating a vehicle for business purposes. But, is mileage reimbursement taxable? Let’s find out!

Table of Contents

Toggle

Are you a field service business that sends off its technicians or sales reps. to repair equipment or sell new products? Do you provide them with vehicles or are they using their personal vehicle?

Well, whatever the case is. As long as your staff is spending their own precious money on gas bills while running business errands, you have got to reimburse them for the mileage they have covered during the workday.

Many businesses debate whether to pay their staff according to the standard rate set by the Internal Revenue Service (IRS), while some prefer to use their pre-defined amounts and calculations.

If you are new to the term or have difficulty comprehending what field employee mileage reimbursement, eligibility, calculation method, IRS rates, and everything is – then this guide is for you. We will uncover every detail that’s important for you, including whether the mileage reimbursement is taxable or not.

What is Mileage Reimbursement?

Mileage reimbursement is the sum payable by the company to their field employee they bore while travelling in their personal vehicle for business purposes. One thing to note, the claims don’t involve mileage incurred to travel to and fro from the office or any personal commute.

Do you know, as per the Internal Revenue Service (IRS), the companies can decide whether they want to pay the entire cost of the trip or pay a specific rate for each mile their employee drove? The IRS has defined standard rates for companies to choose from but companies have the autonomy to decide upon the rate. The rate per mile is usually cheaper than $1.

What is Included in Employee Reimbursement Mileage?

Before you decide to reimburse your employees’ mileage, watch out for the following conditions or scenarios where you are entitled to reimburse your field staff. You are liable to pay your staff when they are:

- Performing business-related transactions in banks

- Out for meetings with clients and customers

- Are providing at-home services

- Into home healthcare services

- Transporting clients to a destination

- Traveling toward a temporary job site

- Out to purchase supplies

- Travelling to a business conference or convention

- Pursuing any additional work like running errands for business where they are using their own vehicle

Make sure you clearly mention the above criteria and conditions in your travel policy so that everyone is on the same page.

| To Pay or Not to Pay?

Situations Where Mileage Reimbursement is Often Questioned Case A. What if the employee owns or leases the vehicle Whatever the case, if the vehicle is used for business purposes, the employer is bound to reimburse its field staff. Case B. What if the employee is self-employed In that case, the employee is supposed to maintain two separate records, one specifically consisting of business mileage for reimbursement. Case C. What if the vehicle is provided by the employer Irrespective of the arrangement, the employee is deemed to be reimbursed for the expenses of driving the allotted vehicle. Case D. When employees own vehicles and work for ride-sharing or food-ordering companies – do they get reimbursed? Employees who work for such business models are not reimbursed for their mileage. It’s because they receive a fixed commission per order. |

IRS Mileage Reimbursement Rules & Standard Rates

Note that the Internal Revenue Service (IRS) issues new standard mileage rates every year, which are optional for companies to adopt. IRS issued the standard rates for 2024 in December 2023, which are as follows:

Here are IRS standard Rates for 2024

| Rates Per Mile | Purpose |

| 67 cents | For business miles driven. |

| 21 cents | Medical and moving purposes (lie active-duty military) |

| 14 cents | In service for charity organisations. |

Federal Mileage Reimbursement Laws

As of now, there is no federal law mandating an organization to reimburse its on-field employees for driving vehicles for business purposes. However, state laws in California, Illinois, and Massachusetts require mileage reimbursement.

But this doesn’t imply that not complying with the reimbursement will have no legal implications. Take an example: If employees’ wages fall below minimum federal wages, then, as per the Fair Labor Standards Act (FLSA), businesses are required to reimburse their employees for mileage incurred for business activities.

Are Field Employee Mileage Reimbursements Taxable?

If the employee’s travel expenses reimbursement is based on the IRS’ standard rate and matches the expenses incurred by the employee, in that case, reimbursement will not be considered taxable income. Organisations can claim tax deductions for the amounts reimbursed.

Supposedly, if a field staff gets over-reimbursed, then organisations might have to pay taxes if employees do not return to the organisation.

Benefits of Employee Mileage Reimbursement

Field staff mileage reimbursements are beneficial to both the employer and employees in every way.

What Advantages Employers Get:

-

No Capital Costs

We know how buying and leasing vehicles can be expensive. You can let your staff use their own personal vehicle and reimburse them the amount for travel they did or regular upkeep of the vehicle (as agreed between you and your staff).

-

No Tax Liability

The good news is that you can file the mileage you are offering to your employees as business expenses and then avail tax breaks on these amounts.

-

No Hassle-led Bookkeeping

When you invest in personal vehicles, you are required to maintain logs of their mileage and expenses. This involves a lot of paperwork, including tracking down depreciation while maintaining the books. It’s best to ask employees to bring their own vehicles and reimburse them for fuel and regular upkeep.

Read Blog – What is Field Employee Tracking Software?

What Advantages Employees Get:

-

Great Financial Compensation

Employees get compensated not just for their fuel bills. They also get compensated for vehicle maintenance, insurance, and wear and tear.

-

Tax-free Benefits

In most places, mileage reimbursements come bearing tax-free benefits. Employees won’t have to pay income tax on the reimbursement amount if it’s within the IRS standard mileage rate.

-

Catalyst for Productivity

Businesses providing on-time, well-calculated mileage reimbursements ensure more motivated employees who are willing to do field-related work with a happy and content face.

Is the Standard IRS Mileage Rate Better?

Can I Go for it?

The standard IRS mileage rate is merely an option that companies can go for. Companies can set their own rate for mileage reimbursement, which can be less or more than the standard rates.

We suggest that you decide the rate based on the area you operate in. If you operate in highly expensive areas where gas and toll prices keep on increasing, then keeping the mileage rates high is not a problem.

Also, please note that any rate exceeding the standard federal rate will be treated as excess income taxable for the employee. In that case, going for the federal standard mileage rate set by federal governments can be an ideal deal.

How to Calculate Mileage Reimbursement for Field Workers?

Businesses have the choice to either go for IRS-established mileage reimbursement rates or set their rates as per the driving costs of a particular city. Some businesses use the following methods to make their travel policies more worth it for their staff.

Method 1 – FAVR (Fixed and Variable Rate Allowance)

Under the FAVR (Fixed and Variable Rate Allowance) method, the employer is supposed to pay a combo of mileage reimbursement followed by a monthly allowance.

In which:

- Mileage reimbursement based on IRS rates will be paid out for variable expenses like fuel, tires, and maintenance.

- Monthly allowance will involve fixed costs associated with owning and driving a vehicle, registration fees, insurance, or lease,

But here’s the catch, if the amount turns out to be more than the standard rate, it will be taxed.

Method 2 – Actual Expenses Method

In this actual expense method, the total money spent on operating the vehicle is added and compiled. Then, it is multiplied by the % of the vehicle’s use for work purposes.

| Suppose,

30% of the miles driven by your mobile staff is for work purposes. And the operating costs of managing the vehicle come up to INR 5000. To calculate the reimbursement amount, 5000 will be multiplied by 30/100, which will come up as — 500. |

Note:

The actual expense method involves the cost of gasoline, maintenance, insurance, lease payments, tires, and even depreciation.

If you don’t want to fall into evasive calculations, just turn to TrackoField. At clicks, automate employee mileage tracking and get accurate payable amounts calculated through our foolproof expense management software.

Manage Field Employees’ Mileage Reimbursement with TrackoField

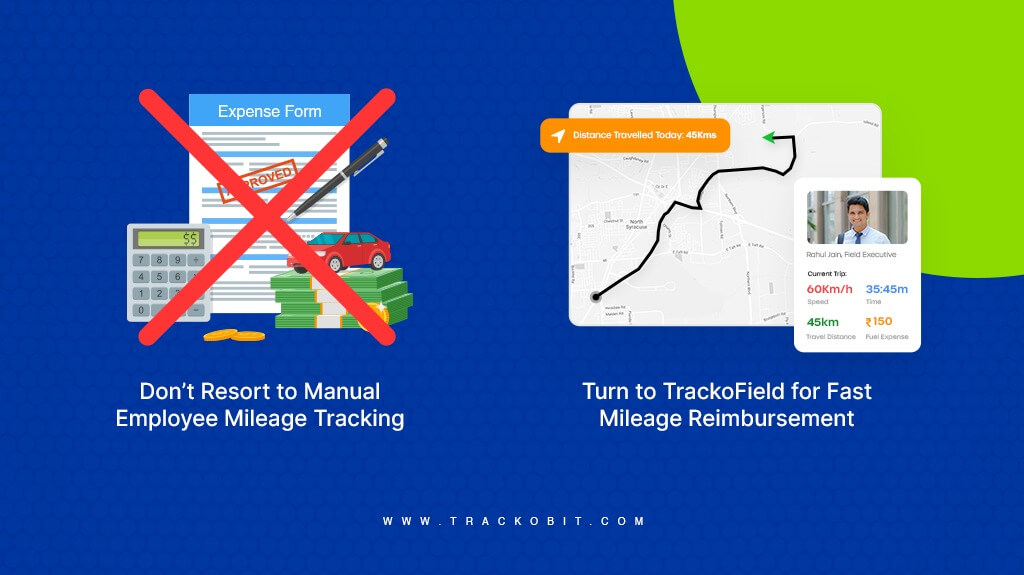

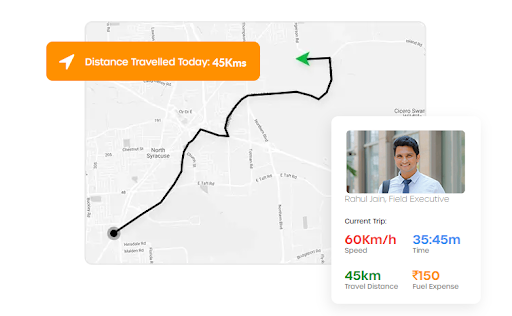

Field force management software by TrackoField lets you track field employees’ precise working hours, on-field activity durations, and total mileage/distance covered in a given workday.

Here’s what you all get:

a) Automated Employee Mileage Calculation

The software offers you a dedicated field employee route distance calculator with which you can auto-log and compile employees’ travelled distances. This will prevent your staff from doing it manually over spreadsheets.

All they have to do is just install and access the executive app and clock in for the day, the app will automatically start tracking the locations and log the accurate mileage throughout the day.

Best part? The tracking and data capturing part stops when your field staff logs out for the day or their shift time has ended. We even let you auto-set the shift time to stop the tracking part. Cool, isn’t it?

b) Every Detail Doesn’t Go Unnoticed

Our calculator serves you with the most accurate employee mileage reports which don’t just consist of total travelled distance but also offer data of:

- The starting point and the destination

- The starting and ending times

- The purpose of traveling with complete date and day

- Jobs and locations, with the exact time that was spent there

- Mileage at the beginning and end of the trip

This makes tracking employee mileage simple and efficient.

c) Verify Travelled Miles Against Assigned Routes

Over a single interface, you can monitor and compare the travelled miles against the assigned routes, watch your executives’ live movements and task activities. You can even notice when your employees are intentionally taking longer routes.

Our software’s USP is that it can track accurate mileage even if the route is as complicated as the Crowfly one.

d) Playback Routes for Double Verification

TrackoField distance calculator comes with a smart and efficient route playback tool that lets you replay all the travelled routes, on repeat. This feature helps clear the air in case employers have doubts or employees feel the travel miles aren’t justified.

e) Process Claims with Expense Management Module

Once you have the mileage data in place, and it’s verified at every turn and step, get actual figures you are supposed to reimburse. Our in-built employee expense management module provides you with precise payable amounts. You can define the rates and the software will just output the payable amount.

f) Disburse Claims Alongside Salary Components

We are not limited to just that. We believe in offering an all-encompassing platform where you do not just process expense claims but also compile salary components. Our more better and powerful payroll management module simplifies the calculation of payroll hours and salary data as per any variable you believe in, be it working hours, overtime, PTO, leaves, deductions, and more.

Make it simple to track employees business mileage and reimburse claims and salaries without pausing and delays.

Final Thoughts!

Mileage tracking is an important variable for businesses that deal with field tasks or operations handled mainly by field staff. Tasks could range from door-to-door selling or visiting a client site to fixing an HVAC system. Mileage reimbursement is a very important term that defines the amount businesses are liable to pay their staff in exchange for the cost their staff incurred on fuel bills for running business tasks.

Any field employee can apply for reimbursement just by checking the criteria we discussed in detail. Choosing the IRS rate is an option while calculating the reimbursement amount, businesses can set their own rates as per FAVR and the actual expense methods as we expanded above.

Now, upgrade your reimbursement policies according to the rules and criteria shared in this piece. But we suggest that you avoid the fuss of doing calculations manually or with basic software. Instead, try TrackoField’s full suite and see how it does wonders in tracking field employees’ mileage and travelling compensation amounts.

Nandita is the Team Lead for Content Marketing at TrackoBit, bringing over a decade of experience in B2B, B2C, and IoT sectors. She has a proven track record of helping Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.