-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

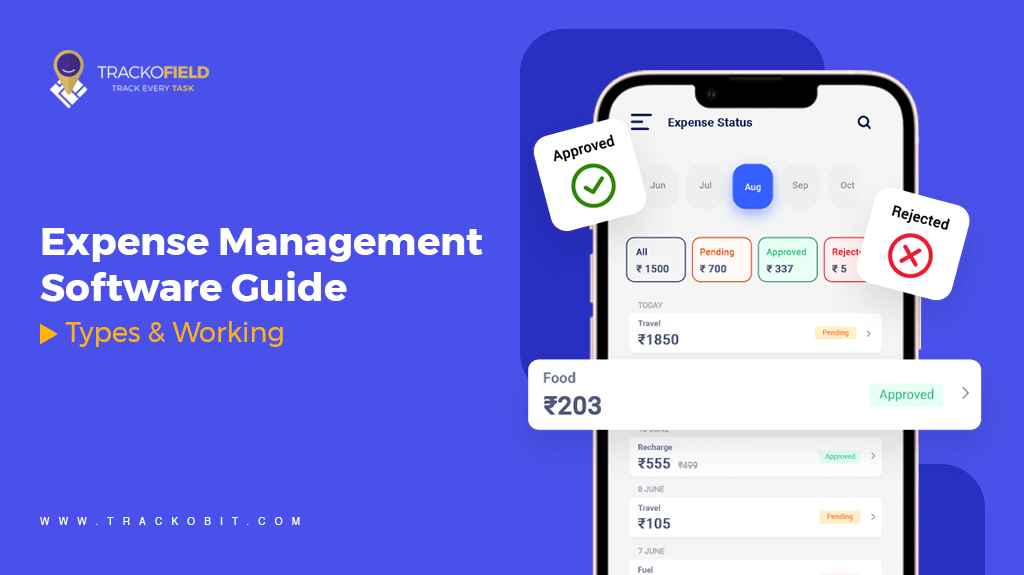

How Does Expense Management Software Work? (What to Expect)

- Author:Nandita Gupta

- Read Time:7 min

- Published:

- Last Update: October 13, 2025

Table of Contents

Toggle

Discover how expense management software works to streamline the expense-claiming process with seamless evidence upload. Is it better than traditional methods? Let’s find out!

Table of Contents

Toggle

When dealing with on-field staff, you cannot ignore all those on-the-way lunches, the fuel they spent, or the stationery they purchased to meet your organisational tasks. All those expenses are somehow business expenses only. You, as a manager, need to record proper receipts for auditing purposes. Many companies are heavily relying on cloud-based expense management software to keep track of their employee spending.

Sadly, 43% of companies still manage on-field expenses manually via pen and paper or spreadsheets. The manual process is time-consuming and simply prone to clerical errors.

Let’s explore how the expense management system works and helps bypass challenges associated with manual expense registering and settlement.

How Does Expense Management System Work? In 5 Steps!

A software-enabled expense management software helps digitally store expense invoices for further tracking, approval, and reimbursement — at a quick turnaround!

Here is the expense management process that automated software solutions come with

| Step 1 | Employees register expenses into the app and press submit for further manager or account department’s approval and reimbursement. |

| Step 2 | Managers receive claim notifications, review it, and either approve or deny these claims. |

| Step 3 | In the background, the finance team audits expense reports for compliance, whenever required. |

| Step 4 | Once the claim is approved, the managers and finance team process it for reimbursement. |

| Step 5 | The software generates records and receipts for future external audits. |

How TrackoField Helps Simplify Expense Management?

Let’s in detail understand the complete expense management process – from claiming to reporting for final reimbursement.

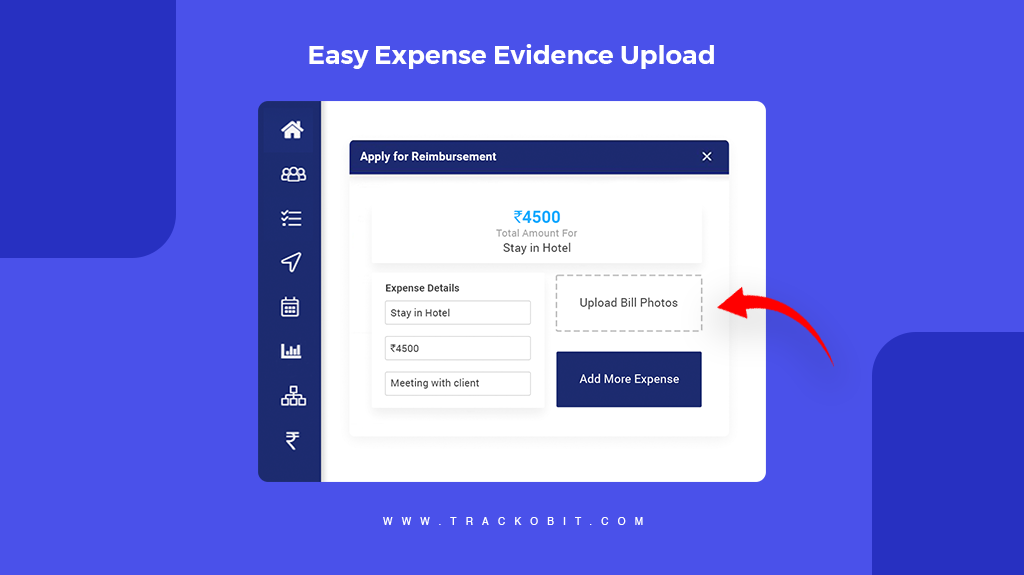

1. Easy Expense Evidence Upload

The expense management system comes with an attachment option, making it easy for the field executives to upload bills as evidence of expenditure, anywhere from the field. This helps them support their claims. Modern expense software supports a number of file formats, be it jpeg, png, or pdf. The expense proofs are not only easy to upload but are visible to every manager who is supposed to approve or process the claims.

Best part? Managers can cross-check the claimed amount with the evidence submitted.

| 💡Are Bank SMS & Notifications Counted as Evidence?

As long as they are in the image format and permissible as per organisational policies. |

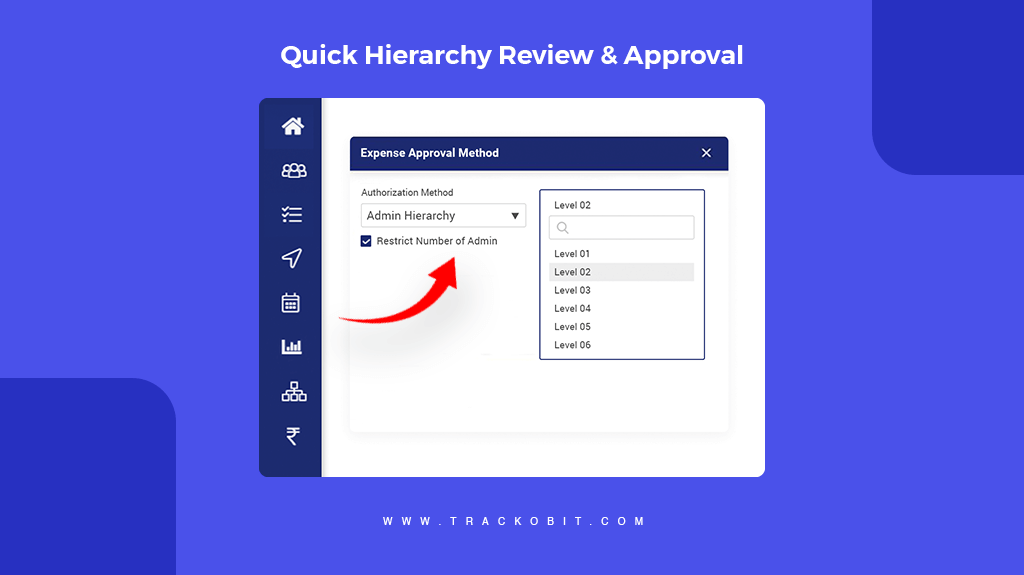

2. Quick Hierarchy Review & Approval

Back in the day, approval of expense claims was time-consuming as it was manual and paper-led. The software-enabled expense management system streamlines and speeds up the process of expense claiming.

No matter whether the organisation has a multi-level approval hierarchy, the software makes it easy for every manager to check, assess and approve requests in a jiffy. All inboxes have been cleared; there are no more pending requests!

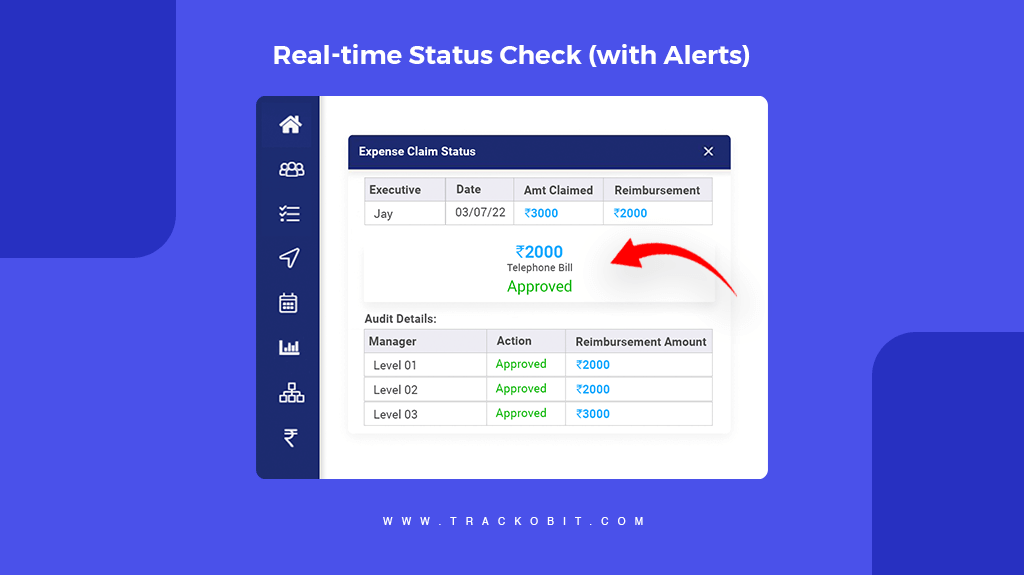

3. Real-time Status Check (with Alerts)

The expense management applications provide real-time tracking of every event — right from expense claiming to approval. Executives are able to see the status of their claim requests in real-time on the app. Managers involved in the approval process also get notifications about claim requests and get to instantly provide the approvals.

Executives will get a notification every time the status is updated.

4. Cap on Expenditure

No more over-budgeting!

For every organisation, running operations in control is very important. With software-enabled expense management apps, managers handling finances can put a cap on expenditure allowance. Managers in the software can set the spending limit —- team-wise, category-wise, and even designation-wise.

Once the managers feed in the limit, the system will not accept the expense claims beyond the defined spending limit. That’s uber cool, right?

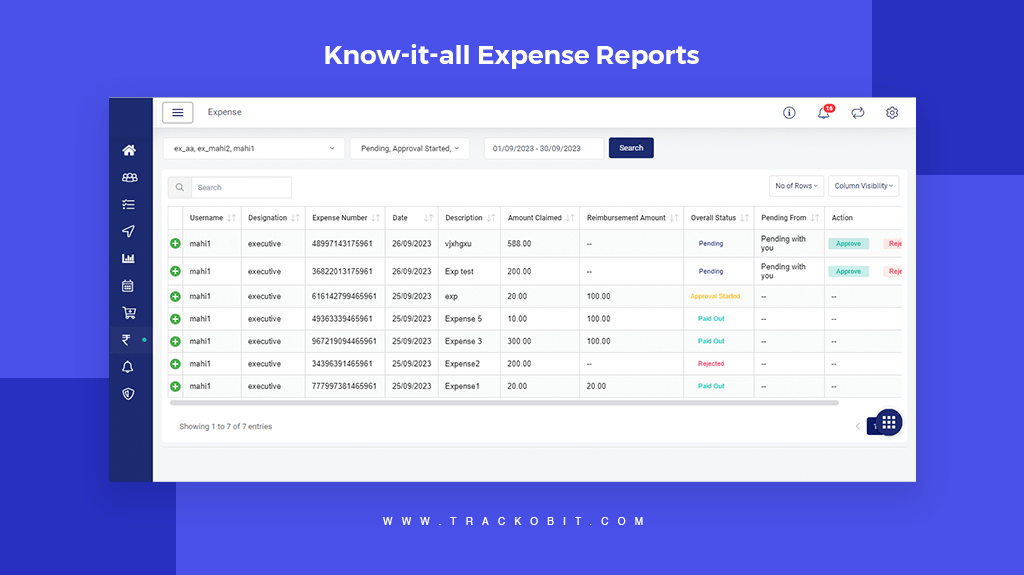

5. Know-it-all Expense Reports

For any organisation, financial audits are important. To support that, cloud-based expense management software helps generate insightful reports to look into the on-field expenses of their delivery or service staff. The software system, based on the entered data and inputs, collates and compiles every information and generates visualised reports.

The accurate expense reports are easy to view by:

- Expense Categories

- Teams

- Designations

- And even individuals

The software, in short, gives liberty to make insightful decisions about future spending and shaping allowance policies.

Types of Expense Management

Expense management is divided into the following types:

| Types of Expense Management | Brief |

|

Traditional paper-based methods where expenses are recorded manually via paper sheets or spreadsheets. |

|

Leveraging cloud-based expense management software or tools to automate expense tracking, reporting, and approval. |

|

Includes management and reporting of expenses particularly associated with

|

|

Telecom expense management incurs costs associated with the use of communication devices by field staff. It involves costs around:

|

Traditional vs Automated Expense Management — Which is Better?

Automated expense management is done via software which helps streamline the process of submitting, approving, and reimbursing expenses with much precision and clarity. In contrast, traditional expense management involves the use of paper spreadsheet-based systems to fulfill the expense handling tasks from claiming to reimbursement.

- More Specialised

Expense management software is more specialized than traditional accounting software and ERP systems. It can effortlessly handle several business functions associated with expense claiming and overall management.

- One-Time Costs (worth spending)

Traditional expense management approach is initially cheaper than purchasing software but yet time-consuming. Automated expense management systems bear one-time costs and enable companies to simplify the expense submittal process, reduce errors, and mitigate the risk of expense fraud.

- Capacity to handle more functionality

Today, companies offer cloud-based expense management software to handle functionality beyond the core ERP system. Expense management software often integrates with traditional accounting and ERP systems. Thus, it’s much more flexible and functional than traditional methods.

- Swift category-wise expense segregation

Within the expense management software, managers get spending controls and the ability to segregate routine expenses under various heads. This helps further filter out which expense took most room and which was less focused. Whereas in traditional methods, there are only slips, folders, and lots of confusion (which certainly you don’t want!).

Benefits of Expense Management Software

Switching from a manual process to automated expense management surely reduces workload and streamlines financial systems — on so many levels. For routine expenses, it helps to — improve accountability, creates faster employee reimbursements, and provides real-time visibility into an organization’s financial data.

That’s not all. Cloud-based expense management software offers better protection against fraud and adds to the creation of more efficient policy compliance. The solution is super easy to integrate with existing accounting and ERP systems.

Automated expense management software wins in all spheres, as it offers:

- Automated claim submission and approval processes

- Enhanced data security patches

- Compatibility with mobile devices

- Automated data entry and management

- Data-driven reports to record digital audit trails for better compliance.

How to Choose from Market-Offered Expense Management Software?

Here’s a quick checklist to help you select the suitable expense management software from the pool of choice.

| ✔️ Mobile accessibility with easy expense recording options for employees. |

| ✔️ Multiple ways to record expenses (receipt scan, import from PC or cloud, etc.) |

| ✔️ Customizable multi-level approval workflows. |

| ✔️ Automated compliance checking (or rules engine). |

| ✔️ Well-visualised real-time analytics and reporting feature. |

| ✔️ Integration with other internal software (especially accounting software). |

| ✔️ Customisation for the desired UI and UX, custom settings, and features integration. |

Here’s Your Final Takeaway!

Every small business or mid-scale company with less headcount can initially resort to spreadsheets, and paper forms for expense reporting. But when moving up the size and strength of field staff, an automated expense management system is a must-have.

Expense management systems are a savior for businesses that often struggle with multiple expense records from 1000s of field staff on the move. The software efficiently streamline the process of recording, reporting, tracking, and managing expenses — without any scope of errors and miscalculations.

If you want to pay the field staff for fuel spend or for any on-the-way expenses, the software takes care of it. In the software, just specify the per kilometer or mile allowance you provide or set a cap for any miscellaneous expense – and you are good to go. Similarly, you get the liberty to track expenses across all areas, be it stationery, travel, food, or miscellaneous.

🔍For businesses, every dime matters! TrackoField offers you flexible and easy-to-integrate, cloud-based expense management software where every penny doesn’t go unnoticed.

What People Are Reading:

What is employee tracking software? Is it legal?

Everything About After Sales Tracking Software

What is an MR Reporting Software? How it works?

FAQs on Expense Management Software

-

What is expense management software?

Expense management software is an application that helps streamline the process right from receipt claiming to reimbursement process for on-field staff out for service tasks or delivery. The software makes it easy to claim expenses with proofs, track expense claims, and record data for auditing.

-

Which is the best expense management software?

Expense management software by TrackoField is an ideal solution for enterprises with soaring field staff. The system offers advanced dashboards and settings, which makes it easy to claim, process, and report expenses of a wide variety for reimbursements. The system comes with analytical reports that help look within the spending habits and improve the financial standing of the company.

-

Who can get expense management software?

Expense management software by TrackoField is suitable for every enterprise with on-field force, bound to make on-the-way expenses. Be it related to food, fuel, or stationery.

Nandita is the Team Lead for Content Marketing at TrackoBit, bringing over a decade of experience in B2B, B2C, and IoT sectors. She has a proven track record of helping Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.