-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

10 Best Mileage Tracking Apps for Field Employees in 2025

- Author:Mudit Chhikara

- Read Time:7 min

- Published:

- Last Update: December 9, 2025

Table of Contents

ToggleAre you looking for the best mileage tracking apps? Our guide here lists the 10 best mileage tracking software for you to consider.

Table of Contents

ToggleAny business with travelling employees requires the use of mileage-tracking software. Not only do you have to track the mileage but you also have to verify staff expenses and track their income. Plus, the expense reimbursement policy needs to comply with tax guidelines.

All these operations can be managed using a mileage tracking app or a route distance calculator. But it’s also important to choose the best software for your business. Wondering how? Well, here’s a list of the 10 best GPS mileage tracking apps for you.

Get riding!

What is a Mileage-Tracking App?

Mileage tracking apps are GPS-based platforms that let businesses track the distance travelled by their staff. The app generates distance covered reports which simplifies employee mileage reimbursement.

The app also optimises expenses and tracks employee income. This is helpful to manage business expenses and avail tax deduction benefits. However, employee GPS tracking software is not just limited to compiling employee distances. It performs several other functions like:

- Providing employees’ past routes playback to review their trips.

- Geofencing the client site and receiving alerts on geofence violations.

- Providing visibility on exact lat-long coordinates and timestamps of every activity.

- Generating stoppage reports to check the number of halts along with their addresses.

- Last active status and task update status.

10 Best GPS Mileage Tracking Apps in 2025 Worth Considering

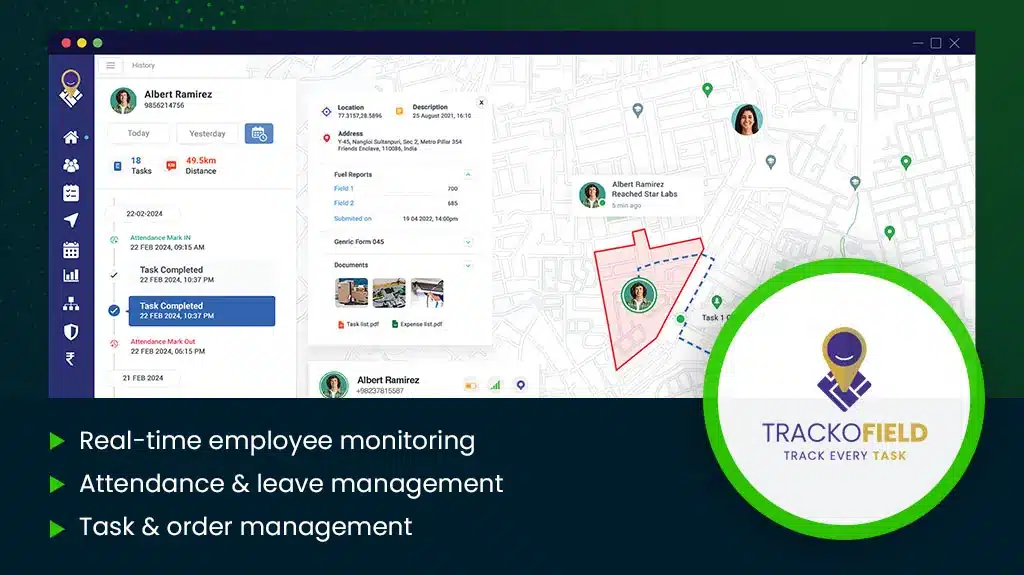

1. TrackoField

TrackoField App Dashboard

TrackoField is a comprehensive field employee tracking software solution. It offers a smart employee distance calculator to compile total distances. This could be the distance between task sites or the total distance travelled during the day.

It also helps with real-time mileage tracking. The software can verify field staff’s conveyance expenses. Plus, it comes with precise GPS-tracking capabilities and an integrated map.

This can calculate the total distance covered by vehicles with just a click. All you have to do is add the number of km or miles travelled. And voila! The software generates data to be compensated as per mileage policy.

But that is not all! TrackoField also:

- Allows employees to log attendance remotely.

- Provides complete visibility of staff’s locations and task progress.

- Utilises real-time GPS tracking to monitor field employees.

- Offers task, order, and expense management solutions.

Top Features of TrackoField Mileage Tracking App

- Efficient Distance Calculation and Route Playback

TrackoField lets managers calculate the accurate distance travelled reports of their employees. They can also view the routes field employees took while travelling. This data is used to authenticate fuel expenses.

- Expense and Payroll Management

TrackoField can manage all employee expenses and simplify payroll disbursement. The app allows managers to check location and visual proof of expenses.

They can even create custom expense categories and cap the reimbursement claims. All the financial data is then consolidated to calculate the employees’ salaries.

- Optimised Task Allocation

The app uses employees’ expenses, distance covered, and proximity to clients’ locations to assign tasks. This saves the field staff’s time and reduces company costs.

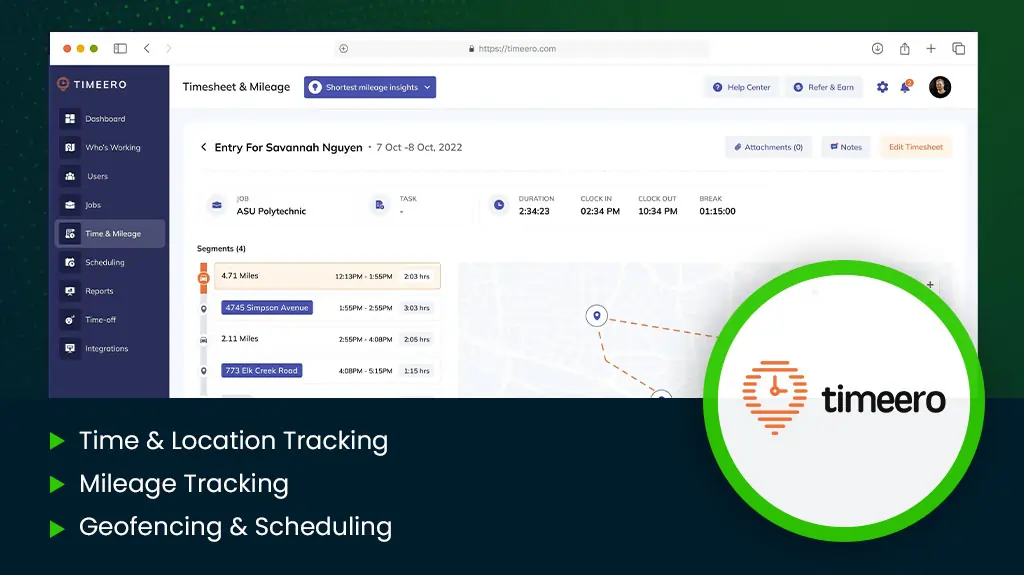

2. Timeero

timeero App Dashboard

If you are looking to manage employees and their travelled miles, then Timeero should be your top choice. Its considered one of the leading GPS mileage tracking apps in the industry. It also offers a simple interface and time management. Plus, Timeero is easy to use, offers great customer support, and is equipped with an insightful dashboard. You can add users, jobs, generate reports, and customise the app easily. It also shows the location of employees and can optimise their task allocation.

Top Features of Timeero:

Geofencing: Timeero uses geofencing to alert managers when their employees clock in or out of bounds or when they enter and leave the area.

Scheduling: Timeero lets you create flexible schedules for employees. Managers can also approve or decline time off requests.

Offline Use: Timeero is built to work offline. It syncs all your data to the cloud once you come within network range.

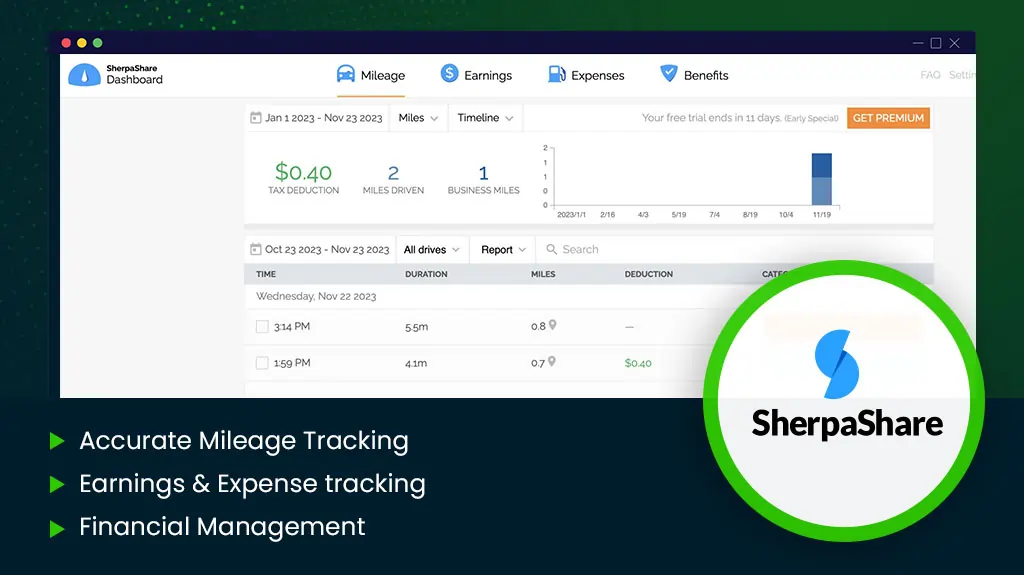

3. SherpaShare- Best for Rideshare Drivers

shepashare App Dashboard

This app is ideal if you’re a freelancer or self-employed driver who hires field employees or drivers. There is no need for logging in and out in Sherpashare to track miles. Instead, it starts creating mileage logs as soon as the vehicle is on the move.

Top features of SherpaShare:

- Accessibility: It is battery-friendly, highly accurate, easy to use, and calculates expenses/salary automatically.

- Driver-to-driver communication: In-the-moment conversations with other drivers on issues like traffic or accidents.

- Financial management: The app tracks mileage, revenue and expenses. It also helps save money in tax deductions.

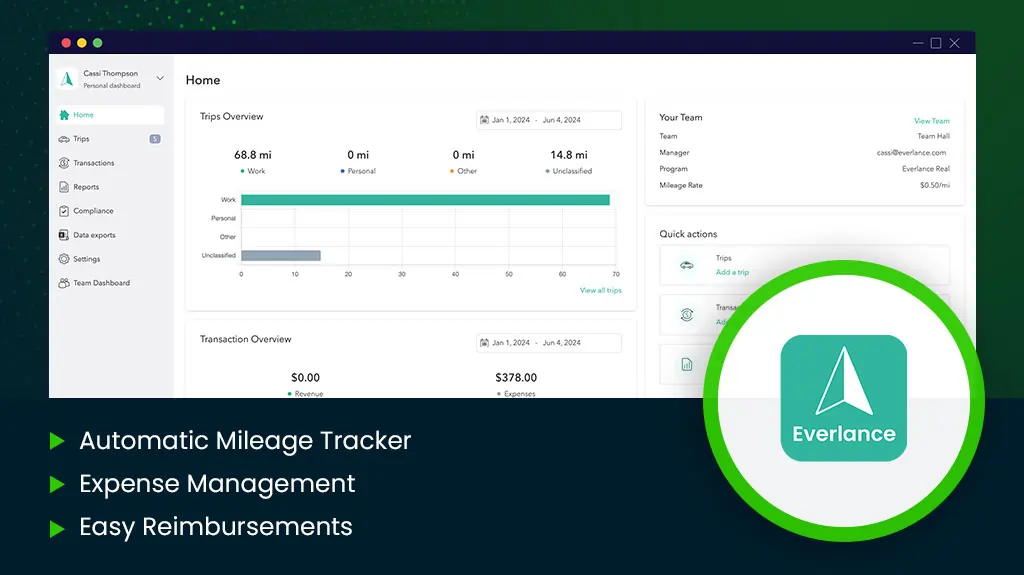

4. Everlance

Everlance App Dashboard

Everlance mileage tracking app is adaptable to all companies, whether small, medium, or large scale. It is user-friendly and automates mileage tracking and trip classification. Plus, Everlance tracks conveyance and other expenses. It lets employees sync their credit card or bank account for automatic deduction and management. The software also identifies expenses that might be tax deductible.

Top Features of Everlance

Automatic Stop Detection: The app can recognise when employees start and stop driving and track trips in the background.

- Expense Management: It tracks all expenses, classifies them into personal and professional, and calculates mileage returns.

- Mileage reimbursements: Reimburse employees the fair amount verified via real-time GPS route tracking.

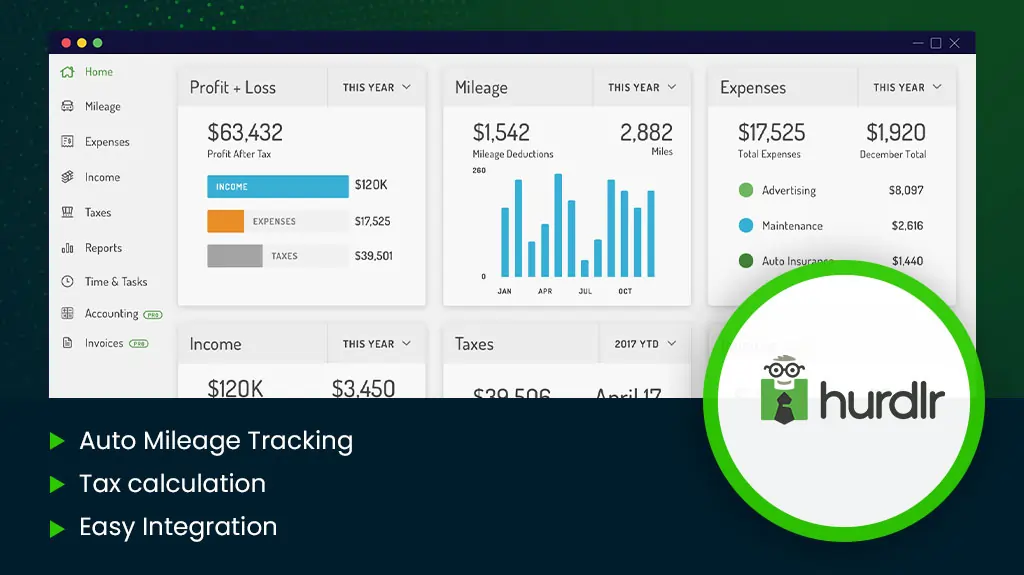

5. Hurdlr

hurdlr App Dashboard

Hurdlr is a robust mileage tracker app that is useful for delivery drivers and gig workers. It’s simple, affordable and offers many useful features.

It can automatically detect movement when the vehicle starts and stops. It identifies repeating trips and tags them. Plus, the GPS-based mileage tracker maximise tax deductions while maintaining accuracy.

Top Features of Hurdlr

- Customisable Categorisation: Employees can create personal categories for mileage tracking, like medical purposes or business purposes. Expense categories can also be classified as per your needs.

- Integration: Hurdlr is integrable with various HRM and financial tools.

- Optimised battery usage: Hurdlr works without draining your device’s battery.

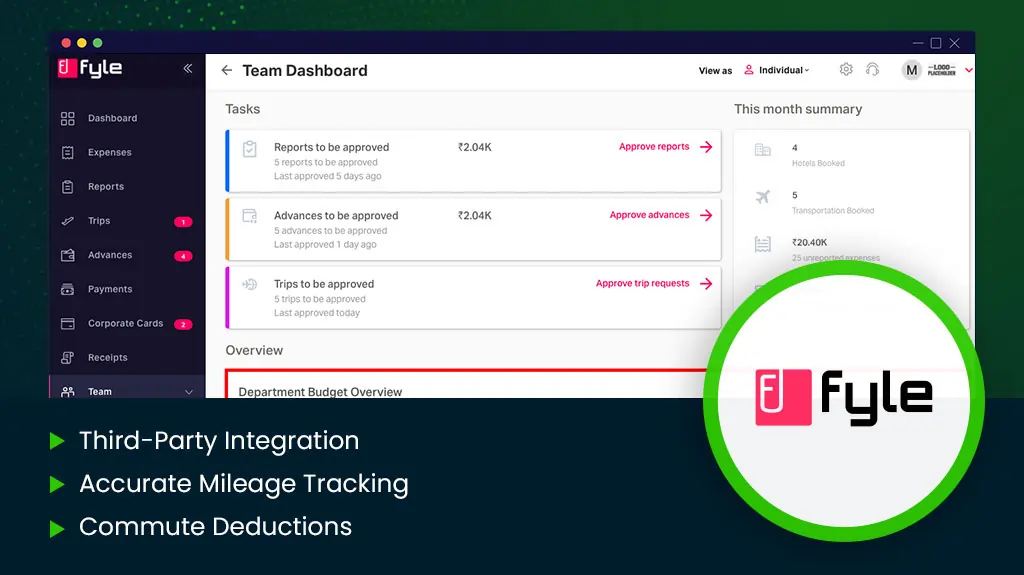

6. Fyle

fyle App Dashboard

Fyle is a Google-powered mileage tracking app. All you have to do is enter the starting point and final destination. Then, the system automatically calculates distance and cost based on differential mileage rates.

Fyle’s miles tracker allows employees to clone recurring expenses or tasks. This is useful when employees repeatedly use the same route. For example, they visit a particular client every Friday or perhaps travel daily from home to office and vice-versa.

Top Features of Fyle

Third-party integration: Fyle can be seamlessly integrated with accounting and HR software.

Multi-stop Mileage: When the employee adds a stop in the mileage form, Fyle calculates the distance and amount for you. It also lets you set up recurring conveyance claims weekly, daily, or monthly.

Per Diems: You can create multiple per diem rates with different currencies, and users can choose the appropriate ones.

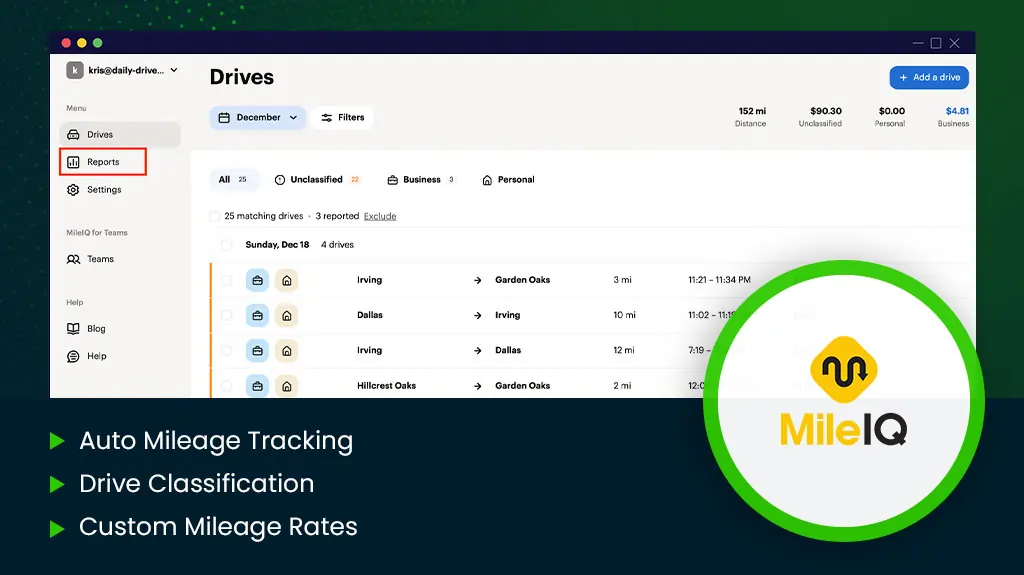

7. MileIQ

Mile IQ App Dashboard

MileIQ is a good choice as mileage tracking software for individuals or small businesses. It uses GPS technology to track employees’ trips without manual logging. MileIQ works in the background, collecting accurate mileage logs and segregating them into categories.

It eliminates paperwork for taxes or reimbursements and acts like a digital logbook. Apart from saving frequently used routes, MileIQ also generates precise distance travelled reports. Plus, the app maximises tax deductions while complying with laws.

Top Features of MileIQ

Easy drive classification: With just a swipe, classify your trips for business or personal. Create simple and accurate tax planning reports.

Add Work Hours & Multiple Vehicles: Automatically classify drives based on your customised work schedule. MileIQ also makes it easy to track every mile for every vehicle.

Custom Mileage Rates: Match your specific needs with custom mileage rates.

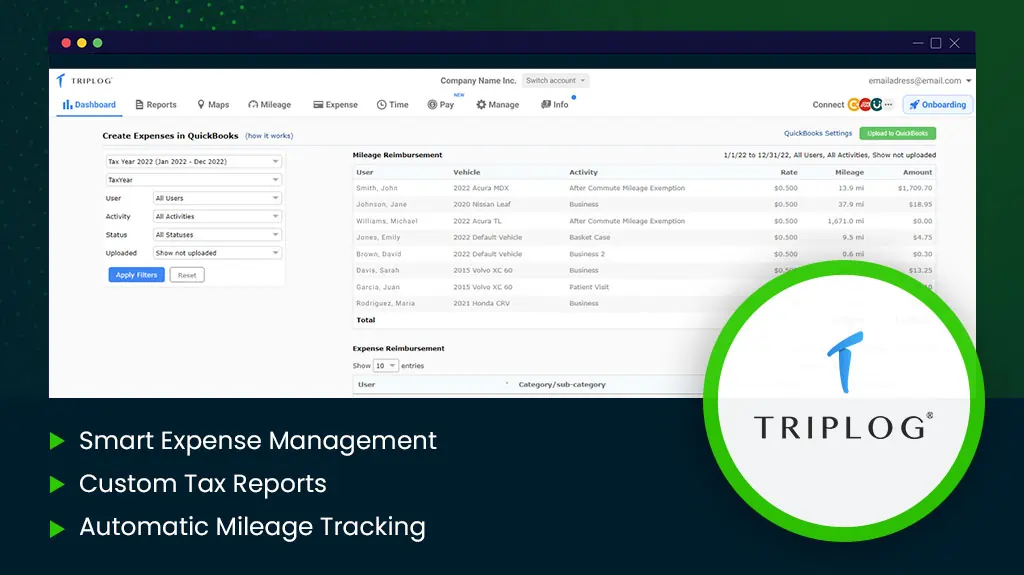

8. Triplog

TRIPLOG App Dashboard

Triplog is one of the top GPS-based mileage tracking apps. It offers automatic mileage tracking and simplifies the reimbursement process.

The app also features data reporting that complies with tax laws, frequent trip rules, and route planning. Additionally, it tracks business and personal expenses separately.

Also, Triplog is one of the few companies that offer free mileage-tracking apps. It comes with manual mileage tracking that can handle 40 entries of expenses or mileage with tolls and parking logging. Plus, the app can be seamlessly integrated with other payroll tolls and offers an easy-to-use admin dashboard.

Top Features of Triplog

Secure cloud storage: TripLog stores employee data securely and ensures access to it anytime, anywhere.

Tax-compliant reports: Categorise your trips as business or personal and generate reports in various formats for convenient tax filing.

Smart expense tools: Easily segregate expenses into personal or business categories to optimise for tax deductions.

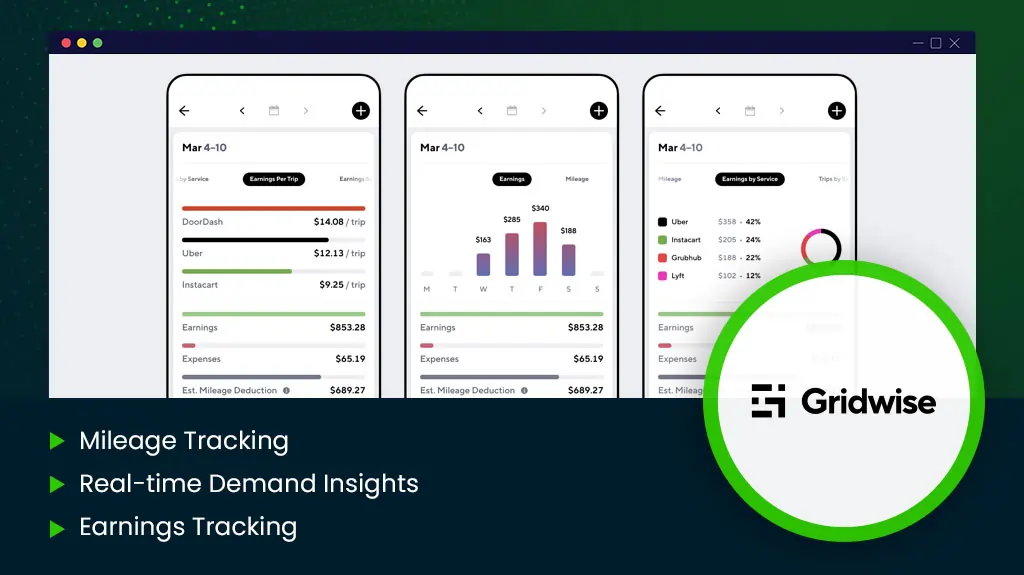

9. Gridwise

Gridwise App Dashboard

Gridwise is one of the best free mileage tracking apps for delivery and ridesharing drivers. It also works well for businesses who want to manage their mobile employees. Gridwise offers various unique features like real-time data insights, tax management, performance monitoring, etc. The app can significantly boost employee productivity, their earnings and cut down resource wastage.

Top Features of Gridwise

Discover the best times and places to drive: Get real-time insights on the most profitable times and places to drive.

Track Earnings and Expenses: Gridwise syncs with your existing apps to track mileage, earnings, and expenses.

Tax reports and performance insights: Simplify tax filing and view detailed stats of your performance and earnings.

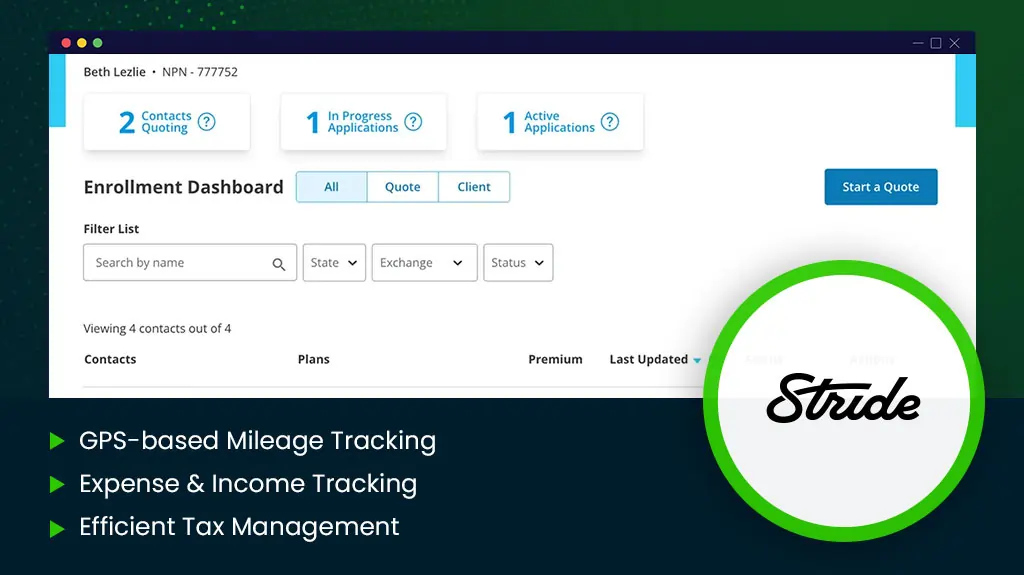

10. Stride

Stride App Dashboard

Stride is a great option for businesses that want to manage their finances. It tracks mileage and expenses automatically and manages tax deductions. Plus, it’s a user-friendly and intuitive app. If you’re a gig worker or business owner and indulge in frequent work-related travel, Stride is made for you.

Top Features of Stride

Automated GPS-based Mileage Tracking

Pocket Friendly: Stride is free to use and maximises mileage deductions.

Set Reminders: It has the feature to set reminders to log trips and track your bills.

Invoice Uploads: Add photos of receipts and bills to verify expenses.

What is the Importance of Using Mileage Tracking Apps?

Efficient mileage tracking apps like TrackoField automate distance tracking and expense reimbursement. It minimises human errors and manual processes. Furthermore, the app lets you:

- Keep accurate mileage records for tax deductions.

- Calculate travel and business costs.

- Access a central to view spending insights.

- Eliminate costly errors and inflated or fraudulent expenses.

Automated mileage tracking software also assists in removing non-compliant claims. This ensures that companies are always prepared for audits. They can actually contribute to a 5x reduction in reimbursement cycles.

Conclusion

Mileage tracking apps can be game-changers for businesses with a field workforce. These apps can be quite beneficial for staff who are always travelling to deliver products or services to customers.

The app also ensures accurate distance tracking and error-free expense reimbursement. Plus, the app can compile this data to comply with tax laws and business tax deductions.

TrackoField is one such field employee tracking software that also offers mileage-tracking features. It even allows you to geofence task sites, auto-track mileage, generate distance reports, and manage staff expenses.

FAQs

-

Who Should Use Mileage Tracking Apps?

Any business that requires its employees to drive between tasks should use mileage tracking apps. This includes companies that employ: - Sales agents for on-ground sales operations - Technicians to deliver repair, installation, or other services - Banking staff travelling for KYC or loan verification - Delivery or rideshare drivers for a platform - Gig workers who drive between jobs - Real estate agents - Sales or MR reps - Wedding photographers - Truck drivers

-

What are the best mileage tracking apps in 2025?

Here are the top 5 mileage tracking apps in 2025 that can help you manage your employees’ expenses, optimise their trips and track their performance. - TrackoField - Timeero - MileIQ - Fyle - Everlance

-

What are the best GPS mileage tracking platforms?

The best mileage tracking apps are those that meet your business requirements and offer key features like: - Mileage tracking automation - Classification of trips - Data reports - Expense reimbursement - Geofencing and real-time monitoring.

Mudit is a seasoned content specialist working for TrackoField. He is an expert in crafting technical, high-impact content for Field force manage... Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.