-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

How MFIs Are Working In Modern Day Scenario? A Complete Breakdown

- Author:Mudit Chhikara

- Read Time:7 min

- Published:

- Last Update: January 30, 2026

Table of Contents

Toggle

How field force automation is helping MFIs transform field operations.

Table of Contents

ToggleMicrofinance institutions (MFIs) have a unique and challenging mode of operation. Their field agents have to visit remote regions where banks don’t operate, use unorthodox risk assessment methods, and disburse collateral-free micro loans to self-help groups.

In this environment, traditional paper-based field operations are not feasible anymore. They’re inefficient, prone to errors, and time-consuming. Plus, borrower behaviour has also evolved. They expect faster approvals and doorstep service. NPA rates have also sharply risen this decade.

The solution? Field force automation for MFIs!

It offers reliable, scalable and fraud-free microfinance operations. Every step, from customer onboarding to EMI collection, can be simplified using automation and AI-driven solutions. Let us explore this transformation of modern-day microfinance institutions in detail.

The Traditional Microfinance Model: Why It No Longer Works

For decades, the MFI ecosystem worked on manual documentation and trust-based reporting. Field officers would visit borrowers, return with papers, and update managers verbally. It worked when teams were small and funding cycles were modest.

But times have now changed! Manual field operations are no longer reliable and people’s borrowing habits and requirements have evolved. MFIs now face several challenges.

1. Manual Work Verification

Managers cannot confirm whether a field visit genuinely took place or was missed by the agent. Similarly, field agents may create fake customers to meet their targets or claim undue expense reimbursements.

2. Paper-Based Workflow

Complete reliance on paperwork leads to incomplete KYCs, data entry errors, damaged forms and operational delays.

3. Manual Attendance

Manual attendance management via paper punch cards or office visits is prone to errors and proxy marking. It also results in time wastage and decreases staff productivity.

4. No Audit Trail

Lack of real-time evidence and no digital data storage results in poor compliance, missed red flags, high rate of inflated expense claims, and low workforce transparency. It makes dispute resolution difficult.

All these issues directly impact portfolio quality and expose MFIs to financial and reputational risk. That’s why the industry needs tools that can maintain accountability while being easy to use and secure.

Digital Transformation In MFIs: How It Works

Today’s microfinance organisations rely on mobile-first field force management software. The best ones, like TrackoField, offer location intelligence, visual intelligence, and smart data analytics to simplify every aspect of microfinance operations.

Field agents work with smartphone applications integrated with AI, GPS and cloud-based systems. This ensures all the stages of an MFI loan cycle – sourcing, investigation, collection and audit are executed seamlessly. Here are the ways field force automation for MFIs works:

1. Digital Onboarding

Borrower documents, signatures and photographs are captured digitally. Verification happens instantly, improving turnaround time while reducing paperwork errors.

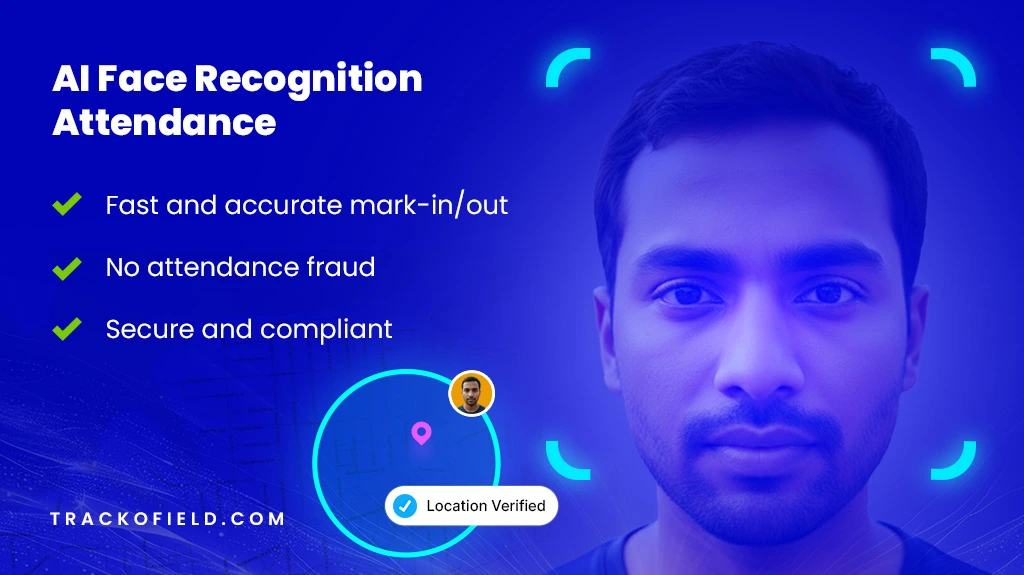

2. AI-Powered Attendance Tracking

Field officers mark-in/out through facial recognition, ensuring real presence on the ground at the borrower site without proxies.

In addition, agents can also capture attendance of SHGs and JLGs. Using the mobile FFM app, they can scan faces of all group members simultaneously. The attendance of each registered face is marked automatically. In case a face is not recognised, the field agent does it manually.

Ensure Accurate Attendance With AI Face Recognition

3. Geo-Verified Field Visits

The system records a verified location and timestamp for every borrower meeting, preventing false reporting and helping branch managers trust the data they see.

4. Route Optimisation

Field agents can follow well-planned travel routes that reduce fuel costs and increase borrower visits in a single day.

5. Smart Territory Management

Managers can create custom zones based on factors like customer density and size. They can then visualize zone-wise reporting like:

- Total sales

- Loan defaults

- Visits per borrower

A territory management software also helps identify repayment default-prone areas. This is done with geo-spatial intelligence for risk assessment.

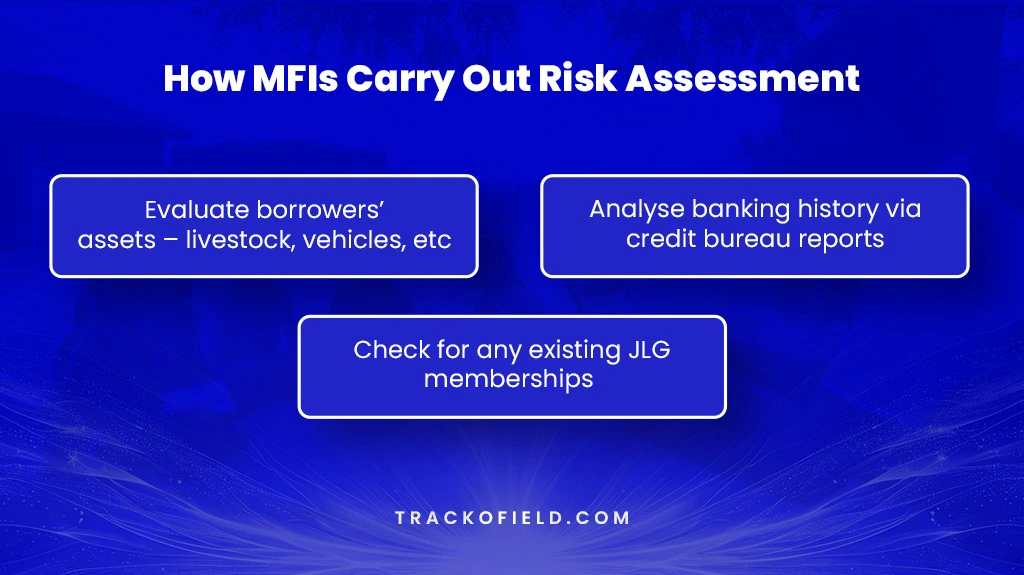

6. Simplified Risk Assessment

Due to the lack of banking history and the unsecured nature of MFI loans, borrower risk assessment can get challenging. It requires alternate methods. Using field force management software, field agents can:

- Evaluate borrowers’ assets (livestock like buffaloes, vehicles, land size, etc) via visual intelligence

- Analyse spending habits and past microloan repayments

- Check for any existing JLG memberships

How Field Force Automation Simplifies Risk Assessment For MFIs

7. Real-Time Visibility

With employee GPS location tracking and live dashboards, managers can monitor their field workforce in real time. They can check:

- Employees’ task status

- Employee attendance

- Daily expense totals

- Top performers of the day

8. Third-Party Integration

MFIs use field force management software like TrackoField which can be linked with LOS/LMS to operate. Once NACH mandate fails and the loan moves into overdue status in the LMS, the data is synced to TrackoField.

Tasks for collection visits are created and assigned to the relevant agents. Similarly, MFIs can use multiple ERP, HRMS or CRM software seamlessly with external integration.

How TrackoField Supports Modern MFIs

TrackoField enables MFIs to operate with full transparency and confidence. It offers:

- AI-based face recognition that prevents buddy punching and attendance fraud

- Liveness detection to capture a person’s real face not an existing photo or video

- Geo-verified borrower visits to log accurate proof of work

- Automated task allocation with real-time status tracking

- Direct integration with Loan Management Systems and data syncing

- Mobile-based customer onboarding, digital signatures and media upload

- Smart beat planning to reduce travel times and save money

- Digital expense reporting

The platform ensures that MFIs remain compliant, efficient and prepared for growth. All in all, TrackoField becomes MFIs’ location mind.

What The Future of MFIs Looks Like

The next era of microfinance will be fully digital and guided by automation and AI. We will see:

- AI-led field verification

- Real-time risk assessment of borrowers

- Better visibility & predictive insights into field performance

- Paperless operations and secure audit records

- Faster approvals and improved borrower satisfaction

- Scalable systems that grow with the business

MFIs adopting these systems early will lead the industry with stronger portfolios, lower fraud and better customer impact.

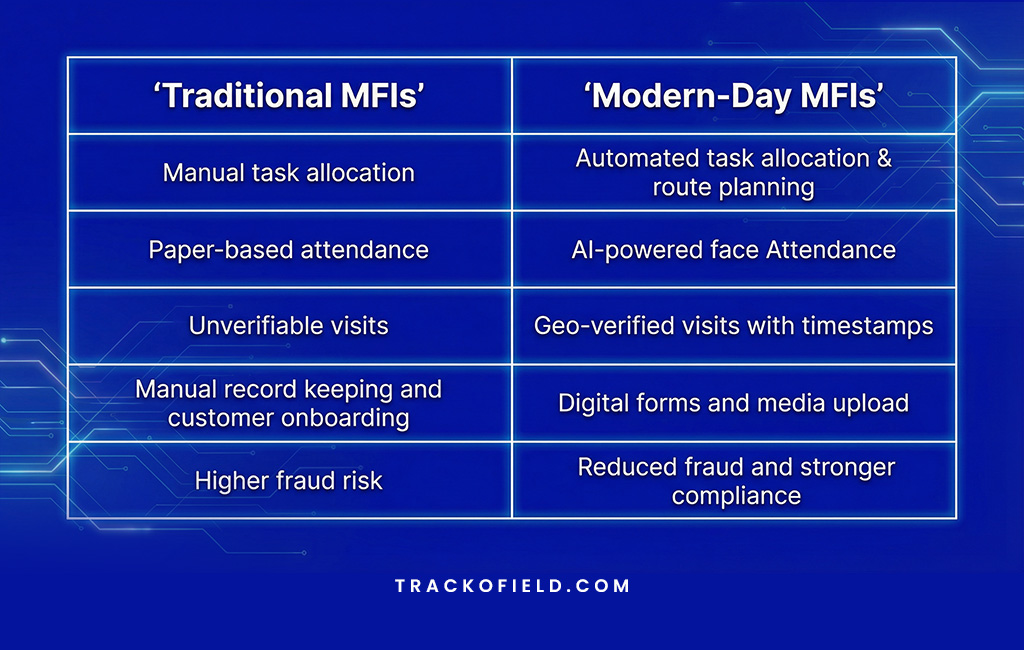

Traditional vs Modern-Day Microfinance Operations

Conclusion

Microfinance institutions exist to empower underserved communities. When field operations run with accuracy and accountability, that mission becomes stronger.

That’s why MFIs are moving on from traditional microfinance operations management methods. By adopting mobile-friendly field force management software with AI-powered solutions, MFIs can reduce the risk of NPAs, increase field staff productivity and enhance borrower trust.

Those who continue relying on outdated methods risk falling behind in a sector that is being reshaped by data and technology every day.

If your MFI is ready for a smarter and more efficient way of working, exploring field automation may be the most impactful step you take.

Frequently Asked Questions

-

How do MFIs operate in the modern day?

MFIs have large field teams that meet borrowers, hold group meetings, collect payments and verify loan use. Most work happens in rural or remote areas, so they now use mobile apps, digital KYC and real-time tracking to keep operations smooth.

-

How can MFIs prevent fake field visits and attendance fraud?

By using AI face attendance, geo-tagged check-ins, device ID tracking, location verification and route playback. These tools stop proxy attendance and confirm that real visits actually took place.

-

How does AI facial recognition help MFIs?

It verifies staff and borrowers instantly, blocks fake selfies, spots spoofing and confirms real presence on the ground. This creates an accurate and tamper-proof record of every visit.

-

Why is digital field automation important for MFIs?

It cuts paperwork, avoids manual errors and shows managers what is happening in the field. Automation speeds up approvals, improves accuracy and helps MFIs stay compliant.

-

What is the biggest challenge MFIs face today?

Ensuring field data is genuine. Fake visits, ghost customers and wrong information make it hard for MFIs to maintain loan quality and prevent fraud.

-

Why are MFIs shifting to mobile-first operations?

A mobile-first approach lets field agents complete all tasks on their phones. They can record attendance, upload documents, verify borrowers and collect data even in low-network areas, which speeds up loan processing and improves service.

Mudit is a seasoned content specialist working for TrackoField. He is an expert in crafting technical, high-impact content for Field force manage... Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.