-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

Grameen Credit Score and the Quiet Redesign of Rural Lending

- Author:Pulkit Jain

- Read Time:3 min

- Published:

- Last Update: February 9, 2026

Table of Contents

Toggle

Rural lending doesn’t usually go wrong at approval.

It drifts when what’s happening on the ground stops being visible.

Table of Contents

Toggle

Rural lending in India did not change in a single moment.

It changed through accumulation.

Disbursement cycles became faster. Branch networks expanded. MFI and NBFC portfolios scaled across districts and states. But the way institutions continuously understand borrower behaviour at the center level did not evolve at the same pace.

Most MFIs and NBFCs still assess borrower risk primarily at approval, using documents, bureau scores, and manual field verification. After disbursement, visibility depends on center meetings, field reporting, and periodic audits. These processes are necessary, but they are supervision mechanisms. They are not systems designed to continuously observe risk.

At smaller scale, this approach worked.

At today’s centre-heavy portfolio sizes, it does not.

What Grameen Credit Score Is

Grameen Credit Score, or GCS, is a behaviour-led credit scoring framework designed specifically for rural and group-based lending models.

It does not score borrowers only on documents or one-time eligibility.

It reflects how borrowers and groups actually behave after disbursement.

The score draws from signals such as:

- Repayment consistency

- Centre meeting attendance

- Group discipline within JLGs

- Verified field-level borrower interactions

In simple terms, GCS answers a question existing credit scores do not:

How reliably is this borrower or group behaving on the ground, over time?

Why Existing Credit Assessment Falls Short in Rural India

In MFI-led lending, risk rarely originates at approval.

It builds during execution.

Borrowers operate in informal and seasonal economies. Cash flows fluctuate. Group dynamics evolve. Field realities change faster than reports capture them.

To manage this, institutions rely heavily on center meetings and field reporting. These processes are critical, but as center volumes grow, they introduce subjectivity, delay, and fragmentation.

By the time stress appears in portfolio numbers, the behavioural patterns behind it have often been present for months.

GCS exists to reduce this time lag.

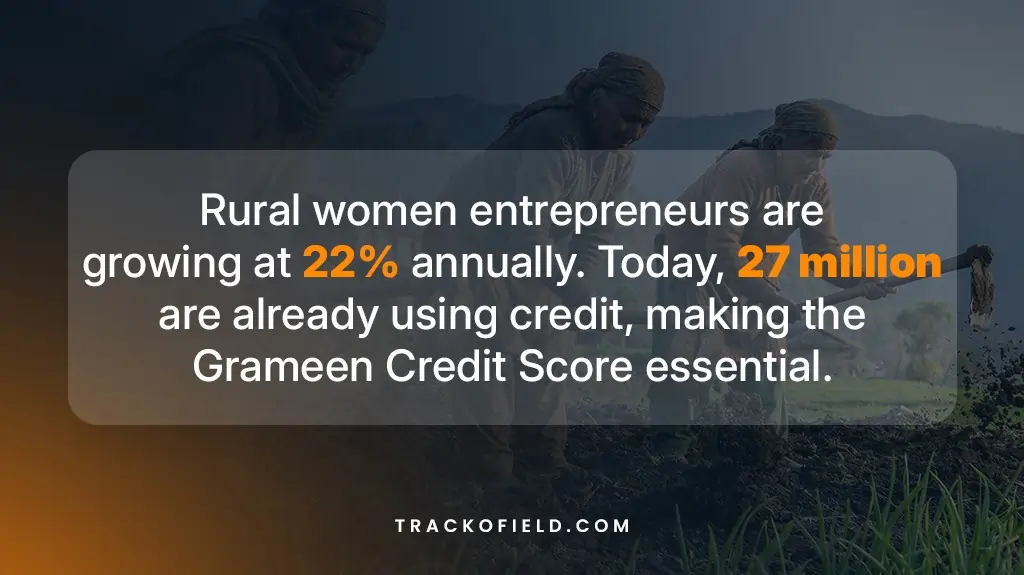

Rural Women Entrepreneur Stats

The Shift from Static to Observable Lending

Existing credit assessment establishes eligibility.

GCS extends assessment into execution.

It shifts rural lending from being assumption-led to being continuously observed.

This does not replace human judgement.

It makes judgement measurable and defensible.

Credit assessment becomes an ongoing process, not a one-time event.

Field Execution Becomes a Credit Input

In MFIs, field execution is often treated as an operational responsibility.

In practice, it is a credit driver.

Attendance authenticity at centers, visit integrity, and genuine borrower interaction directly influence repayment behaviour and portfolio stability.

When center execution is consistent, credit confidence improves.

When execution weakens, risk accumulates silently.

GCS formalises this relationship by linking field reality to credit understanding.

Leadership Thought

What This Changes for MFIs and NBFCs

Credit, risk, and operations can no longer function in isolation.

In MFI-led portfolios, portfolio quality increasingly reflects center-level discipline and field visibility, not just underwriting logic.

Institutions that invest in clean field processes and reliable center data lend with greater confidence, lower volatility, and faster decision cycles.

Over time, this will separate MFIs and NBFCs that scale with control from those that scale with hidden risk.

Closing

Rural lending will always be built on trust.

What is changing is how that trust is verified.

Grameen Credit Score reflects a move toward rural lending that is continuously observed, behaviour-led, and grounded in field reality.

The next phase of MFI-led rural lending will favour institutions that see clearly, not just those that move quickly.

Pulkit Jain is the Director and Co-Founder of InsightGeeks Solutions, where he leads the vision and product strategy behind SaaS platforms for fleet management, field force optimization, and last-mile... Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

-

How NBFCs Can Eliminate Fake Visits With AI-Powered Attendance Software

Mudit Chhikara January 19, 2026Make every NBFC field visit genuine with AI-powered attendance and location verification.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.