-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

Streamline Loan Sales & Recovery with Field Force Automation for DSAs

- Author:Mudit Chhikara

- Read Time:7 min

- Published:

- Last Update: March 7, 2025

Table of Contents

Toggle

Learn how DSAs can automate field operations and simplify loan disbursal and debt recovery processes.

Table of Contents

Toggle

Direct selling agencies (DSAs) play a pivotal role in the financial world. Acting as intermediaries, they bridge the gap between customers and banks, NBFCs, or financial institutions. DSAs employ agents to carry out tasks like loan sales, debt recovery, selling insurance, etc.

However, since these agents work remotely, it can be challenging to monitor their activities. That’s where field force automation software for DSAs comes in. Equipped with GPS tracking and advanced automation features, the software can monitor the real-time activities of field agents and simplify the management of their tasks, client visits, sales, attendance, and more.

Dive in to know more about FFA for DSAs and how it automates field operations.

How Does Field Force Automation Software For DSAs Simplify Loan Disbursal and Debt Recovery?

Dive in to know how field force automation software for DSAs works and how it can help empower field agents in loan disbursal and debt recovery tasks. Here are the 9 most useful features of the software.

1. Field Operations Visibility

Locational visibility of loan sales agents and monitoring their activities is essential to manage them effectively. If managers don’t know where their field agents are and what they are doing, it can make managing tasks, attendance, and other field operations more difficult.

Moreover, direct selling agencies employ hundreds of field agents at a time and it’s not possible to track each of them manually. You can’t call or text them to know if they are busy, travelling, or doing something else.

To solve this issue, you need field force management software with automation. It displays all your field staff on a dynamic centralised dashboard. The software displays the following data on the dashboard.

- Agents’ live location with current address and geo coordinates

- Total expenses and their value

- Total loan sales closed and their value

- Battery and network status of field agents’ devices

- Agents’ travel route and history along with a playback option.

2. Efficient Field Task & Activities Management

The main job of a DSA manager is to maintain a smooth workflow and optimise his employees’ tasks. But that can be difficult to do for hundreds of employees who all work remotely. However, field force automation software for DSAs allows managers to assign and monitor task activities remotely and ensure timely completion without any delays.

They can also plan tasks in advance using intuitive calendar scheduling. Software like TrackoField also provides the option of uploading tasks in bulk with custom task templates. The software also provides flexibility to field agents, allowing them to self-allocate or reschedule tasks.

Moreover, every update in a task is notified to the concerned managers and employees. Whether it is alerting agents about upcoming client visits or pending tasks, the FFA software provides a variety of notifications. Plus, managers can upload voice notes, images, or documents while assigning tasks. This ensures complete task understanding of loan salesmen.

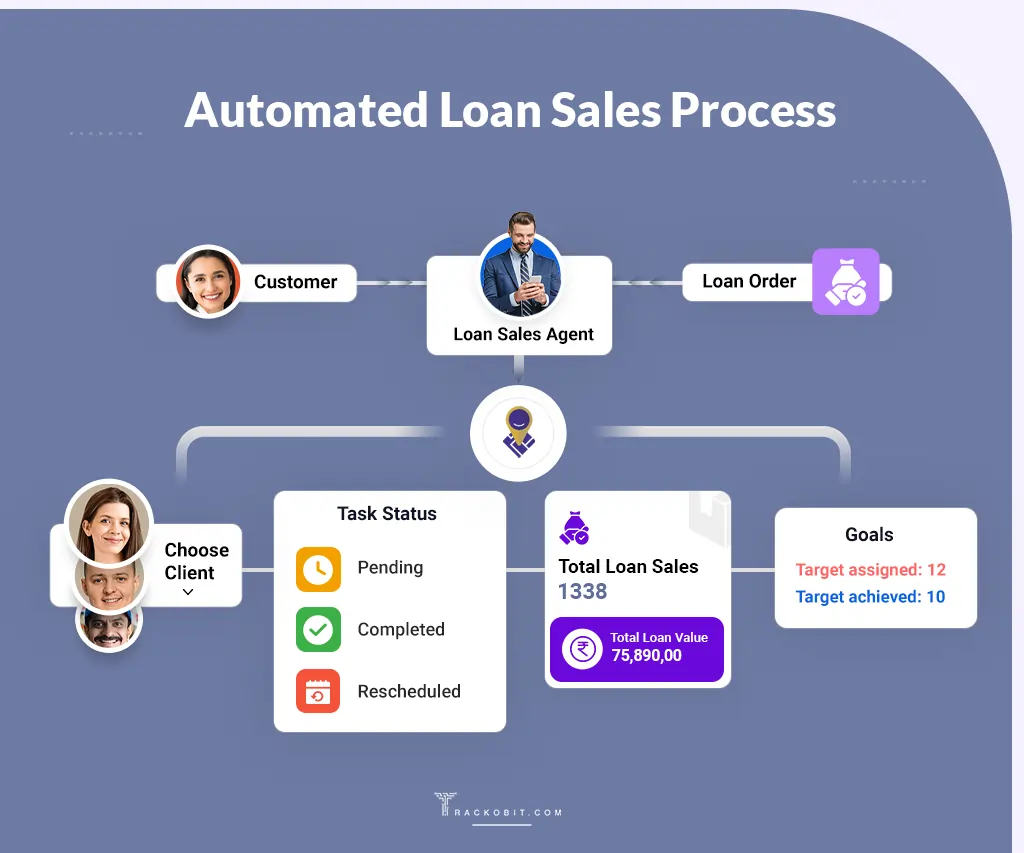

3. Loan Sales & Recovery Tasks Tracking

Loan sales or maybe debt recovery are the primary objectives of DSAs. Therefore, they need a foolproof system to quickly process leads and aid in recovering debt. This can be achieved via automation, which also helps improve the efficiency of field sales agents.

Field force automation software for DSAs allows managers to keep tabs on their field workforce easily. They can track the task status in real-time and even view how much distance an employee travelled or how many new applicants he visited.

Managers can check the exact time their employees began working and reached the customer site. They can also track how long an agent stayed there and when he marked the task complete.

You can also check how much debt amount recovery agents have collected. Software like TrackoField gives the option to upload media. Agents can thus upload geo-tagged images, documents or voice notes while carrying out their tasks. They can also attach invoices and receipts of the recovered amount on the TrackoField mobile app.

Moreover, field agents can take digital signatures from customers or feedback forms as proof of delivery. This prevents any customer disputes later on.

Automated Loan Sales Process

4. Loan Sales Management

You must be wondering how automation aids in loan sales management. Well, it is not a very complex process. The main tasks of a loan sales agent are making inquiries, identifying potential clients, collecting documents, pitching various types of loans, and verifying customers.

Field force automation software can help DSAs better manage their loan sales agents in the following ways. It allows you to:

- Track total client visits made by an executive.

- Track the number of new customers or borrowers onboarded.

- Review the documents collected by executives.

- Track the number of loan applications and their sum.

- Check how many loan sales closures were made.

With such automation, loan agents can create new customers easily, use predefined task templates, and create custom forms with custom fields. Executives can also quickly access essential documents and track their task status in real-time.

5. Error-free Payroll Management

Using the attendance data, field force automation software can calculate the work hours of loan agents and create accurate timesheets. These timesheets are used by the software to calculate the payroll and disburse it equally. Software like TrackoField reduces your reliance on external finance and HRMS needs. It can even accommodate overtime pay and sales commissions in the salaries.

6. Accurate Expense Management

Direct selling agents have to travel from place to place and often incur on-field expenses. This can result in disputed expense claims. After all, how do you verify field agents’ expenses? Well, with software like TrackoField, you can create multiple expense categories and set up a multi-level approval process. You can also mandate that employees upload invoices or receipts to authenticate expenses.

As for conveyance expenses, the software records the total distance travelled by an employee per day. It has an inbuilt distance calculator that syncs with the odometer to automatically calculate the exact fuel charges. This leaves no room for over or under-reporting of expenses. As such, the software eliminates expense dispute claims.

7. Geo-verified Attendance and Leave Tracking

FFA software can record the precise geo-verified attendance of sales agents. Using geofencing technology, the software makes sure that employees don’t misuse remote attendance marking. It also allows managers to link attendance with tasks. This ensures that an employee can only mark attendance and unlock his daily tasks after reaching a geofenced task site.

Managers can also mandate the upload of selfies with locational coordinates and timestamps for biometric verification. Leave tracking is also simplified with TrackoField. Managers can create custom leave categories (sick, casual, maternity) and upload the organisations’ holiday calendars. Field agents can easily apply for leave using their mobile application.

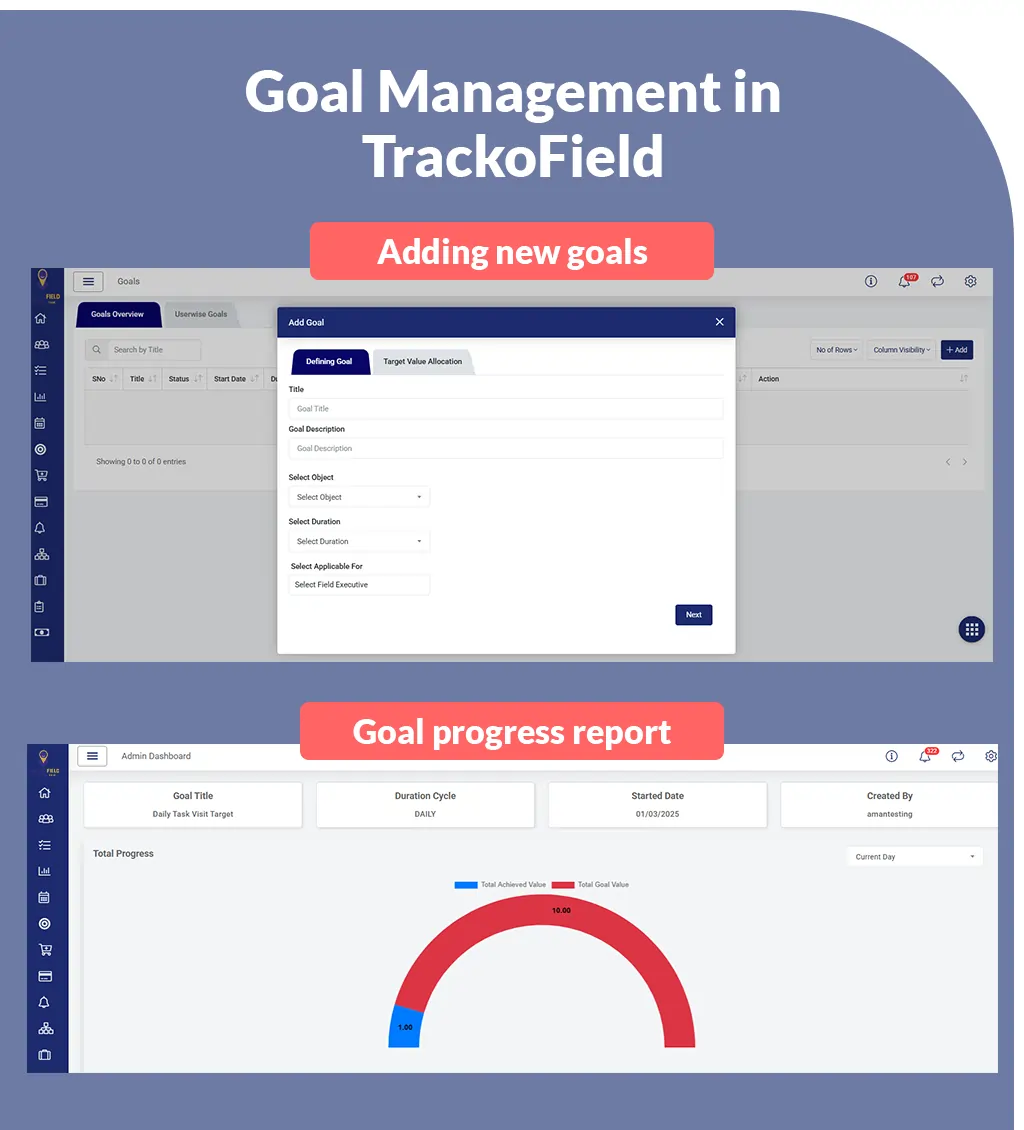

8. Goal Management

Goal Management in TrackoField

Field force automation software like Trackofield also offers a goals module. It enables managers to create and track their field executives’ goals efficiently. A goal could be anything from a required sales quota to meet, completing a predefined quantity of tasks, or adding a certain number of new customers.

Managers can also set the target value of goals and the duration in which to achieve them. They can check the live status of the goals on a dynamic dashboard. It can display the assigned and achieved goal data of field agents and also filter it by target value and duration. Field sales agents can also view their goals on the mobile app but only managers get the access to modify or set goals.

9. Insightful Reports

Field force automation software offers 20+ insightful reports that can be used by field managers to monitor employee metrics like performance, productivity, and attendance.

These metrics can be used to gain insight into your field agents’ weak and strong points. Managers can also use these reports to capitalise on trends, reward top performers, and spot any hidden patterns. Here are a few examples of the reports offered by FFA software:

- Target vs achievement report to see if agents are meeting their loan sales targets.

- Unreachable reports to view why and where an employee couldn’t be monitored.

- Stoppage reports to check the duration and frequency of the halts an agent takes.

- Distance travelled report to review the total distance covered by an employee. This report helps calculate conveyance expenses and check the efficiency of field agents.

- Performance reports to check how many loans executives sell and how much debt they recover.

Conclusion

It’s not easy working for DSAs and managing field agents. Whether it’s loan sales executives or debt recovery agents, working for DSAs involves client visitation, sales management, and more. These operations are challenging to manage but you can simplify them using field force automation software.

It tracks staff’s location and activity in real-time, allows field agents to easily manage sales, and reduces reliance on manual management. Software like TrackoField can help automate field operations, increase loan sales, and simplify the debt recovery process.

To know more about the software and how it can help DSAs, contact TrackoField staff today.

FAQs

-

What ROI can DSAs expect from field force automation software?

Field force automation software for DSAs can help streamline field sales teams’ workflow. It saves time and simplifies field operations like order creation and task allocation, leading to: - More client visits and sales - Lower operational costs - Better customer service

-

How can automation improve loan underwriting for DSAs?

Field force automaton software for DSAs can help to analyse a loan applicant’s spending patterns and credit history. It can then predict the chances the applicant will default on his loans, helping DSAs in the underwriting process. Managers can also use the data analysis in the software to identify potential clients, find ways to optimise agents’ performance, and reduce repetitive tasks.

-

How to handle customer disputes in an FFA system?

An automated FFA system for DSAs stores data on cloud servers and maintains an elaborate record of all employee-customer interactions. In case of disputes, managers can retrieve an executive’s geo-tagged and time-stamped attendance history, PODs, or feedback forms collected to check whether any error occurred on the field agent’s part or if there was a glitch in the system.

-

Why should DSAs automate the entire loan lifecycle?

Automation can be greatly helpful for DSAs. It can shorten the loan lifecycle, allowing field agents to visit more prospective clients and meet their goals faster. An automated loan lifecycle lets DSAs sell more loans, credit cards, or other financial instruments. It also reduces human error in data entry, makes order creation seamless, and helps managers maintain a smooth workflow.

-

How does automation simplify debt recovery?

Automation in field force management software for DRAs can help to optimise task allocation and improve the visibility of field agents. Plus, the software can send automated reminders, SMS, and emails and ensure timely customer service. Employees can quickly access or create forms to log information or customer information.

Mudit is a seasoned content specialist working for TrackoField. He is an expert in crafting technical, high-impact content for Field force manage... Read More

Related Blogs

-

How NBFCs Can Eliminate Fake Visits With AI-Powered Attendance Software

Mudit Chhikara January 19, 2026Make every NBFC field visit genuine with AI-powered attendance and location verification.

-

How TrackoField’s Analytical Intelligence Transforms Field Operations

Mudit Chhikara January 12, 2026Turn complex field data into clear insights. Use analytical intelligence to drive faster, smarter decisions.

-

Grameen Credit Score: Everything that NBFCs and MFIs Must Know in 2026

Shemanti Ghosh January 6, 2026Empower the underserved Joint Liability Groups (JLG), Self-Help Groups (SHG), and residents of rural India with better credit assessment and…

-

How MFIs Are Working In Modern Day Scenario? A Complete Breakdown

Mudit Chhikara December 30, 2025How field force automation is helping MFIs transform field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.