-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

Are Your Loan Agents Meeting Targets? Get Answers with Locational Intelligence

- Author:Tithi Agarwal

- Read Time:6 min

- Published:

- Last Update: March 6, 2025

Table of Contents

Toggle

Bring ease to target tracking and achieving with field force automation for loan agents. You can view where they are at and their task status in real-time. This increases accountability.

Table of Contents

Toggle

Targets are the driving force behind your field loan agents. But the question is – how can direct selling agents keep track of their agents’ targets? They are constantly wondering is the agents are achieving their target. Why are they not able to?

They have no clarity of field operations. That is why field loan sales tracking solutions through field force automation software for DSAs can help. It has tools that help track agents and create and assign goals and targets. To reduce the chances of discrepancies, it has geo-coded attendance.

Intrigued…want to know more about how you can track your agent’s targets?

Continue Reading.

What Targets Direct Selling Agencies Must Be Tracking?

Here are some of the most critical targets DSAs must track for loan sales and recovery agents.

Targets for Direct Selling Agents (DSA) |

Targets for Direct Recovery Agents (DRA) |

|

|

Why is Target Tracking Important for DSAs & DRAs?

1. Performance Evaluation

Monitoring targets helps assess each agent’s effectiveness. Be it in selling loans or recovering debts. It provides insights into individual and team contributions. Thus allowing management to recognize top performers and identify those needing support.

2. Revenue Generation

Loan sales drive business growth, while recoveries ensure the company maintains financial stability. Tracking these metrics ensures a steady cash flow. Also reduces the risk of financial losses.

3. Target Achievement

By regularly tracking targets, businesses can ensure agents stay aligned with company goals. It also helps in setting realistic benchmarks and identifying underperformance early.

4. Incentive Calculation

Many organizations offer commissions, bonuses, and other performance-based rewards. Keeping track of targets ensures fair and accurate compensation for agents.

5. Compliance & Risk Management

Loan sales and recoveries must adhere to legal and regulatory guidelines. Monitoring targets helps identify any deviations from protocols. Which reduces the risk of legal issues or unethical practices.

6. Customer Relationship Management

Tracking targets reveals how agents interact with clients. A high loan rejection or default rate may indicate poor communication. A clear indication that you need better customer engagement strategies.

7. Operational Efficiency

Monitoring progress helps identify inefficiencies in loan approvals, disbursements, and recovery processes. It allows businesses to streamline workflows and allocate resources effectively.

8. Fraud Detection

Regular tracking helps detect unusual activities. These activities can be misrepresentations in loan approvals or unethical recovery practices.

9. Strategic Decision-Making

Data collected from target tracking provides valuable insights for optimizing lending policies. Also helps in improving debt recovery strategies, and expanding business operations effectively.

How Field Agent Tracking for Direct Selling Agencies is Helping Track Loan Agents’ Targets

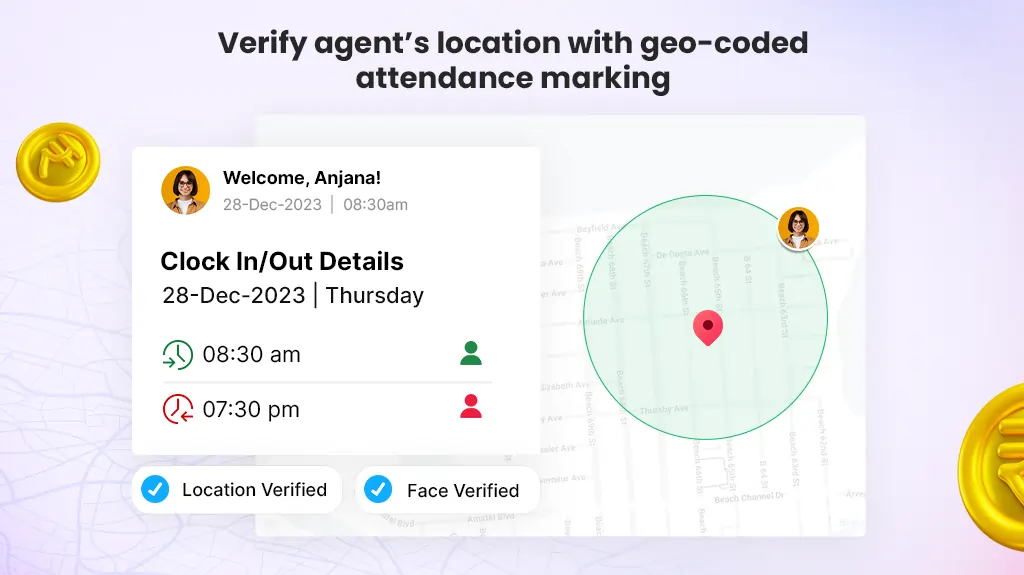

1. Visit Verification

Direct Selling Agencies can verify visits for loan sales and recovery agents. They achieve using geo-coded attendance and task tracking through Field Force Automation. Agents mark their attendance using GPS-enabled check-ins, ensuring real-time location stamping. This prevents fraudulent reporting and ensures accountability in field operations.

Geo-fenced task tracking further enhances verification. It guarantees agents physically visit assigned locations before logging tasks. If an agent attempts to mark a visit outside the designated area, the system denies the update. Thus ensuring genuine engagements.

Live status updates enable managers to monitor visit completion in real time. Managers can timely intervene when required.

Additionally, agents can submit time-stamped proofs such as location-based photos.

This comprehensive tracking system ensures transparency, enhances productivity, and improves the overall efficiency. It benefits for DSA and DRA.

TrackoField’s Geo-coded Attendance System

2. Loan Sales Lead Management

A sales order management solution with field sales agent tracking software gives complete visibility into sales process. Managers can easily track the total order value and the revenue each agent generates. They can also see how many prospects were visited and how many loan inquiry/sales were reported.

For DRA agents, the dashboard shows the amount collected from borrowers. Making it easy to track payments. This helps managers see how close the team is to meeting their targets.

The solution also makes selling loans faster and more efficient. Agents can collect sales lead data using custom forms and fields. Thus ensuring data entry accuracy and ease. With this system, agents can close deals faster and reach their targets more easily.

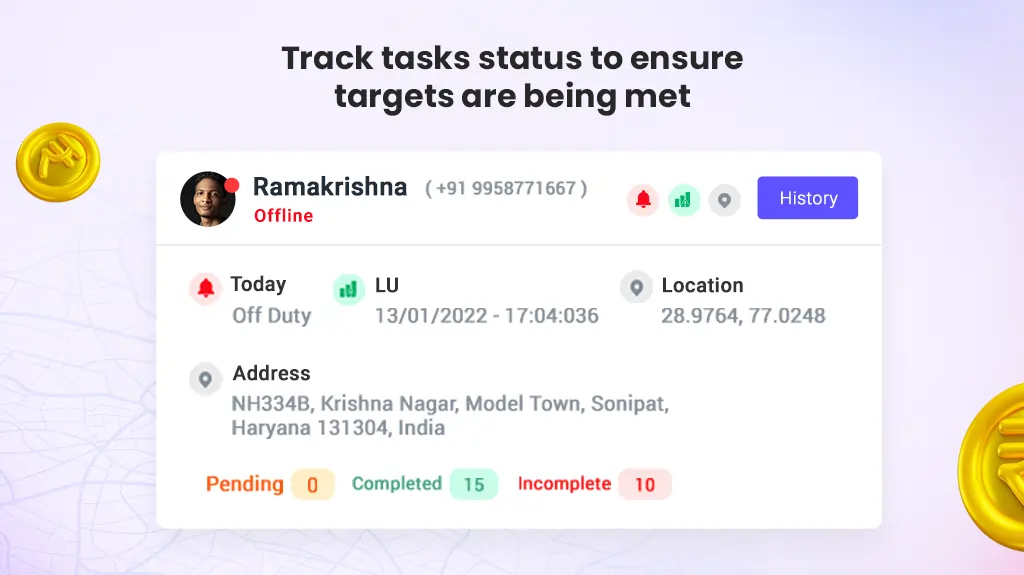

3. Field Task Status Tracking

Each direct selling agent and recovery agent has specific zones to visit and tasks to complete. Their daily job is to meet borrowers or potential clients, sell loans, or collect payments. These tasks help them meet their targets.

With field force automation, managers can track loan agents’ tasks and targets in real time. They can check updated task lists and monitor progress. The task module provides detailed data, including:

- Time and date when tasks were assigned

- When each task was completed

- The location where it was completed

- Task rescheduling reasons (if any)

- Task status – completed, pending, or rescheduled

Direct selling agencies also benefit from task reports and target vs. achievement reports. These reports help managers track loan agent performance, identify challenges, and improve productivity. They can even spot the top five performers based on tasks completed and targets achieved.

Track task status to gain clarity

4. Sales Goal Tracking

The best way to track loan agents’ targets is through a goal-tracking module. Loan agent tracking software for DSAs comes with a goal module. It allows managers to track agents’ goals in real time.

Agencies can create and assign goals for up to 24 months. The module provides key details like:

- Goal Title

- Target Value

- Assigned Employee

On the goal dashboard, managers can view in-depth details, including:

- Goal Name

- Duration (daily, weekly, monthly, etc.)

- Start Date

- Created By

- Total Progress Calculation.

This system makes it easy to track performance over time and ensures agents stay on target. Real-time tracking allows managers to spot gaps early. This way they can help agents improve their success rate.

Conclusion

Clarity of targets and goals is essential for both DSA and agents. With field agent tracking software, direct selling agencies can view the target progress. That too in real-time. Managers can make edits to the plans and goals accordingly. As for the staff, this acts as motivation to be the best in the field. Accountability is a significant factor that gets improved and benefits every party involved.

Field force automation software by TrackoField facilitates both target and achievement tracking. Agencies can view real-time locational data. The field loan agents can use automated tools to achieve targets. Productivity, visibility, and accountability topping charts.

Frequently Asked Questions

-

How to Improve Field Loan Agent Productivity?

The best methods to improve field loan agent productivity are by: - Equipping agents with loan agent tracking software for real-time task monitoring. - Setting clear targets and goals. - Using performance reports to identify weak areas and offer training. - Geofencing zones to ensure agents are at location, reducing inefficiencies.

-

What are the Benefits of Geofencing for DSA Sales Teams?

Geofencing automates check-ins and prevents route deviations. It ensures loan sales agents visit assigned locations. It enhances territory management, reduces travel time, and boosts accountability. Managers receive alerts when agents enter or leave specific areas. Thus making tracking easier and improving sales team efficiency.

-

Which is the Best Employee GPS Tracking Tool for Field Loan Agents?

The best GPS tracking tool for field loan selling & recovery agents is TrackoField. This is because it monitors agent locations in real time. It also provides route history, and enables automated check-ins. It has features like geofencing, task tracking, and productivity reports.

-

Why Loan Agents Miss Targets and How to Fix It?

Loan agents miss targets due to poor lead allocation, inefficient task management, and lack of tracking. Fix this by using loan agent tracking software, setting clear goals, and providing performance insights. Automate workflows, offer training and use geofencing to improve agent productivity and success rates.

Tithi Agarwal is an established content marketing specialist with years of experience in Telematics and the SaaS domain. With a strong background in literature and industrial expertise in technical wr... Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.