-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

Top Strategies for DSA Managers to Help Loan Agents Close Deals Faster

- Author:Tithi Agarwal

- Read Time:5 min

- Published:

- Last Update: January 7, 2026

Table of Contents

Toggle

DSA managers are looking for ways to help loan agents close deals faster. Here are not one but 6 successful strategies to carry out with field force automation.

Table of Contents

ToggleManagers of direct selling agencies (DSA) are stressed out!

Wondering why? Well, the source is the falling graph of loan sales and productivity of loan agents in this quarter!!

This is quite alarming. That is why to help DSA managers out, we suggest the top 6 strategies that will help field loan agents close deals faster and meet their goal of loan sales target. These strategies are even more effective when implemented with field force management software.

Continue reading to know how you can increase both sales and productivity in 6 strikes with the help of field agent tracking software for DSA.

Top Strategies for DSA Managers to Help Loan Agents Close Deals Faster with Field Force Automation

Field agent tracking software for DSA helps you implement strategies to boost direct selling businesses.

1. Go for Centralized Sales Order Management

The most important strategy is using automation to chase leads. The field force automation tool has a sales order management solution. With it, loan sales agents can record the prospective client’s borrowing details. DSA managers can view sales order details in real time.

The solution comes with custom forms and fields. The agents can collect data on sales or borrowers. And can even attach KYC or other key documents.

The benefit of this feature is that it will help increase –

- Accuracy of details recorded

- Faster order recording

- Reduced paperwork

- Real time visibility

This is an excellent strategy to increase your employees’ revenue and productivity.

2. Track Real-time Agents Performance

Every operation can fail if DSA managers do not have any idea of what is happening on the field. Monitoring loan agents’ interaction with prospective borrowers is important. Then only can you identify bottlenecks and unproductive areas.

Another way you can help agents close deals faster is by monitoring their performance and verifying their location visits. The loan agent tracking software for DSA has real-time tracking. It sets geofences on client locations. DSA Managers receive notification whenever employees enter/exit the virtual boundary. This ensures that employees reach meetings on time and operate in assigned sales territory.

Additionally, it helps generate Time-on-Field and Idle Time reports to help measure how much time an agent spends actively working versus being inactive.

The benefit of this strategy is that it –

- Increases loan closure rate

- Improve accountability of field employees

- Help managers make informed decisions

This level of visibility allows DSA managers a clear view of how the staff is performing on the field. They can ensure that the loan agents are achieving their targets or not. Also, they have the analysed data to provide instant feedback. Thus, motivating them to be the best and close deals faster than ever.

3. Enable Automated Follow-ups & Reminders

By using field employee tracking software, agents get a TrackoField employee tracking app made for executives.. Over it, they can access all client and task-related information. They know which burrower to visit first or maybe last. Also, automated upcoming meeting reminders ensure that officers reach the client’s location on time.

This way they can effectively turn cold leads into warmer ones. Also, reduces the chances of missed opportunities and increases sales.

That is not all.

The field force automation software allows DSA managers to form advanced schedule calendars. Helping employees plan their follow-ups with prospective borrowers accordingly.

4. Digital Document Management & Verification

One of the main jobs of direct selling agents is collecting data and documents of borrowers for KYC and verification purposes. However, collecting the loan applications of debtors is a tedious and confusing task.

That is why direct selling agencies’ managers must adopt a strategy to automate it. Field force automation software has custom fields and forms which is just what you need. Automation, accuracy, and speed are what you will gain.

Officers can access these remotely through the app. They can attach files, collect data, and add e-signatures for verification. The best part is that the new custom field can be added if required. Collect as much information as needed. This speeds up the loan processing procedure. Great for winning customer satisfaction.

5. Ensure Seamless Communication & Collaboration

The field force automation software is the best way to stay connected with your remote agents. Using it staff with the executive app. Through it, they can share files, and images and chat in real-time. They can also solve queries regarding loan terms and conditions instantly. Share changes in schedules or edits in tasks.

Since the software is cloud-based, data exchange and collaboration between the in-off and out-of-office teams is smooth. The back office will be able to view the targets achieved in real time. The on-field team is able to access files remotely. It’s a win-win for every team.

6. Enforce Custom Reporting & Data Analytics

Using the analytical dashboard and real time reports will help you optimise workflow, organise tasks and judge performances. For example, the target vs. achievement report will tell you which loan agent are meeting their targets and which ones are lagging behind.

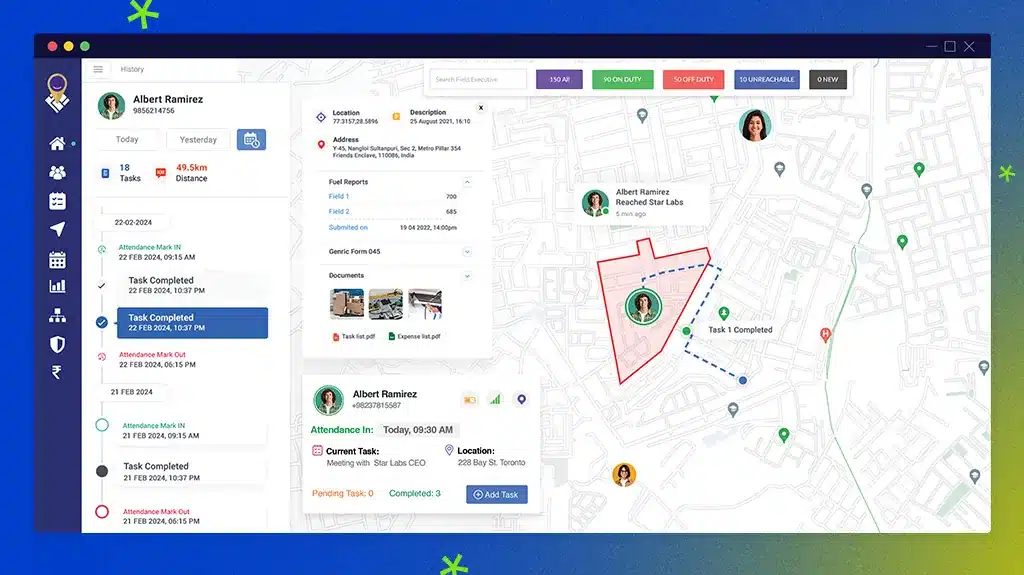

View real time data of loan agents on the dashboard

Distance travelled reports will accurately tell you the total distance travelled. Knowing the exact KMs will ensure correct reimbursement is made. The live dashboard will tell you –

- Real-time location over the map

- Play back history of the route

- Task timeline and location

- Last update received

- Total pending and completed tasks

- Battery and network status

All this information is also helpful while assigning or managing ad-hoc tasks. Managers will also know the top 5 performers based on sales achieved.

Conclusion

Managing loan agents and achieving the most sales are top priorities for direct selling agencies. Now that is not going to happen the straight way. Some tricks and strategies have to be used to score goals, right? So by implementing the above-mentioned strategies with field agent tracking software for DSA, we are sure you are going to see excellent results.

Interestingly, DSA managers have help – field force automation software for DSA. TrackoField is more than capable of helping you increase sales with its multiple hands or should we say tools. With it, you will be able to streamline workflows and optimise field operations with ease.

Frequently Asked Questions

-

How can Automation tools enhance direct selling agencies?

Automation is a big help and tool if you want to grow your direct selling agency. Field force automation tools for DSA reduce manual work and enhance efficiency. TrackoField leverages automation to streamline task management. With its help you will experience streamlined workflow and optimised operations.

-

How can DSA agent generate more leads for direct selling agency?

You need effective strategies to boost direct selling business. The best way to devise and implement them is through field force automation software. It brings visibility to loan agents' targets and methods. It will effectively streamline workflow and operations. Not to forget, it automates a number of processes, thus increasing the productivity of field loan agents. The software will schedule follow ups and sales order management as well.

-

What are the most effective strategies to grow a direct selling agency in 2026?

Investing in field loan agent tracking software is the most effective strategy for growing a direct selling agency in 2026. Not only will it tell you where your agents are, but you will also gain real-time visibility of their activities. With all the accurate data, you can improve your loan selling strategies. This will increase DSA's revenue and profits. It also helps improve customer satisfaction and retention.

-

How can AI enhance direct selling operations?

AI predicts customer preferences for personalized recommendations. Chatbots handle queries instantly. AI-powered CRMs improve lead management. Predictive analytics optimize sales strategies. Automated follow-ups increase conversions. AI-driven insights help in decision-making. Sentiment analysis tracks customer satisfaction. Voice assistants simplify order processing for seamless experiences.

Tithi Agarwal is an established content marketing specialist with years of experience in Telematics and the SaaS domain. With a strong background in literature and industrial expertise in technical wr... Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.