-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

What is a Payroll Management System? Definition, Types, Features

- Author:Tithi Agarwal

- Read Time:10 min

- Published:

- Last Update: December 26, 2025

Table of Contents

Toggle

Payroll management software is the best way for businesses to automate processing payouts. Here is a comprehensive guide to the payout system’s benefits and top features.

Table of Contents

Toggle

Running a business? Awesome!

Struggling to compute the salary of your growing team or relying on accounts books to manually calculate salaries? Not so good!

Adopting a payroll management system is a necessity for businesses in this time and age. The software is a perfect escape from jumbling numbers and committing human errors as it can easily automate the entire process of calculating and processing salaries.

No more typing away on calculators manually. Let’s see how the payroll system is reducing a mountain to a molehill.

What is a Payroll Management System?

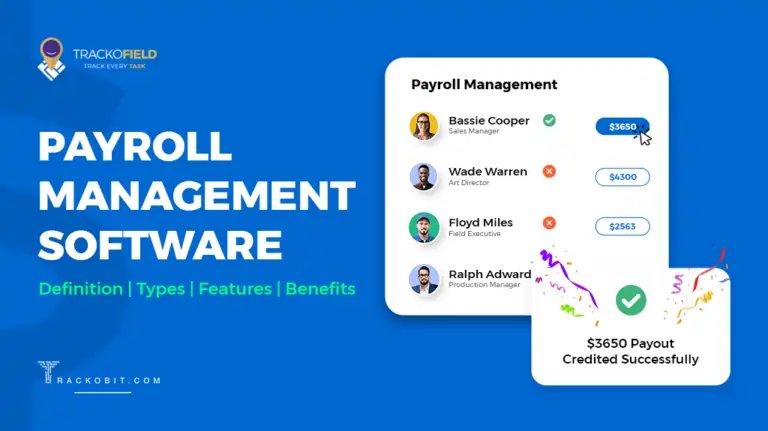

A payroll management system is a program that is streamlining and managing employee payouts. Automating employee payments ensures on-time paychecks and compliance with all rules and regulations. The system automates the end-to-end process of onboarding employees and calculating their monthly salaries, bonuses, benefits, and tax deductions like EPF, TDS, PT, and ESI.

An efficient payroll solution should cover everything related to the financial compensation of employees, including their leave payouts and more.

4 Types of Payroll Management System

There are 4 types of payroll systems:

1. In-house Payroll

Some businesses have an internal payroll process that they manage manually. In such situations, either the business owners or HRs are responsible for managing the payroll. This can be an economical option for small businesses, but definitely not meant for businesses with bigger teams.

2. Full-time Accountant

Accountants are financial experts who can be hired to run payroll and file tax forms on behalf of the company. Outsourcing payroll management to an accountant provides expert support, as they can even provide businesses with expert advice and insights.

3. Payroll Service

Payroll providers specialise in running payroll for other businesses. Businesses can avail of multiple payroll-related services, such as time tracking to fill out the company’s taxes. These payroll providers charge a fee per month.

4. Payroll Software

Companies can now automate payroll processing entirely with a specialised payroll management system. The software minimises the chances of human errors. Additionally, a combination of payroll and HR software programs generates detailed payroll reports for each pay period.

How to Choose a Payroll System: 4 Features to Consider

1. Automation

Automation is a great way to streamline your payroll—making it easier to manage. Automated payroll systems can cover payment processing, calculations, and report generation tasks.

When using payroll software, you can automate most aspects of the payroll process. In this case, you’ll just have to do some initial setup, and then you can run the payroll in a matter of clicks each pay period.

Automated payroll systems tend to be more secure and accurate than manual systems. They come with encryption technology and built-in calculators to prevent breaches and errors.

2. Time and Attendance Tracking

For businesses paying their employees on an hourly basis, tracking time and attendance can be the most beneficial feature of a payroll system. A payroll and time tracking system eliminates the hassle of manually tracking employee time cards.

Adopting an automated attendance tracking system for employee log-in and out makes the data recorded more accurate. The data is stored in the database/cloud and linked to the payroll system that uses this data to calculate attendance days, overtime, etc.

3. Leave Management

In every organisation, employees are entitled to take a certain number of leaves such as privilege or annual leave, casual leave, sick leave, holiday, etc.

If the software has a leave management feature, HR can directly credit these leaves to the account of every eligible employee. As and when required, the employee can apply for leave through the system. These systems monitor absences, sick leave, hours worked, overtime and other factors. Then, they seamlessly sync that information to process payroll efficiently.

4. Integration with Expense Solution

Your accounting or expense module needs to record every financial transaction. Including payroll information like department-wide employee costs and individual payroll components like reimbursements, etc. Some payroll solutions have integration with expense management software via API.

Without such integration, the payroll officer must provide all transaction details to the accounts department. The accountant then manually posts it in the form of journal entries in accounting software like Tally, Quickbooks, etc. These integrations can help the finance and payroll teams work together and avoid any manual data entry.

Key Functions of Payroll Software

Time Tracking Integration

A time tracking module can help keep track of all employees working in your organisation, whether they are working hourly or doing full-time shifts, etc. This feature allows them to log in and log off on the portal, avoiding the hassle of manual entries and improving efficiency and accuracy.

Reimbursement Management

Keeping track of reimbursements like travel lodging and food expenses of employees can become quite chaotic. With a payroll management system, expense management can be a simpler affair. A payroll software must be able to automate your expense reports and payment processes. This can save time and enhance the accuracy of reimbursements.

Employee Self-service

Employees are given access to their records and can change any personal information at any point in time. It gives them direct access to their leave balances, etc. This drastically reduces the HR workload, giving them time to work on other essential tasks of the organisation.

Payroll Reports

Payroll reports are critical for every organisation. The right payroll system must be able to customise payroll reports as per the organisation’s needs and generate reports to give quick, easy insights. These customisable reports help create tailored datasets for your company’s critical metrics.

API Integration

Payroll integration allows you to seamlessly plug into your existing programs, apps, and partners to meet the needs of your company and employees. With the best Payroll software it helps automate the flow of data to and from HR and payroll platforms with immense ease. It helps you leverage systems without the hassle of time management or poor user experience.

Benefits of Payroll Management Systems

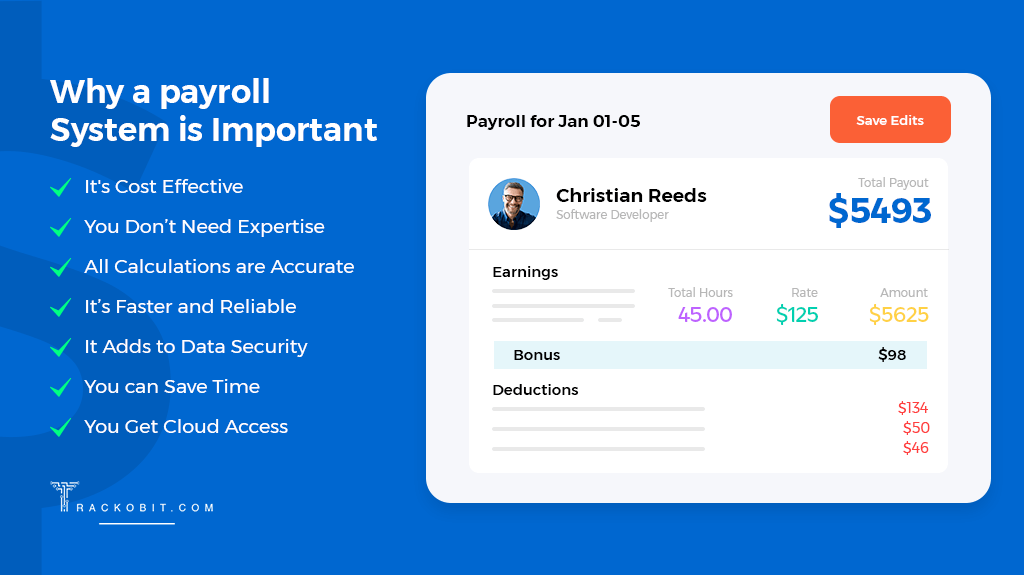

An apt payroll management software streamlines processing salaries. Every business should consider implementing payroll software because:

It’s Cost Effective

The payroll management process involves many complicated calculations that must be done every month. It requires a dedicated and effective workforce to handle the task. But with payroll software’s automated features, the process speeds up while also limiting human input.

Additionally, you don’t have to invest in any hardware when switching to a payroll system. Just have to subscribe to a software and start reaping the benefits. Thus making your payroll process even more cost-effective.

You Don’t Need Expertise

The payroll management system is meant to simplify salary calculation. Its user-friendly interface allows you to navigate and manage payroll processing without having a good understanding of the procedure.

All Calculations are Accurate

Human errors are bound to happen when the process is done manually. With the right payroll system, such mistakes can be eliminated. Thanks to automation, there are fewer chances of entering wrong information, leading to zero errors in salary calculations.

It’s Faster and Reliable

It’s a guarantee that all the calculations done by the payroll management software are accurate, thus reducing the need for reworking. Plus, the system instantly prepares statements and reports in a click. All this minimises the time required to complete the payroll process, making it more reliable and efficient.

It Adds to Data Security

Data security is of topmost importance when it comes to sensitive business information like employee bank details and salary information. The latest payroll systems have data encryption, allowing access only to authorised users.

You can Save Time

Monthly payroll reconciliation is a necessary task that takes up a large amount of employees’ time. But which payroll solution? This process gets automated and speedy. The tasks get easier, allowing your employees to utilise their time in other business development activities.

You Get Cloud Access

The latest payroll management software comes with cloud storage, allowing access to data remotely regardless of the device, whether on a desktop, laptop or mobile. You get access to necessary data like working hours, salaries and other computing data anytime, anywhere—no more confining workforce and tasks to an office.

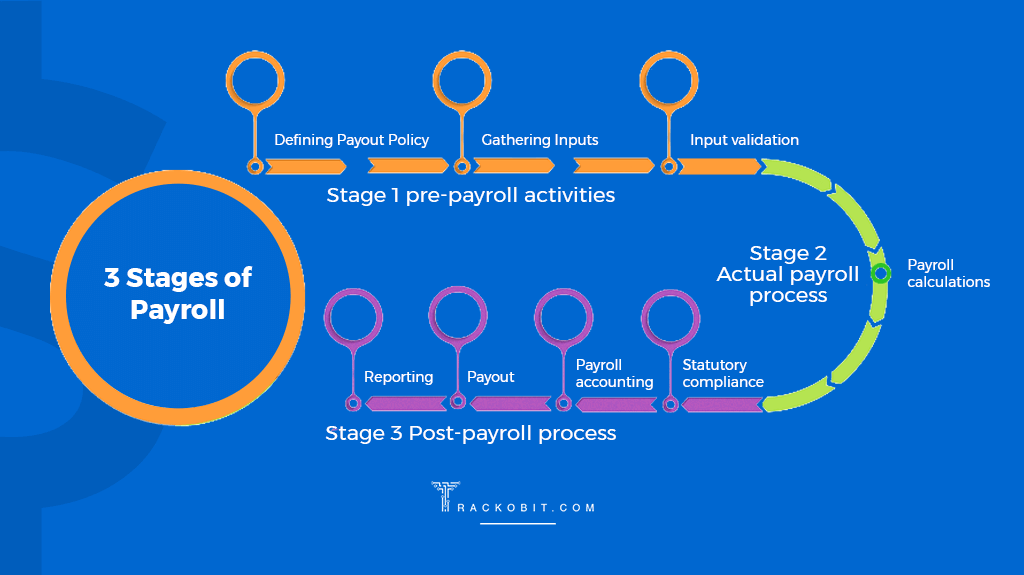

What are the Stages of Processing Payroll?

The entire process of payroll processing can be split into 3 parts- pre-payroll, actual payroll and post-payroll activities.

Pre-Payroll Activities

Defining Payroll Policy

Various factors, such as the company’s policies on pay, leave, benefits, attendance, etc., impact the net amount to be paid. It is crucial to define these policies clearly from the outset.

Gathering Inputs

The payroll process involves interacting with multiple departments and personnel. This information is regarding attendance data, work hours, etc. The task of gathering this information may get overwhelming. However, this problem does not remain problematic when using a payroll system with integrated features, leave and attendance management, time tracking, etc.

Input Validation

Once you have received the inputs, you need to check for the validity of the data and that they adhere to the company policy, format, etc. also must ensure that input is not missed.

Actual Payroll Process

Payroll Calculation

In this stage, the validated data is fed into the system for payroll processing. The result is the net pay after adjusting necessary taxes and other deductions. It’s good practice to recheck the verification for accuracy.

Post Payroll Process

Statutory Compliance

All statutory deductions like EPF, TDS, and ESI are deducted at the time of payroll processing. The company then remits the amount to the respective government or departments.

Payroll Accounting

Every organisation has to keep track of its financial transactions. And salary paid is a significant operational transaction that has to be recorded in account books.

Payout

It’s up to the organisations to select the mode of payment, be it cash, cheque or bank transfer. It’s a common practice for companies to provide employees with salary accounts. After the completion of payroll, you need to ensure that the company’s bank account has the necessary funds to make salary payments.

Reporting

After completing the payroll run, the finance department will most likely ask for reports. As an employee responsible for the payroll process, it will be your responsibility to dig into the data and extract the required information in the reposts. But this process can also be automated with a smart payroll system.

What are the Future Trends of Payroll Management System?

With the technological advancement happening in the HR industry, the future of payroll looks even more promising. Some of the trends that we can expect in the payroll system in the future are:

Automation and AI Integration

Automation and artificial intelligence (AI) have been used in payroll processing to streamline repetitive tasks, reduce errors, and enhance overall efficiency. Integration of AI to analyse and interpret complex payroll data ensures compliance with regulations and the identification of patterns or anomalies.

Cloud-Based Payroll Systems

Cloud-based payroll solutions are widely adopted for increased accessibility, scalability, and ease of collaboration among remote or distributed teams. These systems offer real-time tracking updates, enhanced security features, and seamless integration with other HR and financial applications.

Blockchain for Payroll Security

Implementing blockchain technology for enhanced security and transparency in payroll transactions reduces the risk of fraud and ensures data integrity. Organisations may consult a blockchain development company to build a decentralised and tamper-resistant ledger for payroll records.

Global Payroll Management

Growing demand for global payroll solutions as businesses expand internationally, with systems capable of handling diverse currencies, tax regulations, and compliance requirements across multiple jurisdictions.

Data Analytics for Payroll Insights

Increased use of data analytics to derive valuable insights from payroll data is helping organisations make informed decisions related to workforce management, compensation, and financial planning.

Personalised Compensation Models

Customisation of payroll systems to support flexible and personalised compensation models, including performance-based pay, benefits customisation, and variable pay structures.

Are you Looking for the Right Payroll Software?

Businesses looking to simplify their payroll process have 4 options (3 if you don’t want a headache from all those dancing numbers). And instead of hiring or outsourcing their payroll process, they can adopt an efficient payroll management software.

The software automates the calculation and deduction processes for you, all the while even tracking the time, attendance and leave of each employee.

What else is there to ask for?

Oh, right, a recommendation!

TrackoField can be your go-to solution for simplifying and automating the payroll procedure. With its seamless integration qualities and real time tracking features, TrackoField is a sought-after employee management solution. It is helping businesses streamline their workflow through leave and attendance management software, task management software, expense management and task tracking.

Schedule a demo now!

Frequently Asked Questions

-

How does a payroll system help employees?

Payroll software benefits both companies and employees. With the least effort and time, it helps guarantee that employees receive the correct amount of money at the right time through their preferred payment method.

Employees can easily view their payment history and modify their personal information and preferences using user-friendly interfaces. -

What is the importance of a payroll system?

A payroll system is crucial for organisations as it serves as the backbone of efficient and accurate financial management. It plays a pivotal role in ensuring timely and precise compensation to employees, encompassing salary, bonuses, and deductions. By automating payroll processes, businesses can minimise the risk of human error, reduce the time and resources required for manual calculations, and enhance overall payroll accuracy.

-

Can you run a payroll system in Excel?

Yes, you can manage a simple payroll system with Excel. But it won't have sophisticated features like direct deposit and time tracking. Even though Excel is less expensive for small businesses, as your team expands, a more sophisticated payroll system will help lower errors and boost productivity.

Tithi Agarwal is an established content marketing specialist with years of experience in Telematics and the SaaS domain. With a strong background in literature and industrial expertise in technical wr... Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.