-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

The Best 15 Payroll Software in India: Streamline Your Payroll Process

- Author:Tithi Agarwal

- Read Time:10 min

- Published:

- Last Update: October 6, 2025

Table of Contents

Toggle

Even a single error in payroll computation can result in disaster. It’s wise to invest in payroll management software that could automate the computation process. Here is a list of the 15 best payroll software in India to choose from.

Table of Contents

Toggle

If you want to make payroll computation error-free, hassle-free, and less time-consuming, then using payroll software is the best option. The system helps manage and automate various aspects of the payroll process that require dedication and concentration on the employees’ part.

Choosing a payroll management software that fulfils all your requirements and elevates the process is the right one. Here is a list of 15 best payroll systems in India to help you while investing.

Let’s get into it!

What is Payroll Management Software?

Automated payroll management software effectively plans, controls, and automates employee payments. This effective tool addresses several aspects, including pay, reimbursements, and tax-related procedures. By implementing a payroll system, your HR and finance departments stay compliant with tax laws and other financial standards. As a result, it helps minimise errors and save important time.

Top 15 Payroll Software in India

Here are the top picks of payroll management software that lets you effortlessly manage employee data such as their leaves, attendance, and work hours to auto-process payroll.

1. TrackoField

TrackoField is a premier field employee management software that offers multiple solutions to streamline workflow, including payroll management software. Its payroll tool helps process accurate payroll while considering employees’ attendance and leave data, overtime, deductions, expenses, and more inputs (as prescribed).

Also, TrackoField features a time and attendance tracking module that records accurate working hours data, which is a big help during payroll computation. The data and leave balance are automatically adjusted during the calculation. The best part of TrackoField’s payroll system is that it can easily be integrated with expense management solutions, leave and attendance management systems, and other preexisting systems.

Top Features of TrackoField’s Payroll Management Software:

- Auto-creation of payroll summaries including attendance and leave, vacation, and employee time tracking data

- Auto-management of hourly wages, overtime, commissions, or per diem allowances

- Options to customarily define allowances, deductions, or debits

- Auto linking to leaves and expenses

- Accurate salary slip generation in a single click

- Detailed payroll reports for audit

2. SumHR

SumHR’s payroll management software offers a seven-day trial. It offers customisable plans with tax benefit calculations to meet all of your needs. The software monitors your staff members’ performance and manages their salaries. It can also be applied to your employees’ advance compensation or financing needs.

Features of SumHR Payroll System:

- Multi currency payroll calculation

- Automated Payroll processing

- Self help service for employees

- Income Tax Filing (ITR)

3. Razorpay Payroll

With the Razorpay Payroll software, you can compute payroll and automate TDS, PF, ESIC, PT, and many more filings. Its other features, including the offer letter and CTC calculator, assist you in managing your staff from their onboarding until their departure.

This program allows staff members to view their pay stubs and manage and file their taxes. The plan has three different versions: the pro plan, the free plan, and other payrolls. They also provide a free month-long trial of their pro plan. You can register for the trial and then decide whether you want to make a purchase.

Features of SumHR Payroll System:

- One-click payroll processing

- Automated statutory compliance

- Leave management system

4. GreytHR

Given that it provides productivity features for improved HR and payroll management, greytHR is a well-known top payroll software in India. Since its founding in 2019, it has provided small and medium-sized businesses with reliable people management solutions. They have an employee self-service platform that enables greater staff participation and overall time savings. Among the companies connected to greytHR are Toshiba, Deloitte, Capgemini, and HealthifyMe.

Features of GreytHR Payroll System:

- Configurable Salary Structure

- Payslips generation

- Compliance Management and auto tax calculation

- Expense Management

- Automated Reimbursements

5. Keka

In India, Keka is a top payroll software provider. Keka is a comprehensive HR and payroll management software that automates payroll processing, employee management, attendance tracking, and compliance, streamlining business HR operations. Compared to many of its peers, it is more employee-centric and user-friendly. Its main goal is to make the software easy to use so that everyone can use it. According to Keka, its software is the only HR payroll system in the business that makes it simple for non-financial roles, including HR personnel, to participate in wage operations. Users can also send their paystubs via SMS or digital format.

Features of Keka Payroll System:

- Multi-user login

- Attendace and leave data integration

- Employee loan management system

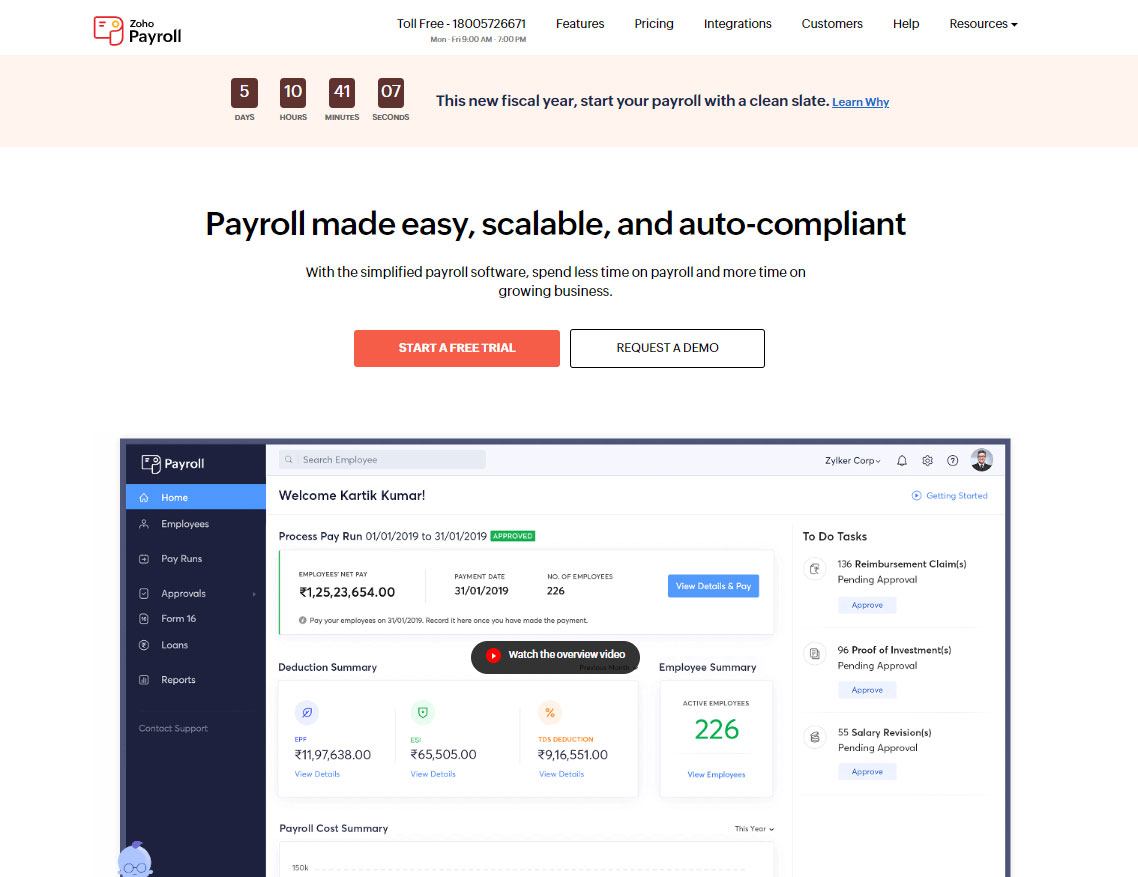

6. Zoho

In the HR department, Zoho is a recognisable brand. In addition to HRMS, Zoho provides payroll solutions to assist companies in handling their payroll and expenditures. The software guarantees that workers are paid on time and accurately while assisting with payroll administration and processing. Having operated in the HR and payroll sector for over 25 years, it has become a well-known and reliable brand. Among the well-known companies connected to Zoho are Tart Labs, Beez Innovation Labs Pvt. Ltd., purpleSlate, CredRight, and so on.

Features of Zoho Payroll Software:

- TDS Calculation

- Automated Payslips

- Connected banking for timely salary payments

7. Qandle

Qandle is an end-to-end HR system that provides businesses with intelligent payroll and HR solutions. In addition to basic HR and payroll solutions, the platform offers services for compliance management, talent acquisition, and employee travel expenses management. The platform gives consumers a hassle-free experience with its user-friendly UI, modular set-up, and granular customisation. Qandle is an HR technology platform designed to help HR professionals save time and money by automating repetitive HR tasks.

Features of Qandle Payroll Solution:

- Claims and Advances data calculation

- Payroll Advisory

- Bonuses and Loans

- Expense Management

- Full and Final Settlement

8. FactoHR

One of India’s leading providers of HR and payroll management systems, factoHR assists its clients in automating every aspect of payroll processing. Its user-friendly interface makes handling the complete workflow, from managing attendance to processing salaries, straightforward. For this reason, factoHR is the ideal cloud-based payroll solution that is sufficiently integrated and safe to facilitate financial controls.

Features of FactoHR Payroll Solution:

- Single click payroll processing

- Off cycle payroll processing

- Create multiple payroll groups

9. Pocket HRMS

Pocket HRMS received the “Best HRMS Software Award” at the 29th World HRD Congress in 2021. It offers an easy-to-use program for all payroll-related requirements. Because it’s cloud-based, it facilitates mobility and can support HR in their hectic schedules! It is a one-stop shop with a self-service portal for active employees to monitor or track their work-related expenses. The Best part is that it also has an AI-enabled chatbot, which functions similarly to an AI receptionist, assisting modern HR with real-time queries and support.

Features of Pocket HRMS Payroll System:

- Multi-company and Multi structured payroll

- Forms generation for easy filling

- Employee self services

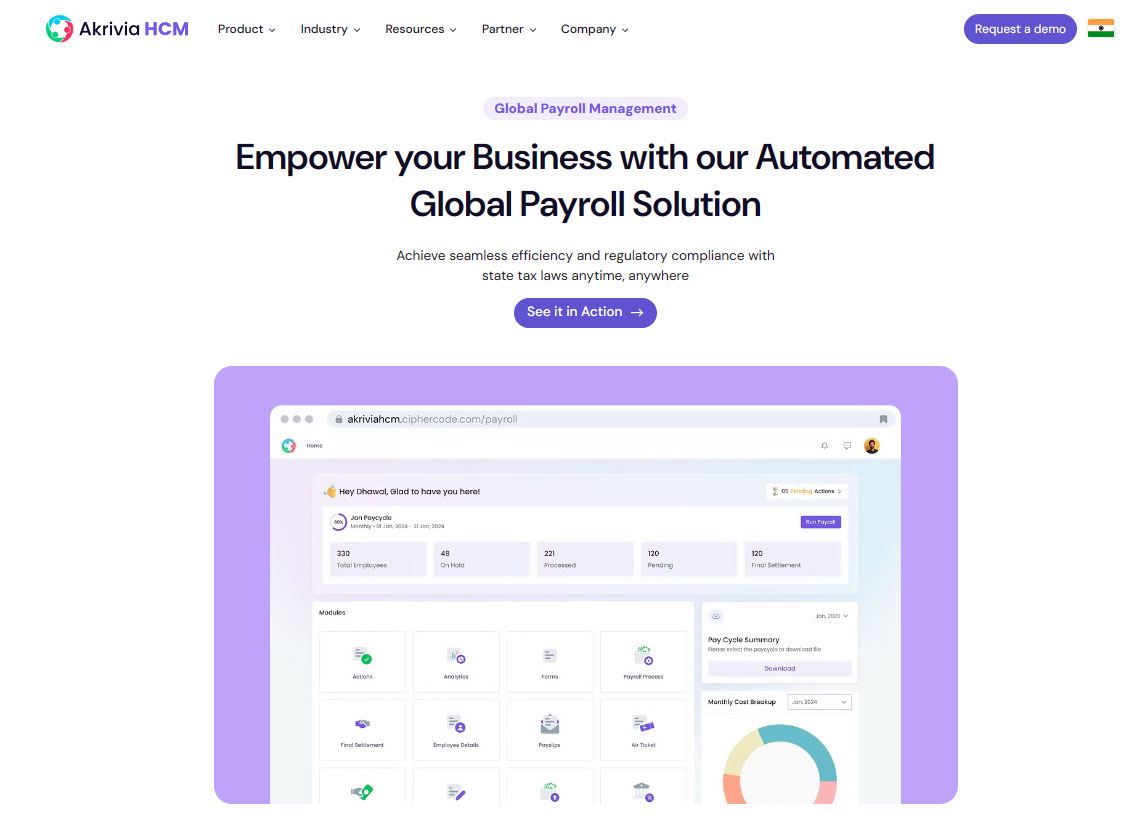

10. Akrivia HCM

Akrivia HCM is a multinational HR and payroll solutions supplier that ensures smooth and compliant payroll processing. Their adaptable payroll administration system, which is easy to integrate with current applications, enables businesses to set a new standard in workforce administration.

Through faster calculation, automation, and generation of thorough reports, this multi-country payroll helps businesses reduce the risk of human mistakes while automating employee payments and monitoring spending. This software meets all payroll requirements, but what sets it apart is its commitment to providing the greatest possible employee experience.

Features of Akrivia HCM Payroll System:

- Employees loans and advances management

- Self service management for employees

- Employees benefits and incentives management

11. Beehive

Beehive’s extensive payroll solutions help you handle employee salary processing, tax declaration processing, compliance management, and other payroll-related tasks. Beehive is available to deploy on cloud, on-premises, and hybrid models and the access can be defined as per company IT policies.

Features of Beehive Payroll Solution:

- Recruitment, resignation, and retirement management

- Time management

- Compliance management

12. Zimyo Payroll Software

Businesses may simplify and expedite their payroll process using Zimyo payroll software. This powerful software allows you to handle taxes and expenses, create and download payroll reports and payslips, and maintain regulatory compliance. Payroll can be processed accurately and quickly in only three clicks.

Features of Zimyo Payroll Software:

- Automated Salary Computation

- Arrears Calculation

- Deduction Calculation

13. Wallet HR

You won’t need to perform manual labour when managing your payroll tasks using Wallet HR. The platform is an amazing automation and innovation solution that handles all your payroll management requirements.

Additionally, you can automate the processing of payroll taxes for the business and the computations and payments of salaries. Specsmakers, Hyundai HYSCO, and the Isha Foundation are just a few of its clients.

Features of Wallet HR

- Financial Management

- TDS Calculation

- Reports and Payslips

- Full and Final Settlement

14. PeopleWorks

One of India’s leading payroll software providers, PeopleWorks, assists businesses in streamlining and digitising their intricate payroll procedures. The platform also offers payroll solutions, labor management, talent management, and human resource planning, as well as learning and development tools.

Features of PeopleWorks Payroll Software:

- Overtime Calculations Pay Structure

- Compliance Management

- Full and Final Settlement

- Income Tax Calculator

15. GoForHR

GoForHR may be the best payroll software option for you if you’re looking for assistance with precise payroll processing. This payroll software can help with end-to-end payroll processing, from handling legislative compliance to calculating salaries. In addition to payroll management, the platform offers assistance in recruiting management, performance management, and attendance monitoring.

Features of GoForHR Payroll Solutions:

- PF Calculation

- Employees Benefits Management

- TDS Calculation

- Exit Management

How to Select the Best Payroll Management Software?

Below are some essential guidelines to consider when selecting the ideal payroll software for your business in India:

1. Assess Your Business Requirements

Before selecting any specific program, thoroughly assess the demands of your organisation. Try asking yourself these questions to see if they can help you assess your needs:

- How often do you run into problems with payroll?

- What is the financial effect of payroll errors on your company?

- Do you still find manual payroll handling to be effective?

- How well do you keep payroll records up to date?

By having answers to the above questions, you will know which solution is best suited for your unique requirements or which one isn’t.

2. Ensure Compliance Management

Adhering to regulatory standards is essential. Non-compliance may result in financial or legal repercussions. Select software that minimises legal issues by keeping you informed about statutory obligations.

3. Seek Essential Features

The programme’s capabilities have a major impact on the effectiveness of payroll automation. Look for important features like automatic wage calculations, tax filing capabilities, expense handling, mobile accessibility, and compliance tracking.

4. Try Before You Buy

Numerous top payroll software providers in India offer a free trial that lasts for roughly 14 days. Take advantage of this chance to determine whether the software satisfies your requirements and expectations.

5. Budget Considerations

Even if cutting-edge features are attractive, you must match your software choice to your budget. Plenty of affordable options are available, but the best ones could require a bigger investment. So choose accordingly.

6. Read Customer Reviews

Websites such as SoftwareSuggest, G2, and IndiaMart provide insightful user reviews. These reviews can be helpful when choosing your next payroll software. For a deeper study, you can even contact these users.

Conclusion

Many organisations in India will offer comprehensive and easy-to-integrate payroll software that meets your organisation’s needs in 2024 and beyond. These software programs reduce the likelihood of mistakes and streamline the complex payroll administration process. As technology develops, we must rely on increasingly effective, safe, and user-friendly payroll solutions to simplify such difficult tasks as payroll.

TrackoField’s payroll management solution makes it easy for modern HRs to compute and manage payrolls. Its features, such as calculation automation, report generation, attendance and time tracking, leave management, and easy integration, make it an ideal pick.

Frequently Asked Questions

-

What is Payroll Software in India?

Payroll software is a cloud-based platform that handles the administration, computation, and automation of an organization's employee payroll process. An ideal software is easy to onboard and integrate to work in unison with existing organizational software functions.

-

How do you choose payroll software in India?

When selecting payroll software for India, businesses must consider many elements, such as firm size, employee count, necessary features, integration requirements, cost, compliance, reviews, demo trials, and post-sale assistance. Understanding individual needs is crucial for determining the software that best fits a budget and workflow.

-

Which is the Top Payroll Software in India?

TrackoField is the top payroll software in India because of its automated solutions and user-friendly and interactive UI/UX. It ensures error-free calculation and easy integration into leave and attendance and expense management software.

Tithi Agarwal is an established content marketing specialist with years of experience in Telematics and the SaaS domain. With a strong background in literature and industrial expertise in technical wr... Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.