-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

What is Vehicle Telematics Insurance? Features, Workings & Benefits

- Author:Nandita Gupta

- Read Time:6 min

- Published:

- Last Update: July 11, 2024

Table of Contents

Toggle

Vehicle telematics insurance helps price policies as per driving patterns and get discounts on premiums. Read what telematics insurance is, how it works & increases operational efficiency.

Table of Contents

Toggle

Fleet businesses take insurance cover for the fleet to protect their operating vehicles or assets from risks. It safeguards against financial losses due to accidents, theft, or any unforeseen events.

A decade back, vehicle telematics insurance was a niche concept. But today, it’s not an alien concept anymore. It’s elevating the fleet businesses and insurance industry in parallel. Today safe driving is not just a personal goal but also has a financial incentive.

Fleet operating businesses that value time, vehicles, drivers, and consignments equally, for them telematics insurance is an added advantage. The term has forced businesses to focus on operating activities more than ever.

| 📚 Key Takeaway

If you have recently discovered the potential of telematics insurance, here’ everything unfolded around it — you will read:

|

What is Vehicle Telematics Insurance?

Telematics insurance is also known as pay-as-you-drive usage-based insurance or pay-per-mile insurance. This type of insurance offers you a discount on your vehicle telematics insurance based on how safely the vehicle is driven or has travelled fewer miles than average each year.

Read Blog – What is OBD GPS Tracker? How Does it Work?

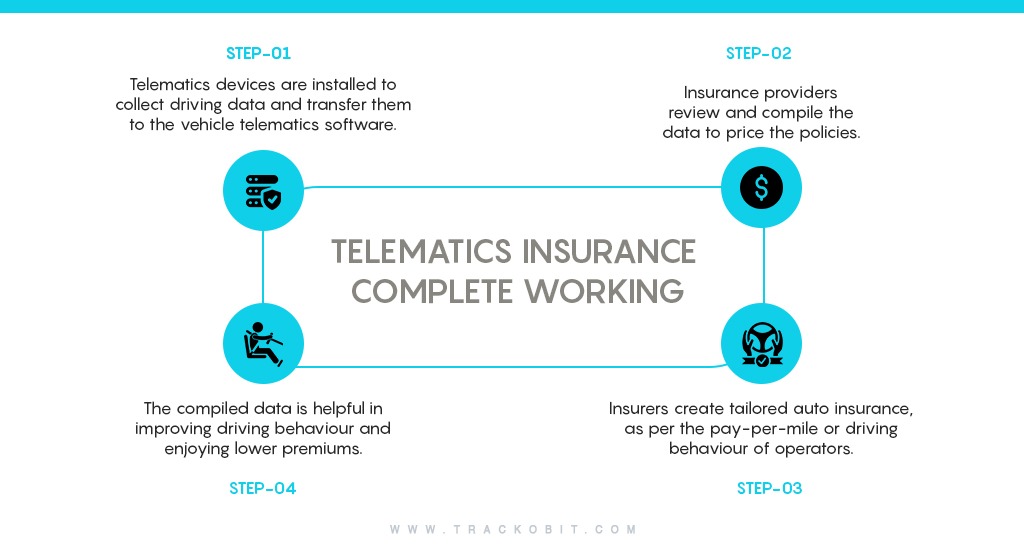

How Does Vehicle Telematics Insurance Work? The Complete Process

Here are the steps on how telematics insurance works in fleet management:

Step 1 – Installation of Telematics Devices

Telematics devices such as GPS trackers and sensors are installed in fleet vehicles to monitor vehicle usage and driving patterns.

Step 2 – On-point Data Collection

The GPS devices start collecting accurate data on:

- Vehicle speed

- Acceleration

- Travelled routes & mileage

- Braking patterns

- Overall vehicle diagnostics

Step 3 – Raw Data Transformed Over Vehicle Telematics Software

The vehicular data collected by telematics devices is presented in neat, visually appealing, and more structured data. It even quantifies concerning events for better oversight and pricing of the policies by insurers. It presents:

- Total mileage covered, to know if the vehicle was over-utilized.

- A number of events when acceleration was harsh.

- Number of times when the fleet vehicle was overspeeding.

- Routes taken currently and in the past 6 months.

- Times when braking or cornering was harsh.

- It provides oversight of the engine’s health and tells how often it was serviced or out with downtime.

Step 4 – Insurers Analyses Risks

Insurers analyze the real-time data generated from the telematics system to assess the intensity of driving risks more accurately. Just so they can provide more tailored premiums after analyzing actual driving behavior.

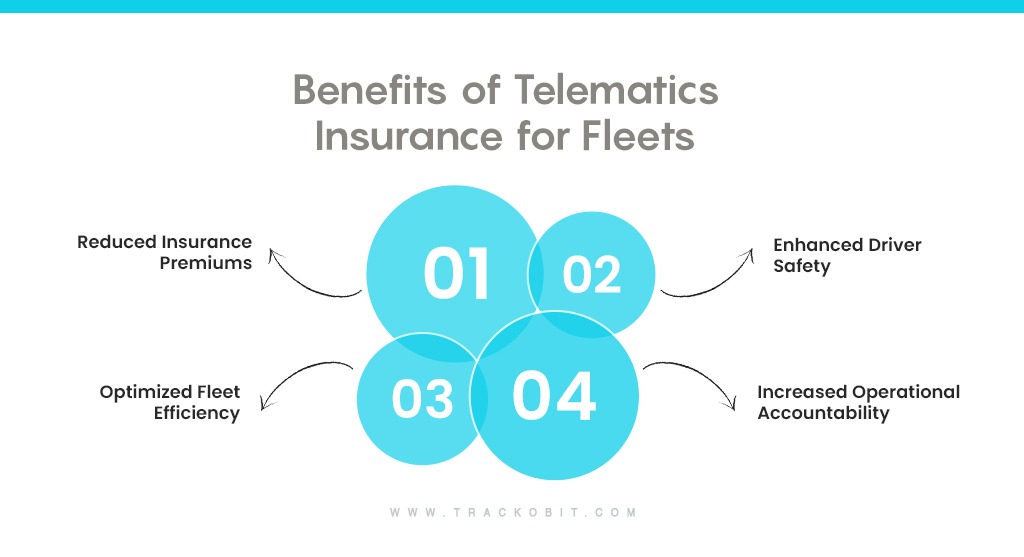

Should You Go for Vehicle Telematics Based Insurance? Benefits

Traditional vehicle telematics insurance is not priced on how well you drive the vehicle. With the augment of telematics-based insurance programs, the policies are priced on the basis of driving habits. Fleet operators get good discounts for having good driving behaviour on the road. In short, the better your fleet is driven, the more you can save.

Here’s everything your business experiences in the long run if you incentivize on a telematics-based insurance policy.

- More Cost Savings – When you have control over your drivers’ driving habits, you can put up good driving behaviour data in front of insurers. This can help you save a big chunk and use that money in other important operational events.

- More Driver Safety – Insights from the data help improve driver safety by identifying risky driving behaviors and promoting safer practices.

- Operational Efficiency – Overall fleet performance is enhanced through data-driven decision-making and efficient resource management.

- Fuel Efficiency – Monitoring driving patterns help optimise fuel consumption, which reduces overall costs.

- Maintenance Optimization- The driving data helps operators with proactive maintenance scheduling, which results in minimized downtime and extended vehicle lifespan.

Telematics Insurance Discount

When you opt for telematics-based insurance, upon enrolling in the program, most insurance providers offer a 5-10% discount. During the first month of the policy period, the company starts collecting your vehicle’s driving pattern. Most programs require you to install telematics devices, dashcams, and software to continue reaping beneficial discounts.

| Here are some of the best ways to get good discounts:

💡Maintain mileage less than average. 💡Restrict harsh braking, accelerating, and cornering events (that can put pressure on your engine). 💡Prevent your fleet from driving in rush hours or on congested routes, where pressure on the engine is evident. |

Read Blog – What’s Coolant Temperature? How to Maintain it?

Types of Vehicle Telematics Insurance Plans (Terms Coined By Auto-insurers)

To make policies more accessible, the auto insurers divided the insurance in the following ways:

a) Pay as You Drive Insurance (PAYD)

Pay as you drive is a comprehensive insurance plan that allows drivers to customize the policy based on their requirements. Simply put, fleet owners who drive vehicles more ought to pay more, and vice versa.

b) Pay How You Drive Insurance (PHYD)

PHYD is an auto insurance plan where the fleet driver’s behavior and trip history data are used to define the premium money. Drivers with good driving scores and behavioural patterns can get low-cost vehicle insurance from the top provider in the market.

c) Distance-based Insurance

The distance-based insurance is calculated based on the total miles your fleet travels during the insurance period. Here an average of the miles driven and the number of years/ months you owned the vehicle are considered to calculate the premium.

d) Control Your Drive Insurance (CYD)

Control your drive insurance (CYD) is just like the above three vehicle insurance plans, CYD lets operators define the premium price based on their driving patterns, miles, and overall requirements.

“Embrace Vehicle Telematics to Drive Safely & Earn Discounts!”

Ask any small-scale to biggest logistics and supply chain business, they would tell you how badly they wish that their fleet is:

- Running on-scheduled time and itinerary

- Routing around safer paths with risk-free driving events

- Operating without any signs of expediating operational cost

- Insured with the best policy and heavily discounted premium plans

To bring all these points to reality, fleet managers are readily adopting vehicle telematics software technology. The proven technology is helping them kill two birds with one scone.

a) Number 1 – They can watch over their drivers’ behaviour and take note of risky driving patterns.

b) Number 2 – They can utilise the technology to win back the best-discounted premium plans for the fleet insurance plans.

Intrigued by the advantages of telematics-based insurance? Want to harness vehicle telematics technology first? TrackoBit offers you an advanced vehicle telematics solution range that provides with which you can enjoy maximum fleet visibility, get driving data events, and use it to enjoy discounted premiums.

Trending Reads:

- How GIS Integration with Fleet Management Software is a Game Changer?

- What are 4 Clear Cut Ways to Reduce Engine Idling

- 5 Common GPS Device Problems – How to Fix Them

FAQs on Telematics Based Insurance

-

What is telematics insurance?

Telematics insurance also known as usage-based insurance lets telematics insurance providers define premium calculations as per vehicle or fleet operator driving habits. Through this, premium providers adjust rates by monitoring driving mileage and habits through the use of vehicle telematics software technology.

-

How does telematics insurance benefit insurance companies?

Telematics or usage-based insurance helps insurers reduce their risks of providing policies by assessing fleet vehicle driving profiles as per their - Covered mileage - Average speed - Usage rate - Events of collision, harsh acceleration, and braking Such real-time data analysis aids in the investigation of claims by insurers and aids in detecting fraud claims.

-

What are the benefits of telematics insurance?

Fleet vehicle telematics insurance allows you to enjoy lower premiums based on overall driving behavior. Plus, it promotes real-time feedback to improve driving skills and the safety of the fleet and driver.

Nandita is the Team Lead for Content Marketing at TrackoBit, bringing over a decade of experience in B2B, B2C, and IoT sectors. She has a proven track record of helping Read More

Related Blogs

-

5 Best Driver Behavior Monitoring Systems for 2026

Tithi Agarwal February 23, 2026Having the best driver behavior monitoring system is a necessity as it helps you ensure driver safety and optimize operational…

-

Why is Driver Drowsiness Detection System Important for Fleet Management?

Shemanti Ghosh February 4, 2026A driver drowsiness detection system is critical for fleet management. It helps prevent fatigue-related accidents and reduces operational risks through…

-

When Tracking Needs a Clock: Rethinking Fleet Visibility

Tithi Agarwal December 24, 2025Read on to understand why fleet tracking works better when it follows working hours. Because visibility should support operations, not…

-

What Makes TrackoBit’s Video Telematics Software Truly Next-Gen?

Shemanti Ghosh December 17, 2025TrackoBit’s video telematics software blends smart video intelligence with full server control. The result? Superior fleet reliability and safety.

Subscribe for weekly tips to optimize your fleet’s potential!

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.