-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

How to Calculate Payroll Hours? A Detailed Guide 2026

- Author:Shivani Singh

- Read Time:6 min

- Published:

- Last Update: December 26, 2025

Table of Contents

Toggle

Wondering how to calculate payroll hours? Get into the details, adopt tried and tested methods, and prevent mistakes from happening for streamlined payroll management and processing.

Table of Contents

Toggle

Before calculating payrolls, managers first need to assess employees’ accurate working and payroll hours.

But, this seems to be a bit tricky in remote or field workflow. Because, unlike regular clocks in/out in offices, employees here mark their attendance from multiple task locations. Moreover, they may work on a fraction, half-time, and hourly basis.

All these highlight the need for companies to calculate payroll hours accurately and convert employees’ minutes to payroll. Here is how they can do it and adopt precision in payroll calculation. Keep scrolling to learn state-of-the-art ways, and conveniently measure payroll cost per employee.

Get A Brief on Payroll Hours

Payroll hours are a critical component of the payroll process. It indicates the total time an employee has worked while on duty.

Time is stored in hours and minutes via the time tracking software and spreadsheets that include employees’ overtime, vacation, time off, total working hours, sick leaves, etc. Managers access employees’ total working hours and follow the further procedure to calculate payroll hours manually.

Step-by-step Procedure to Calculate Payroll Hours Manually

Here are three simple steps that help in converting minutes into payroll hours.

1. Calculate Total Hours and Minutes

You can choose any of these options given below to calculate your employees’ total working hours, i.e.,

- Actual hours worked

- Round hours worked

Wondering what are they? Let’s find out:

Actual Hours Worked

This calculation involves the total hours and minutes employees have worked during their working hours. Let’s understand it with a weekly timesheet of an employee who does not take lunch breaks.

Now that you receive the weekly working hours of the employees, it’s time to make the calculations:

👉 To initiate, calculate employees’ hours (excluding minutes)

i.e., Total hours = 8 + 8 + 8 + 8 + 8 (or 8 X 5)

So, the employee has worked 40 hours in a week. (Keep in mind this is only the hours’ calculation, we still have to measure the minutes)

👉Now, just add employees’ total minutes.

i.e., 15 + 0 + 11 + 16 + 25

Employee’s total minutes equal to 67.

👉After that, just convert 60 minutes into one hour.

And the rest counts as only 7 minutes

(67 minutes – 60 minutes = 1 hour and 7 minutes)

👉Here you get the employee’s weekly working hours.

(41 hours 7 min)

Round Hours Worked

Rounded time is calculated at the nearest quarter of an hour which is 15 minutes. If you are applying 15-minute rounding, then you must also follow the 7-minute rule. It states that you round down if a logged time is below 7 minutes and round up if it is between 8 to 22 minutes.

Let’s take a look at the rounding hours calculation with an example. So, suppose, your employee clocks in at 09:03 AM and clocks out at 05:12 p.m. (this excludes lunch breaks). Normal calculation displays their actual working hours as 8 hours 9 minutes.

However, round hours calculation will vary:

👉The time of 09:03 a.m. is rounded down to 09:00 a.m.

Because the minutes are in between (:00 to :07)

👉Meanwhile, the time of 05:12 p.m. is rounded up to 05:15 pm.

Because the minutes are in between (:08 to :22)

👉Now, employee’s clock in/out based on rounded time is

(09:00 a.m. to 05:15 pm)

👉So, rounded hours would be 8 hours 15 min.

Read Blog – 10 Key Benefits of Payroll Management System

2. Convert Payroll Minutes to Decimals

After scratching your heads over round hours calculation, let’s move on to a more time and energy-consuming step.

Here, you need to convert minutes into hour decimals by dividing them by 60.

For instance, if an employee works 41 hours 7 minutes in a week. You must divide their total minutes by 60 to get the decimal.

7/60= 0.12

So, the total working hours an employee devoted in a week is 41.12 hours.

We know calculating payroll cost per employee is a tough task. But you can simplify and automate it by switching to the payroll management software.

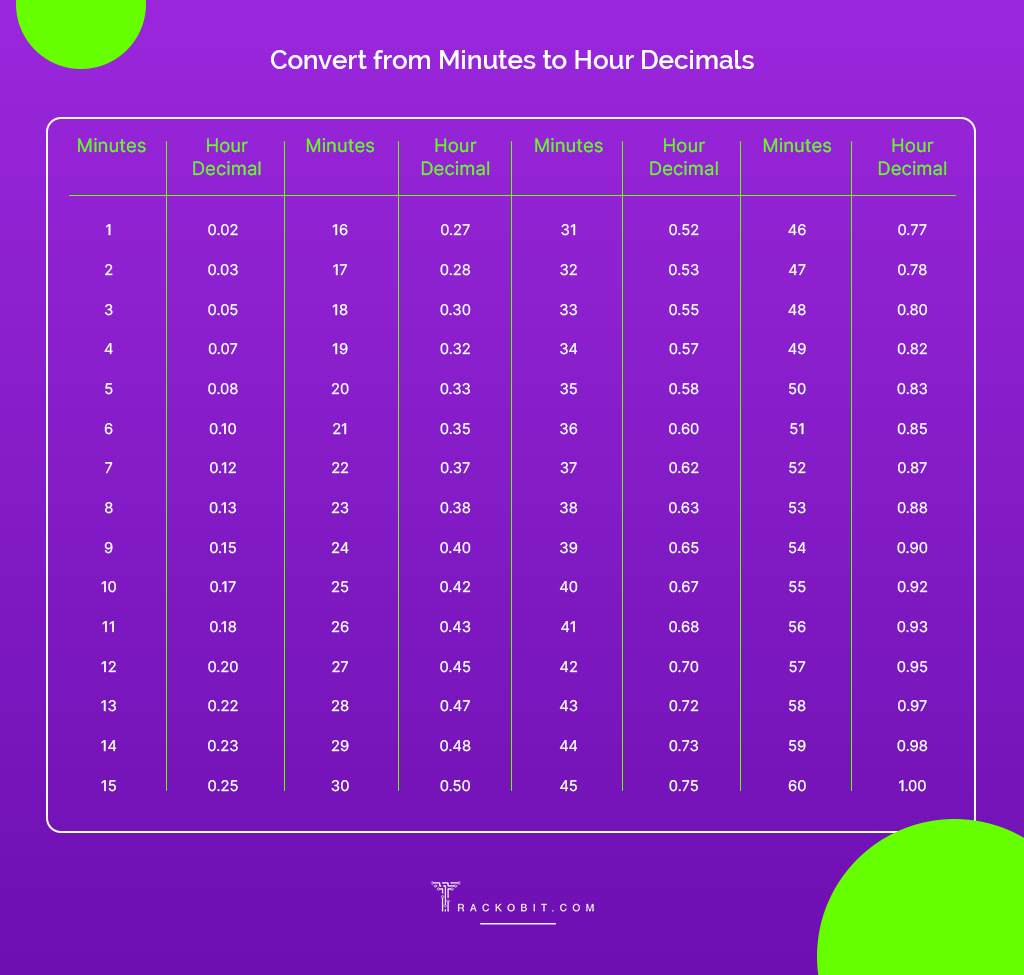

Also, look at the chart below to easily turn minutes into hour decimals.

3. Multiply Calculated Time and Pay Rate

Now that you have converted the employee’s time, it’s time to calculate how much you need to pay them. For that:

👉Calculate your employee’s gross pay

(Gross Pay = Wage Rate x Time in Decimal)

👉So, if an employee works 41.7 hours and earns $12.00 per hour,

Their gross pay would be $12.00 x 41.7 hours = $500.4

👉The weekly compensation for this employee before tax deduction is $500.4.

TrackoField Can Help You Automate Payroll Calculation

Calculating payroll hours requires great attention to detail. Also, there are higher chances of clerical errors among companies that use time-tracking tools like paper timesheets and Excel sheets to fetch data.

As it’s a matter of concern, it requires an approach that helps you get rid of mundane tasks, automate all the calculations, and upgrade time management, data accuracy, and payroll calculation within your company.

Hence, we highly recommend choosing an all-encompassing payroll management software like TrackoField. The software auto-compiles employees’ working hours and converts them into accurate payroll hours without having to move your pen. It generates employees’ payslips that they can access on their mobile apps.

Here is how the software removes complications and makes payroll calculation error-free.

- Auto-generate payroll slips after calculating employees’ salaries with precise attendance and leave data

- Manage employees’ hourly commissions, wages, overtime, time-offs & per diem allowances.

- Automatically collects on-field and remote expenses for travel, meals, and lodging.

What else?

TrackoField’s payroll management system lets you focus dedicatedly on other business-driven activities with

- Seamless data migration on employees’ attendance and leaves that restrict duplicate entries.

- Expense tracking on the move and reimbursing employees be it for stationery, food, travel, and other expenses.

- Location-based tracking to consider payout for verified field visits only.

- Detailed reporting on payroll summaries, time tracking reports, etc. to identify trends and areas for improvement.

- Shift scheduling tool integration to measure payroll on scheduled shifts and actual hours worked.

Final Words!

Since manual payroll hours calculation cannot be a good fit for enterprises in this time and age, payroll software has become a valuable tool. Using the software means optimizing and calculating accurate payroll hours.

On top of that, you can simplify and automate various tasks like calculating employees’ actual work hours, taxes, benefits, and wages. If you are eager to explore more about payroll software and the potential it offers, get yourself signed up today for TrackoField’s free trial.

You can churn the most out of the software for your specific business needs and accurately track your employees’ attendance, leaves, working hours, expenses, etc., for streamlined payroll calculation.

Frequently Asked Questions

-

How to measure the final payroll cost per employee?

- Convert timesheet hours into decimals - Multiply the hours worked by the wage rate. - Now, you get the gross pay, and the employee’s earnings before taxes and deductions.

-

Which tools can assist in payroll calculation?

You can use various tools to automate payroll calculation such as - Attendance tracking software - Expense tracking software - Payroll management software. Syncing the data from attendance and expense tracking software into the payroll system helps you get the final payment.

-

How to calculate payroll weekly time of employees?

- Record an employee’s weekly working hours - Calculate them - Divide the sum by the weekly count - Now, you get the average time your employee has worked in the last week.

-

How to determine hours and minutes for payroll?

- Sum all the hours and minutes an employee has worked while on duty. - Now, convert the minutes into hour decimal form (60 min = 1 hour) - Multiply the employee’s total hours with the hourly rate to compute their pay.

-

What kinds of deductions are taken out of gross pay?

Here is a list of deductions to make while - - calculating payroll. - Insurance premium - Child support payments - Retirement contribution - Union membership fees

-

What is the benefit of automating payroll calculation?

Automated payroll calculation saves managers’ time and energy in converting employees’ working hours into accurate payouts. The payroll management system syncs the data from attendance tracking software. Therein, it automatically calculates the payouts of each employee according to their actual working hours. Managers’ efforts for payroll calculation go to minimal. Thus, they focus more on deriving workforce productivity.

-

What is the difference between payroll and salary?

The money received by employees for the duty performed during their working hours often comes in the form of wages or salary. For a firm, these payments are an expense that is recorded as payroll.

Shivani is a Content Specialist working for TrackoField. She comes with years of experience writing, editing and reviewing content for software products. Her underlining expertise in SaaS especially H... Read More

Related Blogs

-

AI Analytics Dashboard Reporting: A New Era for Tracking Field Employees in 2026

Shemanti Ghosh March 6, 2026An AI analytics dashboard for field employees converts real-time operational data into decision-ready insights for compliance control and revenue protection.

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.