-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

7 Payroll Challenges Solved By Payroll Management Software

- Author:Shivani Singh

- Read Time:8 min

- Published:

- Last Update: September 9, 2024

Table of Contents

Toggle

Has payroll calculation and disbursement become a hassle? Here are common payroll challenges that are adding to your frustration. Read on to know how you can resolve it.

Table of Contents

Toggle

When employees are dispersed across various locations, work irregular hours, and frequently submit expenses, managing the payroll process can become a nightmare. The frustration peaks when discrepancies arise from missed overtime entries and inaccurate time logs. This delays payroll processing and disrupts team trust.

But here’s the good part– these challenges are beatable. You can go past the payroll obstacles with the practical solutions provided in this guide. Implementing these strategies, helps you ensure your payouts are on time, the team is satisfied and your HR operations are running smoothly.

7 Common Payroll Challenges with Reviewed & Tested Solutions

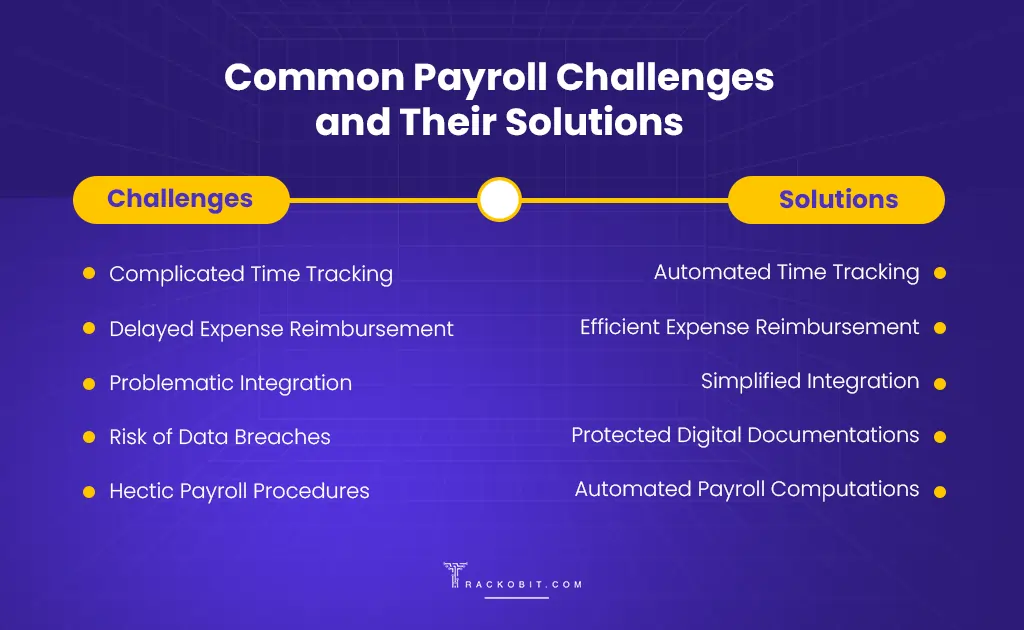

Common Payroll Challenges and Their Solutions

#Challenge 1- Tracking Work Time is Complex

Managing payroll for field service teams involves accurately tracking actual working hours, overtime, breaks, days off, etc. It also includes recording employees’ time across various locations and tasks.

But that’s not all! As employees move from one site to another, tracking their time requires accurate precise recording of task duration and travel time. The challenge intensifies when managers rely on ineffective and traditional time-tracking methods, leading to discrepancies and payment errors.

The Solution

To capture work hours correctly, you must use the best payroll management software that automatically records the working hours, and defines the time offs, breaks, and overtime. Such software helps you ensure that all hours your employees worked, including overtime, are accurately recorded and are good to proceed with payroll computation with HR and accounting teams (without fearing any risk of errors).

Additionally, look for software that has a distance and duration breakup report so you can easily verify each visit made by your field executives. Analyzing this report helps managers assess the time employees take to reach their destined tasks, ensuring that wages are both accurate and fair.

#Challenge 2- Complex Payroll Procedure

Payroll calculation and disbursement across the entire team when done through ancient methods can appear far from a simple task— it can appear to be a lengthy and multi-step process. It may require compiling employees’ actual working hours, converting them into payroll hours, and then calculating their monthly wages and salaries.

Well, this complexity deepens when you deal with varying pay rates, shift differentials, deductions, bonuses, and other variables. Each of these elements demands meticulous calculation and verification to ensure accuracy. A single misstep in this intricate process can lead to payroll errors, underscoring the need for efficient handling of these complexities.

The Solution

What if you could transform this lengthy and complicated process into something simple and swift? Yes, with the right payroll process management software like TrackoField, you can easily bypass the complexities associated with calculating employee wages.

The best payroll software offers an integrated attendance tracking system that auto-syncs employees’ working hours directly into the payroll system. This ensures that every minute worked is accurately recorded without manual intervention. The software streamlines everything from payroll computation to disbursement, drastically reducing the risk of errors, and making payroll management smoother and more efficient.

#Challenge 3- Limited Employee Accessibility

It’s clear that managing payroll for dispersed teams introduces significant complexity. This complexity often hinders employees from accessing their payroll information promptly. For instance, the time-consuming nature of creating pay slips and processing payroll at the same time leaves HR staff stretched thin, especially when they handle 100+ field employees.

As a result, HR teams struggle to produce payslips from scratch in a timely manner, leading to frustration among employees, a huge administrative burden, and a heightened risk of errors.

The Solution

The solution to this payroll challenge lies in implementing a self-service employee portal. Most payroll software offers this key feature, letting employees access, view, and download their attendance and leave data relevant to payslips, and other compensation details anytime over their mobile phones.

This level of access fosters transparency within the organizations, ensuring that employees have all the necessary details they need without having to wait for HR. By reducing the load on HR managers and encouraging employees to manage their own data, organizations can significantly enhance efficiency and employee morale.

#Challenge 4- Inaccurate Expense Reimbursement

Field employees often incur some expenses as they move from one designated client’s site to another. These expenses are typically reimbursed by field managers as part of the travel allowance. However, accurately tracking and reimbursing employees for the expenses they have actually incurred can be a significant challenge.

Why? Because managers need to deal with a wide range of expenses related to equipment, lodging, and travel. Each expense requires careful documentation and verification to prevent data theft and fraud. Tracking these expenses and ensuring that every bill is accounted for can be a time-consuming process, often leading to delays and frustration among employees.

The Solution

One effective solution to this payroll challenge is leveraging payroll software that’s integrated with the expense management system. With the blended force of expense and payroll systems, employees can easily upload their expenses directly from the field. They don’t have to visit the office to request and submit the bills. This saves valuable time for employees and immediately notifies managers whenever an invoice is uploaded.

During the process, managers can then assess the validity of the expense claims, fostering transparency between field managers and employees. Additionally, it ensures smooth and accurate expense reimbursement without any glitches or errors as managers have full visibility into why, how much, and where company expenses are being incurred. This minimizes the risk of errors, ensuring that the expenses are processed promptly and accurately.

#Challenge 5- Inconsistent Payroll Accuracy

Payroll accuracy streamlines the payroll process and ensures that employees are paid accurately and on time. It helps managers maintain employee satisfaction and trust within an organization. However, achieving payroll accuracy is often easier said than done, particularly when manual processes are involved.

Manual payroll operations increase the risk of errors such as miscalculations of hours worked and incorrect data entry. These inaccuracies make payroll management a constant struggle for organizations. Field managers struggle with underpaying or overpaying employees, creating disparity and frustration among team members. Additionally, delays or incorrect payments can demotivate employees, impacting their overall efficiency and productivity.

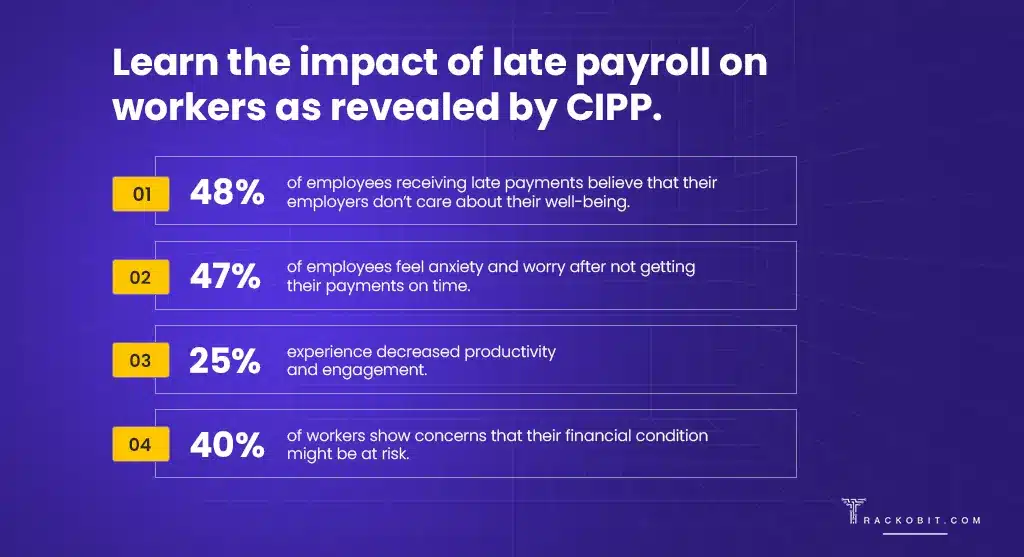

Impact of late payroll

The Solution

Now, let’s learn how payroll management software overcomes this challenge. The software automates complex calculations and validates data before processing. For instance, with TrackoField, you get accurate insight into how many hours an employee works in the field, along with their overtime and breaks. This stimulates the data collection and analysis, ensuring payroll is processed accurately and on time.

Moreover, with TrackoField, you don’t need to input employees’ working hours, days off, overtime, etc. You can easily eliminate the pitfalls associated with manual payroll calculation by auto-syncing crucial attendance data. Thus, calculating and disbursing employees’ accurate wages and salaries.

#Challenge 6- System Integration Issues

Payroll systems today don’t operate in isolation– they often need to integrate with various other systems such as time tracking and expense management platforms. However, integrating payroll systems with these diverse platforms can be a bit problematic.

The impact when integration is not done correctly can lead to duplication, data inconsistencies, and errors. For instance, if the time-tracking software does not integrate well with the payroll system, it can result in inaccurate calculations. Therefore, ensuring seamless data transfer between systems is essential.

The Solution

The solution to one of these payroll challenges faced by HR is utilizing centralized software like TrackoField. The software offers payroll management and attendance & leave management systems in a centralized location. While the latter records and tracks every hour employees invest in the field, the former offers seamless payroll computation and disbursement. The payroll software seamlessly synchronizes employees’ benefits, deductions, and working hours, eliminating the need for manual input.

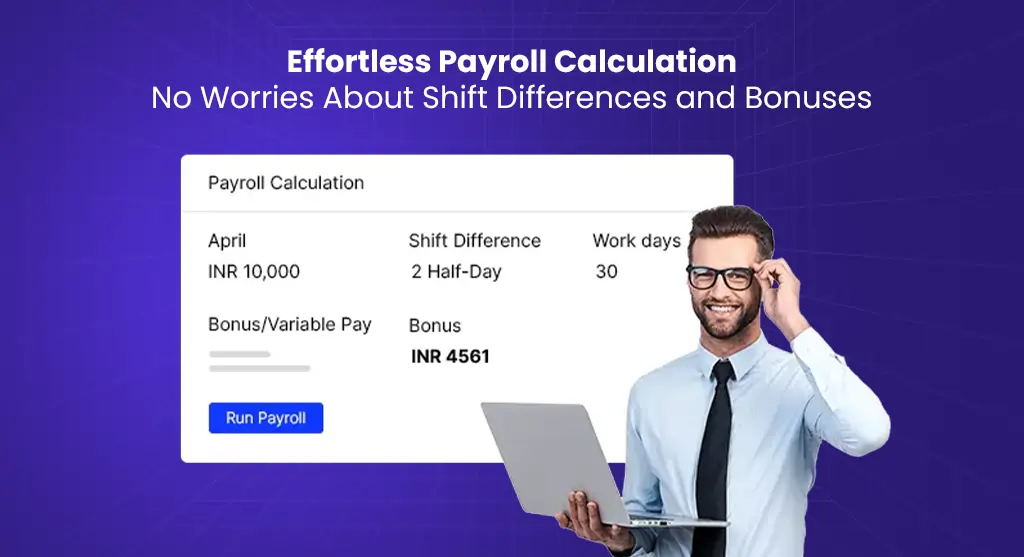

Effortless Payroll Calculation

Thus, it ensures smooth data flow, keeping information consistent and relevant. Organizations can process payroll efficiently and accurately even in complex environments. This is how payroll management software like TrackoField provides data synchronization, ensuring that payroll is up-to-date and reflects the employees’ latest information.

#Challenge 7- Data Breaches

HR payroll challenges do not end here but move further with handling sensitive employee data including their personal information, bank account numbers, salary details, and other confidential data. Ensuring the security of this data is vital to assess employees’ final payouts. However, manual documentation increases the risk of unauthorized access, data leaks, and insufficient access controls.

Moreover, manually creating, organizing, and managing payroll documents is extremely time-consuming. Administrative staff spend countless hours handling paperwork, and payroll management adds more to their burden. This inefficiency not only delays the decision-making process but also has serious consequences such as financial discrepancies and loss of credibility.

The Solution

As everything is recorded automatically with the right payroll management software in place, no such manual procedure is required. The payroll management software automates documentation processes, reducing the time and effort needed to manage documents.

The software provides detailed reporting and analytics capabilities, helping managers gain insights into payroll costs, financial planning, labor trends, etc., which are essential for making informed business decisions. Digitally recording documents also helps organizations mitigate risks and errors associated with manual documentation.

Read Blog – 10 Key Benefits of Payroll Management System

Streamline Payroll Challenges Only with TrackoField

TrackoField is a comprehensive field service monitoring software that goes beyond the computation of salary data. It additionally includes comprehensive systems to manage field employees’ attendance, leaves, and expenses. Additionally, it addresses common payroll challenges such as complicated time tracking, data breaches, and inconsistent accuracy that ensure a smooth payroll process.

With the software, you can enable the finance team to generate detailed payroll reports for audit and achieve precise salary computation with “0” gaps. Moreover, you can simplify managing wages, commissions & per diem allowances, overtime, etc., and auto-compile field expenses like travel, meals, lodging, etc.

While generating payslips, the software provides a clear breakup of salary components. You will find more features and components with TrackoField that drive faster payroll processing and accurate timesheet management. Sign in for free and make TrackoField your one-stop solution for field employees’ salary computation and disbursement.

Shivani is a Content Specialist working for TrackoField. She comes with years of experience writing, editing and reviewing content for software products. Her underlining expertise in SaaS especially H... Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.