-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

5 Signs Your DSA Needs a Loan Agent Tracking Software—Before It’s Too Late

- Author:Tithi Agarwal

- Read Time:6 min

- Published:

- Last Update: January 7, 2026

Table of Contents

ToggleAre you seeing a dip in your loan sales agents’ productivity and targets? This is one of the signs that your DSA needs loan agent tracking software.

Table of Contents

Toggle

Some of the challenges and questions that plague DSA managers are –

- Which loan agent is present in the field?

- What amount of loan sales agents have cracked?

- How do they verify their client visits and activities?

- What are some of the areas that are hampering their productivity?

Field agent tracking software for DSAs is the answer. It provides the level of visibility like no other.

Now, if you are unsure when or which loan agent tracking software for DSAs to invest in, look out for these signs.

5 Signs That Are Indicating It’s Time To Invest In Loan Agent Tracking Software for DSA

Sign#1 – Lack of Accountability and Transparency in Loan Agent Activities

This is one of the most harmful practices. Not having visibility of the field loan’s activities. Agents play a crucial role in facilitating credit access for borrowers. However, it is common for agencies to lack accountability and transparency.

Without proper knowledge of agents’s activities and location, chances of –

- Agents misrepresenting loan terms and conditions

- Client visits are misreported

- Prioritizing commissions over customers or DSA interests is high.

Also, unverified locations will make it tough to offer timely services. It also leads to misconduct, or unresolved disputes. Poor oversight raises the chances of data misuse, financial losses, and customer dissatisfaction.

This is slowly starting to sound like a DSA’s biggest nightmare, right?

But we come prepared with a solution.

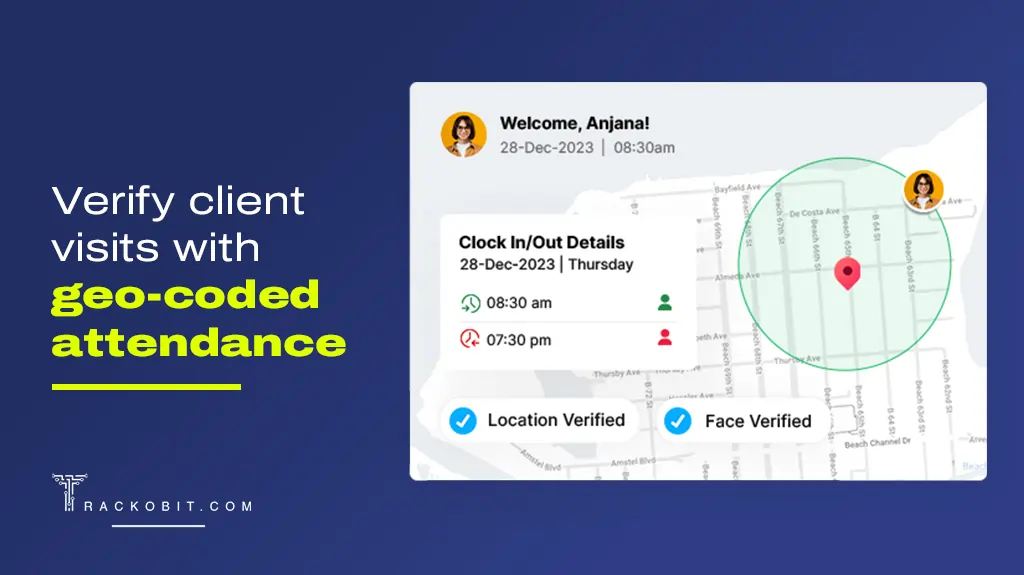

🏆 The Solution – Verified Client Visits with Location and Task Status Tracking

With real-time tracking through field agent tracking software for DSA, you gain visibility. Additionally, you will gain valuable insights into their activities. The software allows you to verify every client visit by geofencing. They can create geofences on the client sites. This way, they are notified when and where the load agent is. Did he reach on time, and how much time did he spend at one task location? All gets answered live over a map.

Not only location but also track task status. You can view the timeline and location of tasks for further clarity. All this adds to the accountability.

Sign#2 – Unreliable Attendance Records and Unclear Agent Availability

Unreliable attendance records and unclear agent availability are major challenges for DSAs. Not having accurate timesheets leads to managers struggling to allocate resources effectively. This results in missed sales opportunities and even uneven distribution of targets/work.

Without real time monitoring, agents may claim availability. This will disrupt sales targets and team performance. Also, inconsistent attendance affects customer interactions, and leads are difficult to assign ad-hoc.

Also, this might diminish trust and reduce morale. Ineffeinct scheduling leads to delays in lead follow-up and poor customer service. Negatively affecting revenue and client satisfaction.

🏆The Solution – Geofenced Attendance and Reporting

Loan agent tracking software has geo-verified attendance management software. The solution is offering –

- Accurate and digitalised timesheet

- Auto mark-in/out from assigned location only

- Real time tracking for verifying client visits

- Visual attendance verification

- Multiple geofencing.

TrackoField offers geo-coded attendance feature

The loan agent tracking software enhances transparency, fostering accountability and trust among agents. This way direct selling agencies are able to verify presence at assigned locations. Resulting in a reduction in false attendance claims and improved resource allocation.

Sign#3 – Cumbersome Paper-Based Lead Management (Slowing Down Sales)

Paper-based lead management and sales order collection will slow down the agents. Manually recording and tracking leads increases the risk of errors. There are also chances of misplaced information and missed follow-ups. Agents spend valuable time handling paperwork instead of engaging with potential customers. Thus reducing overall productivity.

Recording loans on paper even makes collaboration between teams difficult. Without field force automation for DSAs digitalizing the process, agencies will face –

- Slower sales cycle

- Decreased conversion rates

- And lower overall revenue.

🏆The Solution – Loan sales management and custom forms

Loan agent tracking software for DSA has a sales order management solution. It is coupled with custom fields and forms. It digitalises the paper-based process.

Loan agents can report loan sales leads on the app. This way, there is less chance of inaccuracies and faster lead recording. Furthermore, managers can view each agent’s collected sales leads in real time. This makes it easy to judge performance and sales tactics.

The custom fields and forms help record accurate lead details. Users can attach documents like an Adhar card and address or other documents. They can also feed in lead details for follow-ups.

All helps to shorten the response time and increase conversion rates.

Sign#4 – Frequent Travel Reimbursement Disputes Causing Frustration

You have loan agents in the field, which naturally means they will incur expenses. Such as fuel, food, stationery, etc.

However, incorrect or delayed reimbursements are discouraging. DSA struggles with verifying these expenses as well, causing delays. They also face difficulties tracking legitimate claims, increasing the risk of fraud or overpayments. These disputes lower agent morale, affecting their motivation and performance.

🏆The Solution – – Expense Management with Distance Traveled Reports

Best loan agent tracking software solves this challenge with expense management software. It automates the reporting of travel claims for reimbursement, reducing disputes.

Agents can log expenses digitally with receipts. They can trace the status of their claim. And are notified whenever it’s approved.

Also, they can categorize these expenses like food, beverages, travel, stationary, etc.,. Managers have the option to put a limit on reimbursement amounts as well.

You get distance traveled reports to ensure that the travel reimbursement is accurate. It provides a precise distance breakdown of KMs traveled between client sites.

Ensure accurate reimbursement with expense management solution

Sign#5 – Unstructured Goal Management Leading to Performance Gaps

For DSAs, unstructured goal management creates confusion and inefficiencies in sales operations. Agents cannot meet performance expectations without a system to set, track, and measure targets. This lack of clarity will lead to –

- Missed sales opportunities

- Inconsistent productivity

- And difficulty in identifying underperforming agents

Performance analysis becomes manual and inaccurate without targets vs. achievements reports. It also causes delays in crucial decision-making and incentive planning.

🏆 The Solution – Sales Goals Management with Target vs. Achievement Reports

With field force tracking of loan agents, you get a goal dashboard. It includes goal name, duration, start date, creation by, and total progress calculation. The progress is calculated on goal duration – daily, weekly, monthly, etc,. You also get a leaderboard that displays employee-wise progress. There are a lot of filters that will help get goal status clarity quickly.

The loan agent tracking software enhances goal tracking and performance monitoring. Self-updating target vs. achievement reports clarify your top-performing agents.

Conclusion

Automating specific processes is necessary whether you have 30 or 300 loan agents. They are expected to go to multiple locations daily. You don’t even have to look for signs then. The top priority is gaining clarity of operations, increasing agents’ productivity, and increasing loan sales.

That is why DSAs (direct selling agencies) must use loan agent tracking software. It has solutions like task management, activity tracking, sales lead management, geofence attendance, and more that bring accuracy to field activities.

TrackoField is here to help direct selling agencies manage loan sales, leads and agents as easily as possible.

Frequently Asked Questions

-

How to improve DSA productivity with tracking software?

Tracking software boosts DSA productivity by automating lead management, attendance tracking, and task assignments. It eliminates manual reporting, reducing errors and delays. Real-time location tracking ensures agents stay accountable.

-

How can loan agent tracking software improve my DSA's performance?

It enhances accountability with real-time tracking and automated reports. Goal-setting modules align agent performance with business targets.

-

How to track loan agents in real time?

Use loan agent tracking software to monitor agents’ locations and movements. Geofencing ensures attendance is marked only at assigned locations.

Tithi Agarwal is an established content marketing specialist with years of experience in Telematics and the SaaS domain. With a strong background in literature and industrial expertise in technical wr... Read More

Related Blogs

-

Grameen Credit Score: Everything that NBFCs and MFIs Must Know in 2026

Shemanti Ghosh January 6, 2026Empower the underserved Joint Liability Groups (JLG), Self-Help Groups (SHG), and residents of rural India with better credit assessment and…

-

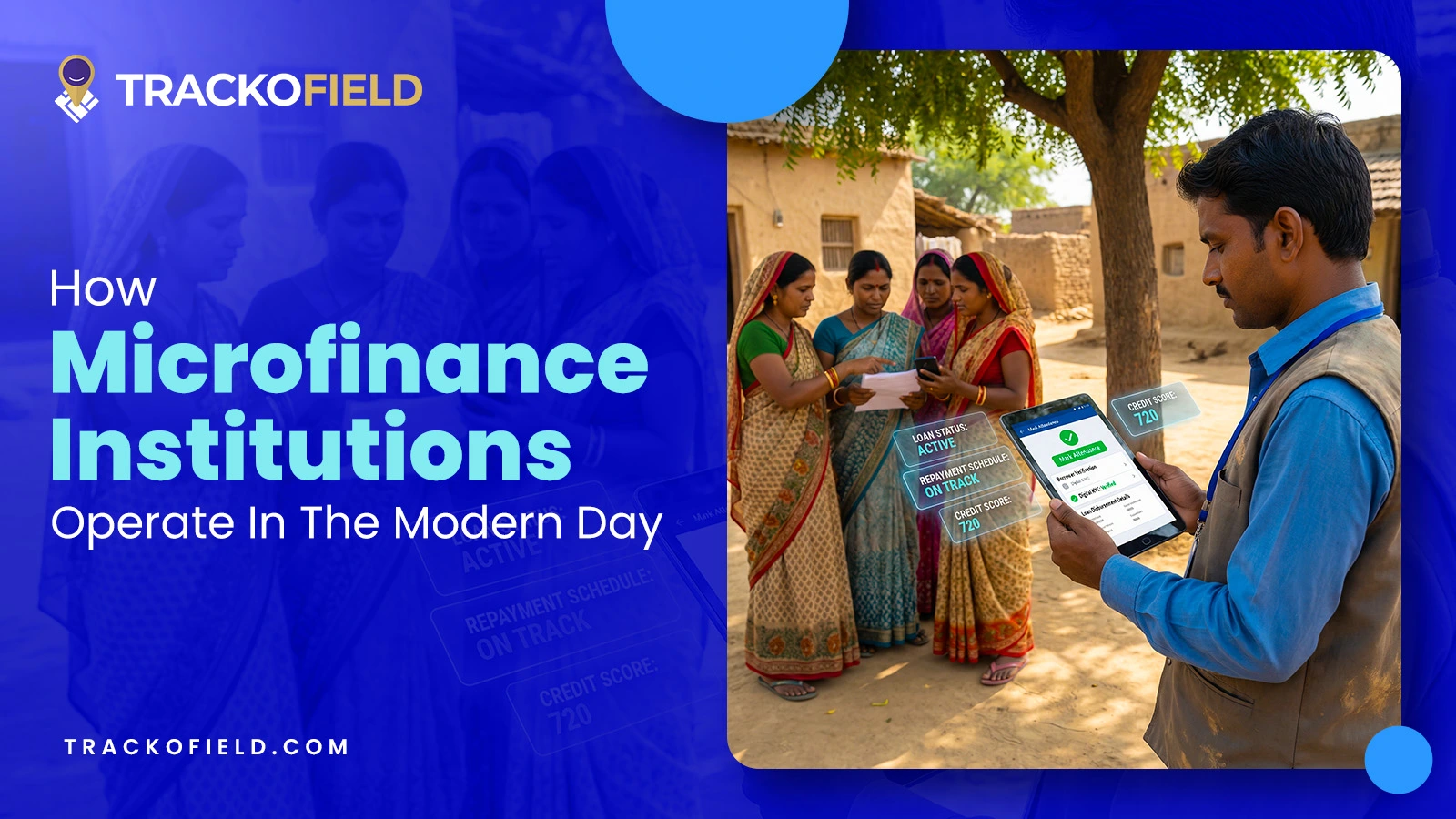

How MFIs Are Working In Modern Day Scenario? A Complete Breakdown

Mudit Chhikara December 30, 2025How field force automation is helping MFIs transform field operations.

-

Unified Field Workforce Dashboard: Monitor Tasks, Attendance & More In One Place

Mudit Chhikara December 15, 2025Bring full clarity to field operations with a single, real-time field workforce dashboard.

-

Loan Disbursement in NBFCs: From 15 Days to 3 Minutes – Learn How

Shemanti Ghosh December 11, 2025TrackoField’s AI-enabled field force automation software speeds up loan disbursals in NBFC with field agent task monitoring and facial attendance…

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.