-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

Loan Disbursement in NBFCs: From 15 Days to 3 Minutes – Learn How

- Author:Shemanti Ghosh

- Read Time:7 min

- Published:

- Last Update: December 12, 2025

Table of Contents

Toggle

TrackoField’s AI-enabled field force automation software speeds up loan disbursals in NBFC with field agent task monitoring and facial attendance system.

Table of Contents

Toggle

In today’s lending ecosystem, speed and efficiency are the defining moments for any NBFC. This is powered by powerful technologies like AI. This is a competitive transformation, especially when it goes from 15 days to just 3 minutes. Yet, for years, the process has been slowed. This is due to paperwork-heavy workflows, manual verifications, and fragmented approvals. While NBFCs are curbing it by embracing digital adoption, the lending struggle continues. This is primarily due to field agent fraud and technological mismanagement. Other factors are low transparency and non-addressal legacy system complexities.

These come together to restrict scale and inevitably stagnate AUM over time. What should have been a simple journey for the borrower often stretches into 15 days or more. The consequences at this point are quite concerning:

- Significant process friction

- Inflated operational costs

- Institutions are exposed to risks of error and fraud.

In today’s where customers expect financial services to move at the speed of a click. Such delays are more than an inconvenience; they turn into a competitive liability.

The lending industry is now at an inflection point. By harnessing technologies and field force automation software, NBFCs can compress disbursement timelines. This is from weeks to as little as 3 minutes. Plus, no compromises on compliance or risk controls. Field agents are the first human touchpoint between NBFCs and customers. They can also be closely monitored. This is critical since speed and precision are key differentiators that impact brand perception.

This blog explores that transformation. From unpacking the bottlenecks in traditional processes to the urgency for faster turnarounds. Plus, the cutting-edge tools that power NBFCs. They reimagine lending for scale, efficiency, and trust in underserved Bharat.

The Traditional Loan Disbursement Process

NBFCs are emerging as key players in MSME lending ecosystem. They are recording a 32% CAGR from FY21 to FY24. This way NBFCs are outpacing the growth rates of public sector banks (10.4%) and private banks (20.9%). However, for most, loan disbursement historically follows a linear, manual-heavy sequence. While compliant, it is slow and resource intensive.

Here’s a closer look at how the stages unfold.

Step-by-Step Walkthrough

Step 1: Application Submission

Here, borrowers fill out tedious physical or semi-digital forms. This is with personal, financial, and employment details. Field staff are responsible for facilitating the process.

Step 2: Documentation

Once the application is received, the next stage is documentation. This is where the credibility and eligibility of borrowers take a tangible form.

- KYC documents (ID proof, address proof, PAN/Aadhaar) and income proof. Others are collateral papers (if applicable), and guarantor details are collected.

- Documents are photocopied or scanned, then transported or uploaded into systems.

Step 3: Verification

The next step is to verify the borrower’s authenticity. This is to ensure that all details are accurate and trustworthy.

- Field visits are conducted to validate addresses, collateral, and guarantor credibility.

- Calls are made to employers or references to confirm employment or income details.

Step 4: Credit Assessment

This step is for evaluating the borrower’s financial strength. Plus, repayment capability is also checked. Here’s how.

- Underwriters rely on credit bureau reports and bank statements. Income proofs are also evaluated for repayment capacity.

- In many cases, traditional bureau scores exclude thin-file customers, especially in rural segments.

Step 5: Approval

Here, final evaluations and internal signoffs take place. This is done once the verification and credit assessment are complete.

- The application passes through multiple back-office desks and hierarchical signoffs.

- However, lack of workflow automation leads to back-and-forth queries and resubmissions.

Step 6: Payout

Funds are released to the borrower. This is after completing all compliance and disbursement formalities for payout.

These steps are lengthy and cumbersome. This is due to extensive documentations and multiple hierarchical approvals. That’s why the disbursement time is often 15+ days.

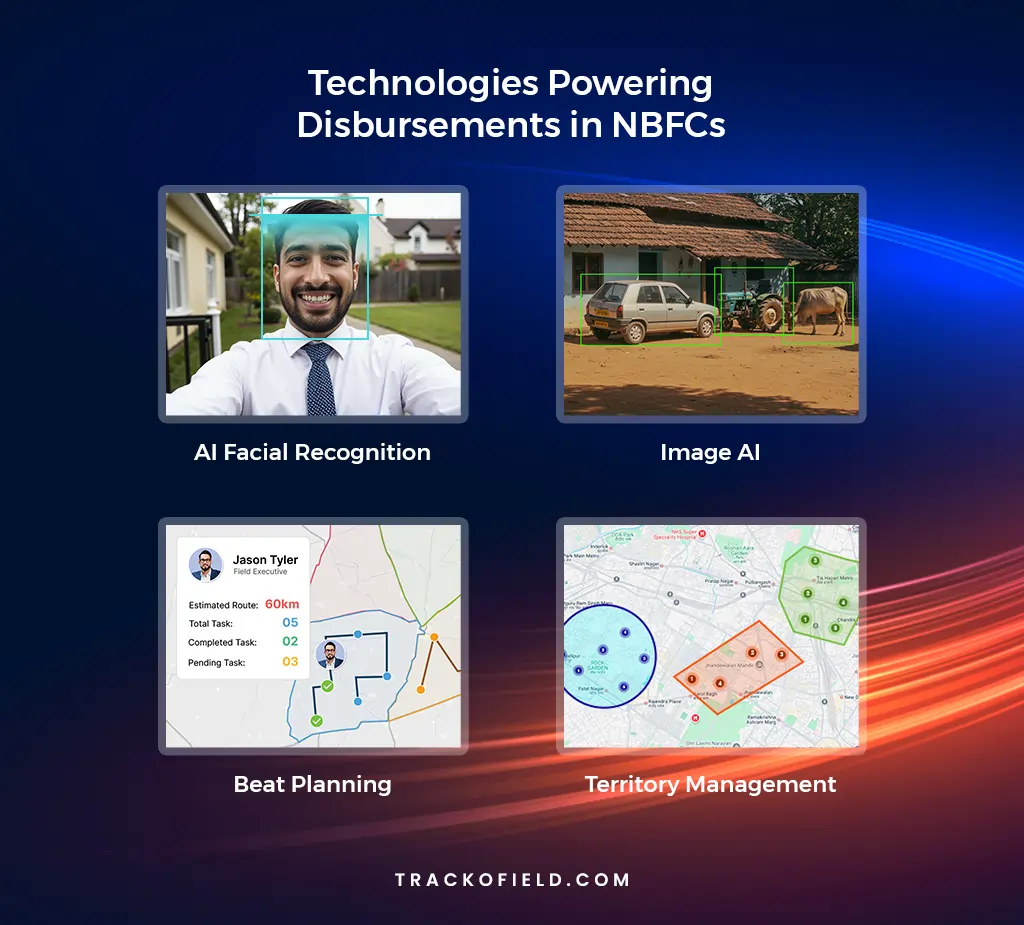

Technologies Powering Disbursements in NBFCs

3 Strategic Pain Areas Slowing Down NBFC Loan Disbursals

In today’s competitive lending landscape, NBFCs face multiple operational and customer-facing challenges. These can slow down the loan disbursement, increase costs, and impact borrower trust. However, identifying strategic pain areas can help streamline processes and enhance overall efficiency. Keep reading.

1. High Manual Effort

Traditional NBFC loan disbursements heavily rely on human involvement. This is right from collecting applications to conducting data entry and verifications. Each of the stages require time and coordination among multiple teams. This increases operational costs and turnaround times. Altogether, this manual dependency limits scalability. Ultimately, this makes it tough to manage high loan volumes efficiently.

2. Error and Fraud Risks

Field agents are the frontline of NBFCs. They manage verifications and customer engagement along with representing the brand. However, the risks of inaccuracies, document manipulation, and misplacement increase. This is especially true when they are not monitored accurately. Field verifications, done without digital proof, create gaps that lead to false reporting. Proxy attendance and duplicate applications are other issues. Thus, it is a constant struggle to maintain consistency and accuracy.

3. Poor Customer Experience

Speed and transparency attract today’s borrowers. However, repeated document requests and a 15-days turnaround time can erode trust. This is especially where credit needs are sensitive.

NBFCs also risk losing market share. This happens when they fail to expand into high-potential segments. Altogether, these reduce business potential. It also increases the chances of losing customers to competitors offering faster lending.

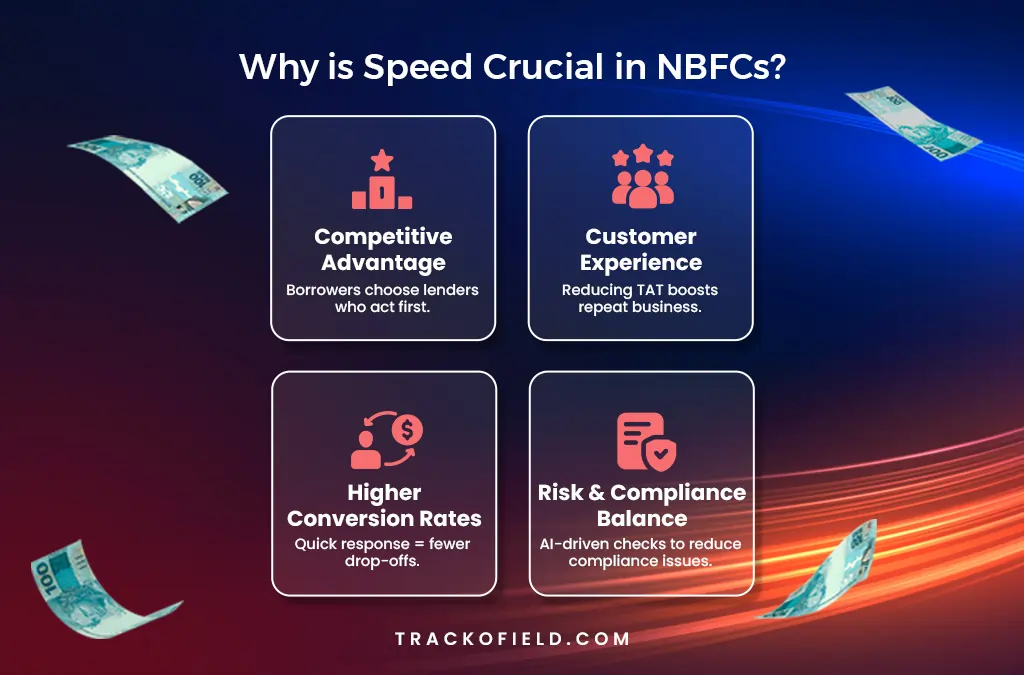

The Need for Speed in Lending

Speed is no longer a luxury. It is an expectation and a critical differentiator for NBFCs. Slow disbursement stands out sharply against this backdrop of immediacy. This is since customers today hardly have the patience to wait for weeks for loan approvals.

Borowers now expect instant, frictionless loan disbursals, and anything slower feels outdated. In fact, quick fund access ranks among the top 2 borrower expectations. A study has also found that 22% of borrowers aged between 18 to 24 abandon loans due to a lengthy process. So, institutions that deliver within minutes stand out. They drive higher loan conversions rates and customer loyalty.

Tech-Stack Behind 3-Minute Disbursements

The journey from 15-days loan disbursement to 3-minute approval is not a leap of faith. It is a result of a strategic adoption of powerful technology stacks. This includes intelligent data systems, AI, and automation. They help NBFCs simplify and speed up the process. Plus, they eliminate the risks of fraud among their field agents.

Why is Speed Crucial in NBFCs

AI Facial Recognition

With large, scattered field teams, maintaining authenticity in field operations is a must. Face AI, introduced by TrackoField, is a powerful feature in the field employee tracking software. It incorporates a robust layer of identity verification to ensure operational transparency. By leveraging such visual intelligence, NBFCs can:

- prevent false check-ins during field visits and customer verifications.

- verify borrower and field agent activities in real time.

- detect abnormal patterns for corrective measures.

Overall, these enable authentic loan disbursement within minutes instead of days.

Credit Assessment

Borrowers in rural and semi-urban areas lack formal income documentation. These include ITR or bank statements, making credit scoring a tough nut to crack. TrackoField’s Image AI bridges this data gap. Wondering how? With its AI-driven object and asset recognition. Economic stability can be assessed by counting tangible items like livestock, farm machinery, and land size. These are then converted into structural data. The outcome? Well, NBFCs can confidently lend in the underserved markets.

Location Intelligence

This uses geo-fencing and geo-tagging. It helps provide precise and real-time visibility into on-ground operations. See in detail:

- geo-fencing ensures collection visits are completed within pre-defined geographic boundaries

- geo-tagging attaches verifiable location data to each activity ensuring. This ensures activities have been performed at the intended site only.

These reduce the risks of false reporting and strengthen monitoring.

By integrating these advanced capabilities, NBFCs can build a high-speed disbursement ecosystem. This is even for borrowers who fall outside of the traditional scoring parameters.

Conclusion

15 days to 3 minutes is a paradigm shift in customer centric lending. Plus, it is a revolution in the operational philosophy of NBFCs. By adopting AI-led employee verifications via a strong field force management software, institutions can achieve better portfolio quality. They also build trust that drives long-term loyalty. In fact, faster disbursements directly shape AUM. This is since every reduction in turnaround boost conversion rates. It also lowers loan abandonment.

Therefore, NBFCs must test and implement employee tracking apps. They accelerate loan approvals to secure a competitive advantage. This remains non-negotiable in a rapidly evolving financial landscape.

Shemanti is a Content Marketing professional with 7+ years of experience in shaping credible narratives across B2B products. As the Content Team Lead for TrackoBit, TrackoField, and TrackoMile, she br... Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.