-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

Expense Management Guide: Streamline Your Business

- Author:Tithi Agarwal

- Read Time:7 min

- Published:

- Last Update: November 5, 2024

Table of Contents

Toggle

Discover how beneficial streamlining expense management can be and how automating the process with expense management software boosts profits.

Table of Contents

Toggle

The second most difficult thing to manage for organisations besides their workforce is their expenses. Expense management is no simple task; even the best accountant tends to break into a sweat when it comes to calculating a hundred pages of expenses jotted down on pen and paper. After all, expense management is not limited to daily debiting and crediting balances into the accounting books.

But what is more harmful is the error full reports, chances of cash leakage and inaccuracy of expense reporting when done manually. So, if you are looking for an innovative method to make the process as robust as possible, it’s best to use expense management software.

In this article, we have broken down everything you need to know about expense management.

What is Expense Management?

Expense management forms the backbone of any company’s finances. But it is also common for finance/accounting heads to describe expense management and reporting as a tear-inducing process as it can be

- Time-consuming

- Laborious

- Error-prone

If done manually.

The process of expense management includes recording expenses, executing payments, and tracking spending. It also includes keeping track of operational expenses incurred by employees, like traveling.

Efficient expense management involves drafting a spending policy, enforcing it, an devising ways to reduce expenses.

3 Types of Expense Management

1. Paper Forms

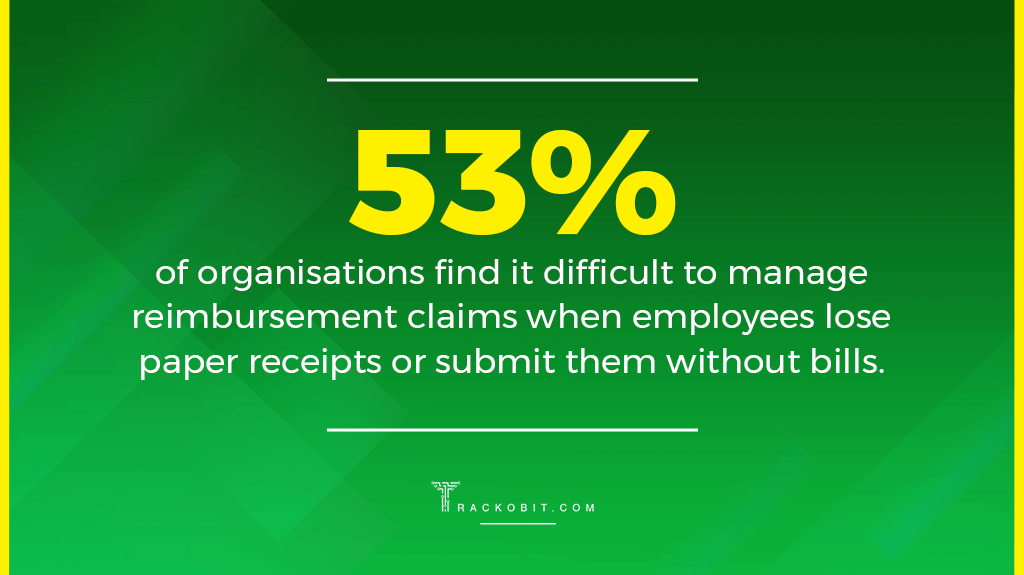

Although using paper forms to manage expense reports is less expensive, it still requires a time-consuming manual logging process. Employees also need to be mindful of their paper receipts, as they may misplace them during transit.

2. Spreadsheets

Spreadsheets allow you to import financial data from banks for simpler reconciliation, which is why they are more advanced than tracking paper. Nevertheless, they still need paper receipts. These sheets are also vulnerable to human error because they need manual data entry.

3. Software

Software automates much of the expense management process, including approvals and compliance. This immediately lessens the workload in your accounting department. The software has many other features that automate reimbursement and calculation aspects of expense management.

Why is Expense Management Important?

|

Traditional Expense Management System Working

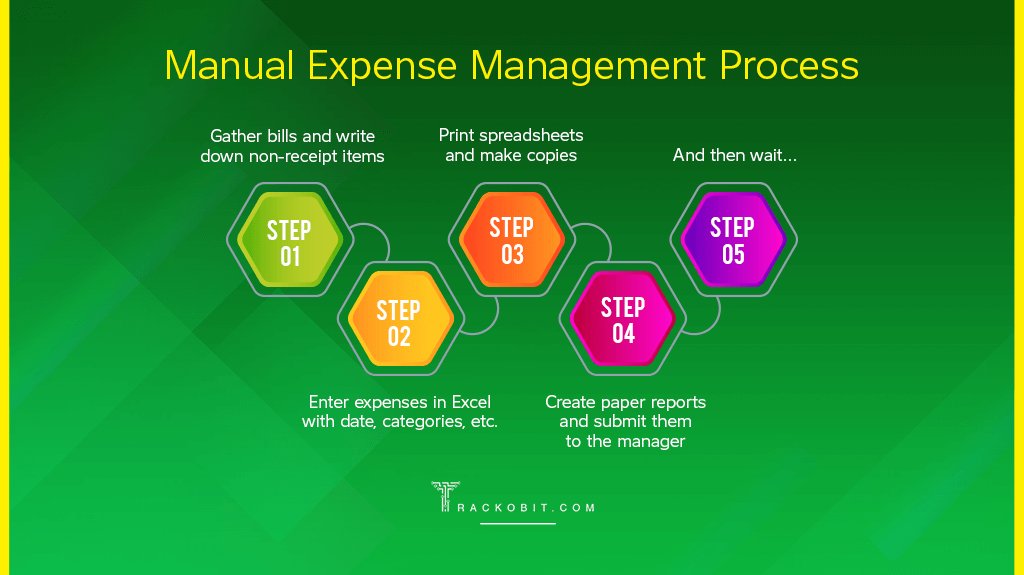

The entire process of managing expenses in the traditional way depends on spreadsheets, paper bills, receipts, etc. The manual process in businesses using the conventional expense management system looks like this:

- For approval, employees are required to turn in manually completed expense reports and hard copies of all invoices, receipts, and bills.

- The manager receives this expense report after that. They accept or reject the claim.

- The claim is then forwarded to the finance department for review to ensure it adheres to the company’s policy regarding business travel and expenses. The finance team will approve the expense claim if it complies with the policy. And will reject it if does not.

- Lastly, they keep bills, receipts, and other crucial records for taxation.

| Did you Know?

43% of companies are still managing expense reporting manually |

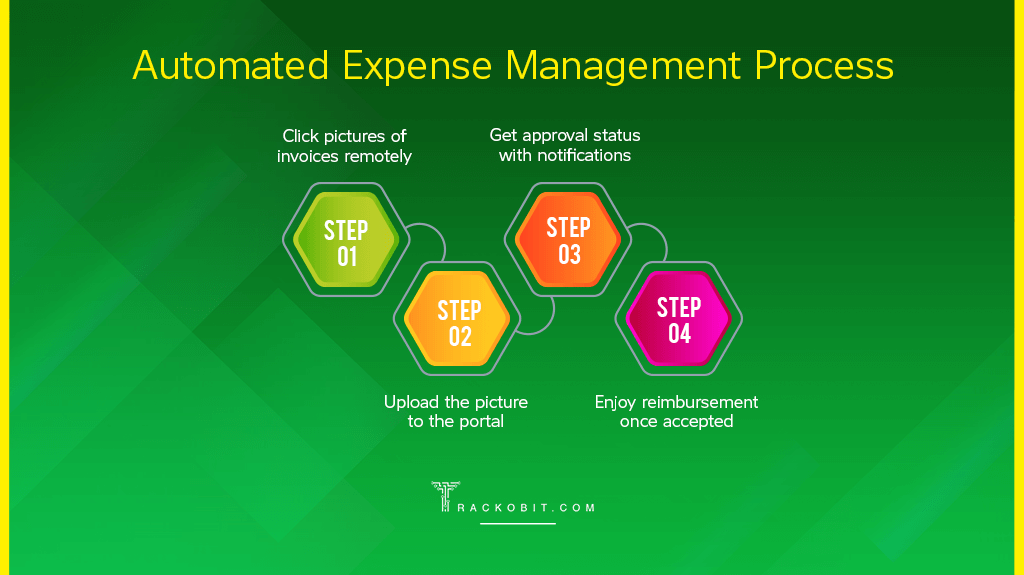

Automated expense management process

Every step in this expense management method is fully automated, from filing expense reports to setting up policy checks to approving reimbursement. Another great advantage is that automated expense management software will streamline your expense reporting, processing, and reimbursement process.

| Did you Know?

Only 27% of companies have a system that automatically flags out-of-policy expenses. |

Traditional vs Automated Expense Management Process

Traditional expense management methods are no match for automated expense management. Here are some of the fields where automated expense management outperforms traditional expense management methods:

| Parameter | Traditional Expense Management | Automated Expense Management |

| Expense Tracking | Limited real-time visibility into spending | Real time tracking and insights of expenses |

| Expense Reporting | Done through manual paper reports and Excels | Digital submission on the portal |

| Approval Process | Manual submission for approval | Automated hierarchy approval |

| Reimbursement Processing | Manual verification and processing | Automated reimbursement procedure |

| Policy Compliance | Manual verification and processing | Automated mechanism for policy enforcement |

| Audit and Compliance | Paper-based bills and records for audits | Digital records and audit trails |

Challenges in the Manual Expense Management Process

Unclear Expense Policies

Due to unclear expense policies, companies might face a lot of trouble in reimbursing employees. Employees will undoubtedly make mistakes when submitting claims for reimbursement if they are unclear about the types of expenses that are permitted.

Poor Expense Visibility

Manually examining expense details can be time-consuming. However without access to information and expense data, organisations will be unable to make important decisions. For instance, you cannot bargain for better prices with a vendor if you are unaware of which vendor your business majorly deals with.

Inefficient Process

Is your company’s expense management procedure effective? Is it capable of handling hundreds of your employees’ submitted expense reports? If not, now is the moment to employ effective technology to speed up and eliminate errors from the process.

Delay in Employee Reimbursement

Does it typically take your company days or months to reimburse employee expenses? Employee morale and productivity will eventually suffer if your finance team takes an eternity to reimburse the claims.

3 Tips for Streamlining Your Expense Management Process:

|

What is Expense Management Software?

An expense management software is an application that automates your organisation’s expense reporting, processing, and reimbursement process, removes all manual effort, and makes it efficient and more straightforward.

Additionally, expense management software ensures policy compliance for every expense report in your firm. This means goodbye to non-policy expense reimbursements.

Read Blog – How Does Expense Management Software Work?

Features of Expense Management Software – To Expect & Get

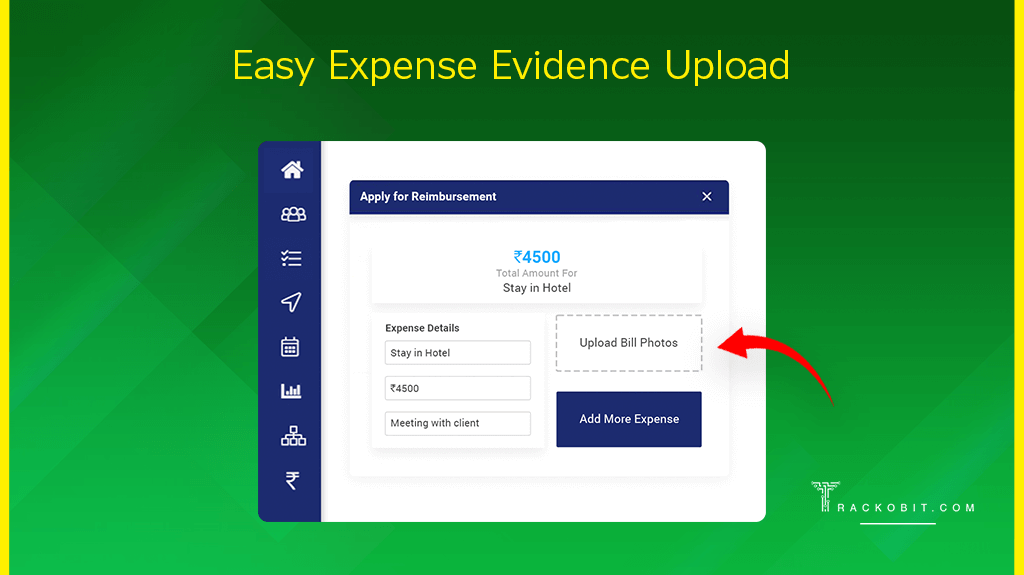

Easy Submission and Approval of Expense Claims for Reimbursements

Say goodbye to the painful burden of storing month-old receipts for reimbursement. Expense management software allows employees to digitally upload expense claims and invoice pictures for automated expense reporting. It streamlines your expense approval system with real-time notifications sent to the relevant approvers for super-fast approvals.

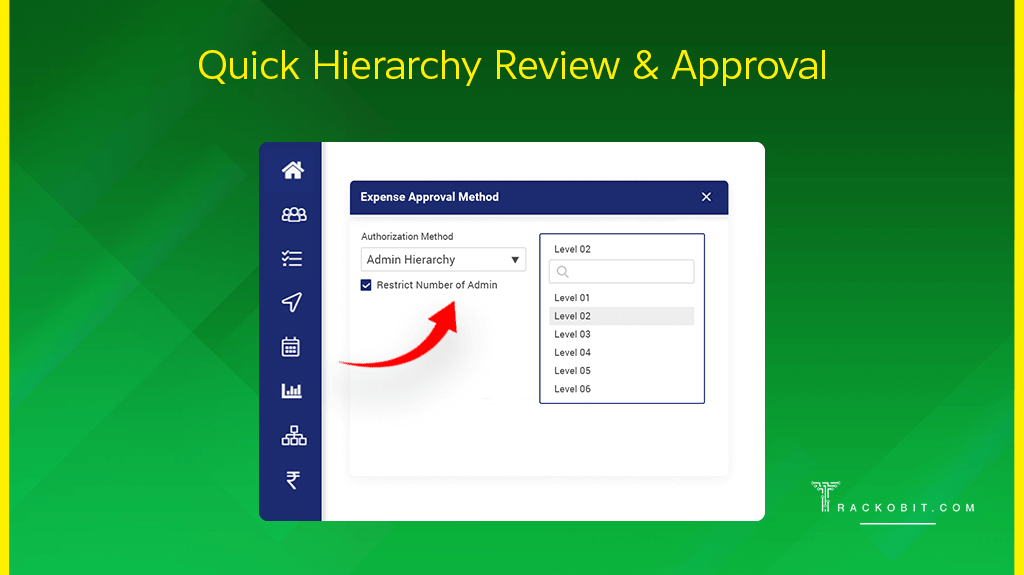

Hierarchy Approval

Expense management software simplifies the reimbursement process by allowing every manager in the multi-level approval hierarchy to check, assess and approve requests quickly.

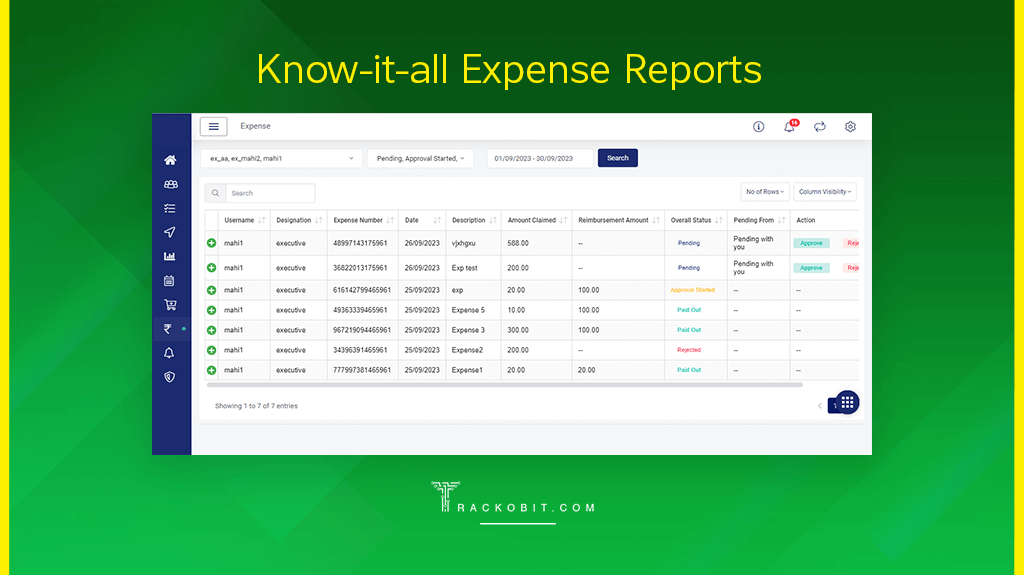

Tracking Real-time Status of the Claim

From expense claims to approval, the expense management system offers real-time tracking of every event. On the app, executives can view the current status of their claim requests in real-time. Involved managers receive instant notifications regarding claim requests and are able to provide approvals without delay.

![]()

Reporting and Analytics

A live dashboard with automatic expense reporting and real-time updates simplifies business expense tracking. Additionally, spend analytics are provided by expense management software like TrackoField, which can greatly streamline your workflows and help you exercise better expense control.

Accounting Software Synchronization

Expense software for business can automate bookkeeping like never before, replacing the laborious tasks of spreadsheets and manual data entry. The majority of the top accounting systems in the world are easy to integrate with elite expense management software. With real-time updates, TrackoField can be easily integrated with leading accounting programs like Netsuite, Quickbooks, Xero, Deskera, MYOB, Zoho, and Tally.

Checklist for Choosing the Right Expense Management Software

When choosing the software, it is recommended to make sure that it has the best expense management software solution, features, and all the right components/elements that aid in scaling your business.

✅ Remote accessibility- be it through phone or website

✅Customisable approval hierarchy

✅100% visibility into business expenses

✅Cap expense limit

✅Categorises expenses automatically

✅Automated reports that can be diced

✅API software integration

✅Scalability and flexibility

✅Data security

What Happens if You Don’t have Expense Management

82% of small businesses fail due to cash flow issues and poor expense management. The absence of a streamlined expense process can bring a company to a standstill.

- Financial Instability: Without proper expense management, a business may struggle to control costs, leading to financial instability.

- Overspending and Budget Overruns: The absence of expense management may lead to overspending, as there are no controls or monitoring mechanisms in place. Budgets may be exceeded, affecting the financial health of the organisation.

- Limited Strategic Decision-Making: Lack of accurate expense data hampers the ability to make informed strategic decisions. Businesses may miss out on growth opportunities or make decisions based on incomplete or inaccurate financial information.

- Inefficient Resource Allocation: Organisations may struggle to allocate resources efficiently without proper expense tracking. This can lead to under-investment in critical areas and over-investment in less important ones.

- Poor Cash Flow Management: Inadequate expense management can result in poor cash flow management. A business may find itself unable to cover operational costs, pay suppliers, or invest in growth initiatives.

- Limited Cost Control: The absence of expense management means there are no controls in place to manage and reduce costs. This can lead to wasteful spending, negatively impacting the bottom line.

Conclusion

Expense management in emperors’ organisations gives them a clear understanding of their present condition, future goals, and past mistakes. Managing it manually can be a mistake because not only will it make the process longer than necessary, but it will also be full of errors. After all, you don’t want your accounting head to work overtime, right?

Technical immaturity in this time and age can derail businesses off their track. So to avoid this happening, it’s best to do away with manual expense management. Automating the process makes it more effective, easy, and lucrative.

Expense management software like TrackoField can streamline expense management, provide real-time visibility, and simplify reimbursement. This will translate into more productive operations and employees.

Frequently Asked Questions

-

How does expense management software work?

Here is how expense management software works - in 5 steps Step 1: Employee registers reimbursement claim by uploading for picture of the invoice. Step 2: Managers receive claim requests. Step 3: Finance team audit expense reports. Step 4: once the claim is approved, it is processed for reimbursement. Step 5: The software generates records for future reference.

-

What are the 4 types of expenses?

Businesses can split their expenses into 4 categories: Fixed Variable Intermittent discretionary

-

What are the benefits of expense management software?

Faster employee reimbursement Improved expense visibility Reduce delays and errors Increased compliance Prevent fraud

Tithi Agarwal is an established content marketing specialist with years of experience in Telematics and the SaaS domain. With a strong background in literature and industrial expertise in technical wr... Read More

Related Blogs

-

How to Track Field Employees Offline With Field Force Management Software

Mudit Chhikara February 11, 2026Use field force management software to track field employees offline and ensure managers never lose visibility of on-ground operations.

-

How AI-Powered Field Force Management Simplifies Field Operations With Analytical Dashboard

Mudit Chhikara February 10, 2026How AI-powered field force management enhances field operations using AI manager bot and analytical dashboard.

-

Grameen Credit Score and the Quiet Redesign of Rural Lending

Pulkit Jain February 9, 2026Rural lending doesn’t usually go wrong at approval. It drifts when what’s happening on the ground stops being visible.

-

How NBFCs Can Reduce NPAs Using LMS + LOS + FFA Integration

Mudit Chhikara January 30, 2026Here’s how NBFCs can smartly integrate LOS, LMS, and FFA software to reduce NPAs and ensure seamless field operations.

Subscribe for weekly strategies to boost field team productivity.

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.