-

TrackoBit

Manage commercial vehicles with the new-age Fleet Management Software

TrackoBit -

TrackoField

Streamline your scattered workforce with Field Force Management Software

TrackoField -

Features Resources

-

Blog

Carefully curated articles to update you on industrial trends. -

White Paper

Insightful papers and analysis on essential subject matters. -

Glossary

Explore an alphabetical list of relevant industry terms. -

What’s New

Get TrackoBit & TrackoField monthly updates here. -

Case Study

Explore the cases we solved with our diverse solutions. -

Comparisons

Compare platforms, features, and pricing to find your best fit.

-

About Us

Get to know TrackoBit: our team, ethos, values, and vision. -

Careers

Join the most dynamic cult of coders, creatives and changemakers. -

Tech Support

Learn about our technical support team and services in detail. -

Events

Check out the exhibitions where we left our marks and conquered. -

Contact Us

Connect with us and let us know how we can be of service.

Impact of ADAS on Insurance Premiums: What Fleet Owners Must Know

- Author:Anvesha Pandey

- Read Time:7 min

- Published:

- Last Update: May 30, 2025

Table of Contents

Toggle

Curious how ADAS can turn the insurance game in your fleet’s favor? This blog breaks down the impact of ADAS on insurance premiums.

Table of Contents

Toggle

Your fleet runs on ADAS for accident prevention, but your insurance premiums haven’t budged? Frustrating, right?

So why aren’t your premiums reflecting that? The truth is safety tech is only half the battle. Awareness and data-backed reporting are what turn protection into savings.

As a fleet owner, it’s crucial to understand how insurers evaluate Advanced driver assistance systems (ADAS). When you know what they look for, you can make smarter choices that not only enhance safety — but also cut costs.

Because when you invest in smart technology, it shouldn’t just safeguard your drivers. It should reward you where it counts in your bottom line.

This piece is all about that smarter move where fleets are driven safer and insured better.

Why Should You Care about an ADAS System?

The answer’s not up for debate because safety, savings, and data driven decisions shouldn’t be optional.

Let’s get a bit into the benefits of an advanced driver assistance systems:

1. Cuts down accident rates

Advanced driver assistance systems help you detect potential collisions, lane departures, signal violatons & more. The system alerts you before the driver even realizes the risk. This results in less accidents, reduced downtime and most importantly saved lives.

2.Enables min to min monitoring

Both ADAS & DMS (Driver Monitoring System) cameras & sensors offer a 360° view of what’s happening on & around your vehicle. This helps you get notified of events that are risky events. These events include downiness, distractions or tailgating.

3. Reduces operational cost

Undoubtedly, fewer crashes results in lower repairs & insurance premiums. Infact not to mention but vehicles last longer & you avoid legal trouble.

Simply put, ADAS isn’t just another expense but it’s a smart investment that saves you more than it spends.

4. Improves Driver Behavior

When combined with driver behavior monitoring systems, ADAS performs remarkably effectively. It supports the promotion of safe driving. Feedback creates safer behaviors, and safer behaviors result in more seamless fleet travel.

And the benefits don’t stop there. They directly impact one key metric i.e. Your insurance premiums.

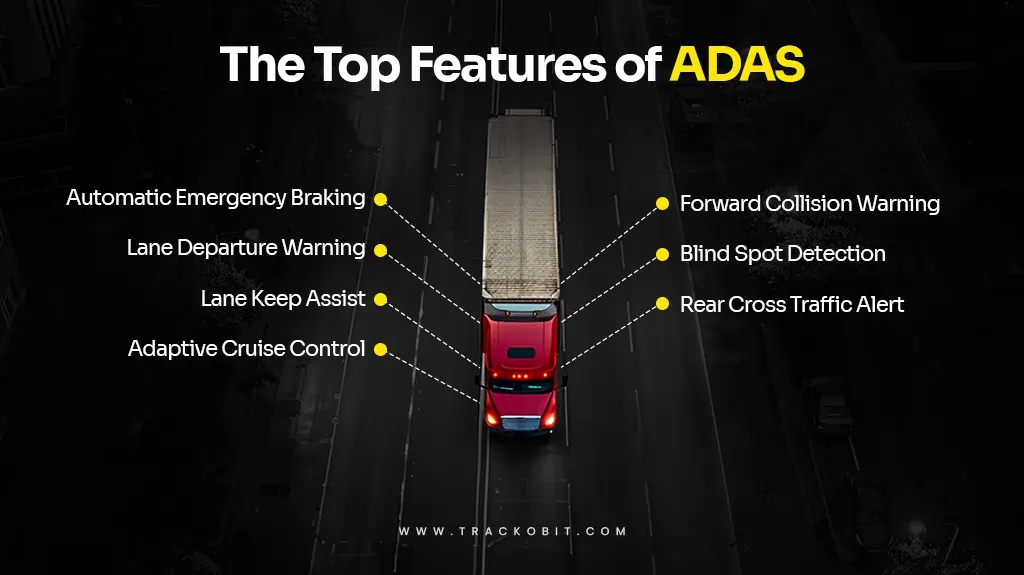

Have a look at the top features of ADAS

The Link Between ADAS and Insurance Premiums

Okay so, insurance companies are in the business of evaluating risk. A vehicle’s danger increases with its likelihood of being involved in an accident. As a result, the premium increases with risk. Basic maths, right?

Now when you get your hands on an ADAS system things get simpler!

Here’s how!

ADAS systems use AI dashcams & sensors to prevent accidents before they take place. So, naturally, when a fleet is equipped with an advanced driver assistance system, it becomes much safer.

And trust us insurers love safe fleet.

1. Lower Risk= Lower Premiums

Insurance companies praise proactive safety measures. When your vehicles are less likely to be involved in accidents, you file less claims. This in the end results in reduced premium over time.

In fact, many insurers even offer upfront discounts for fleets that implement ADAS. The other way includes risk dynamically which means if your fleet’s incident rate drops, your insurance cost adjusts accordingly.

2. Real Impact – Backed by Data

With data you have insights into every important detail that needs to be looked into. In fact, a study by the Insurance Insitute for Highway Safety (IIHS) found that forward-collision warning systems with automatic emergency braking can reduce front-to-rear crashes by up to 50%.

For a fact, several real-world fleet case studies report insurance savings of 10-20% annually. This occurs following the installation of ADAS and driver behavior monitoring.

Simply put, the safer your fleet, the lesser the amount of insurance premiums.

Factors That Influence Insurance Premiums Beyond ADAS

Well, insurance companies consider multiple factors just ADAS when calculating premiums-

- Driving History: If there are more infractions or accidents in your fleet’s past. The premiums increase in proportion to the level of risk.

- Fleet Size: The risk increases with fleet size. But it also gives insurers more data to work with, which could work in your favor.

- Vehicle Type & Usage: Heavy-duty trucks or specialized vehicles? They might cost more to insurers.

- Driver Profiles: Inexperienced or high-risk drivers increase overall liability.

How ADAS Affects Your Insurance Premiums?

Okay, so insurance premiums are one such base for fleer owners that has evolved with time. Traditionally, insurers offered better rates only after observing improved loss history or visible safety changes. However, things are shifting—quickly.

According to a webinar by Partners for Automated Vehicle Education, FMCSA, and the Tech-Celebrate Now program, insurers are now leveraging ADAS-generated data to offer upfront insurance savings.

But that’s only possible if the right technology stack and data-sharing agreements are in place.

ADAS Affects Your Insurance Premiums?

Vehicle telematics insurance is evolving. Traditionally, insurers offered better rates only after observing improved loss history or visible safety changes. However, things are shifting.

According to insights from a webinar by Partners for Automated Vehicle Education, FMCSA, and the Tech-Celebrate Now program, insurers today are leveraging ADAS-generated data to offer upfront insurance savings—if the right technology and data-sharing agreements are in place.

Dickinson, a participant in the webinar said…

“Now, I think a lot of insurance companies are recognizing the shift and the importance of data with technology. Just a handful of companies are starting to do this, but those that are, use the data in their underwriting.”

Insurance underwriters increasingly ask fleets about their ADAS usage, and in some cases, may deny coverage to fleets not adopting such safety tech. It’s becoming “the new norm.”

More critically, insurers and even attorneys in civil cases are now using technological data like lane departures, braking events, and dashcam footage as core evidence. That’s where the real impact of ADAS lies: Data creates accountability.

“More data creates more duty,” warned transportation attorney Rob Moseley, emphasizing that fleets must not only collect but also interpret and act on the data. Neglecting to respond to red flags.

Ultimately…

The value of ADAS is in its actionability. Fleets that manage the data well, coach drivers, and delete irrelevant info are safer, more compliant & increasingly less expensive to insure.

What Fleet Owners Need to Consider Before Installing ADAS?

Fleet owners must carefully assess vehicle compatibility, driver training, and system integration before installing ADAS (Advanced Driver Assistance Systems). Hence smart planning helps you achieve good planning & also fosters a safer environment.

Click on the link below to discover additional valuable insights and considerations for implementing ADAS effectively in your fleet.

Cut Insurance Costs with Confidence

Download the Ultimate ADAS Installation Guide!

Reduce Risk and Enable Pay-per-mile Insurance with TrackoBit’s ADAS Solutions!

Get insights into the benefits you enjoy with TrackoBit

Thinking about less risk & more savings?

Here’s how ADAS solution enhances safety and unlocks pay-per-mile insurance for your fleet:

-

Risk Reduction through Real-Time Alerts

ADAS uses sensors and cameras to provide real-time alerts to drivers, keeping them aware of potential risks on the road. Alerts such as collision warnings, lane departure warnings, and blind-spot detection help prevent accidents before they happen. By reducing human error and encouraging drivers to stay focused, ADAS lowers the overall risk of accidents.

-

Enhanced Safety Features

The system includes critical safety features like automatic emergency braking, forward collision warnings, and adaptive cruise control.

These features don’t just alert the driver but actively assist in avoiding or mitigating collisions, making the fleet more resilient to potential hazards. With a safer fleet, you can expect fewer incidents, lower repair costs, and less vehicle downtime.

-

Unlocking Pay-Per-Mile Insurance

With the real-time safety improvements provided by ADAS, your fleet becomes a lower risk for insurance companies. This opens the opportunity to take advantage of pay-per-mile or telematic based vehicle insurance.

You pay for the actual miles your cars are driven rather than a set charge.. Since ADAS enhances driver behavior and safety, insurers are more likely to offer flexible insurance options based on driving patterns, which often results in savings on premiums.

-

Cost Savings on Repairs and Insurance

By minimizing accidents, ADAS helps save on repair costs and insurance premiums. With fewer accidents, your vehicles spend more time on the road and less in the repair shop.

Furthermore, the ability to use pay-per-mile insurance instead of a flat rate ensures that your fleet only pays for the miles actually driven, leading to significant savings, especially for fleets with sporadic or lower mileage.

FAQs On Common ADAS-Insurance Questions

-

Will all insurance providers offer discounts for ADAS?

Not all insurers offer discounts, but many recognize ADAS as a risk-reducing factor, potentially lowering premiums.

-

Do I need to retrofit older vehicles with ADAS to benefit from lower premiums?

While retrofitting older vehicles with ADAS can help, some insurers may offer discounts based on driver behavior even without full system installation.

-

How do I prove my fleet's safety improvements to insurers?

You can provide data from the ADAS system, such as driving behavior reports and incident reduction statistics, to demonstrate safety improvements.

-

What happens if the ADAS system malfunctions or is not calibrated properly? Will it impact my insurance coverage?

If the system malfunctions or is improperly calibrated, it may affect your safety record, and insurers may not provide a full discount or coverage.

Anvesha is a communication specialist at TrackoBit. With a strong background in media and communications, she adds much-needed balance and brevity to TrackoBit’s... Read More

Related Blogs

-

5 Best Driver Behavior Monitoring Systems for 2026

Tithi Agarwal February 23, 2026Having the best driver behavior monitoring system is a necessity as it helps you ensure driver safety and optimize operational…

-

Why is Driver Drowsiness Detection System Important for Fleet Management?

Shemanti Ghosh February 4, 2026A driver drowsiness detection system is critical for fleet management. It helps prevent fatigue-related accidents and reduces operational risks through…

-

When Tracking Needs a Clock: Rethinking Fleet Visibility

Tithi Agarwal December 24, 2025Read on to understand why fleet tracking works better when it follows working hours. Because visibility should support operations, not…

-

What Makes TrackoBit’s Video Telematics Software Truly Next-Gen?

Shemanti Ghosh December 17, 2025TrackoBit’s video telematics software blends smart video intelligence with full server control. The result? Superior fleet reliability and safety.

Subscribe for weekly tips to optimize your fleet’s potential!

Your inbox awaits a welcome email. Stay tuned for the latest blog updates & expert insights.

"While you're here, dive into some more reads or grab quick bites from our social platforms!"Stay Updated on tech, telematics and mobility. Don't miss out on the latest in the industry.

We use cookies to enhance and personalize your browsing experience. By continuing to use our website, you agree to our Privacy Policy.